Two paths from now, deflation and reflation.

Analysis of microeconomic data, macroeconomic data, political data, geo-political data, and monetary policy with commentary on it.

United States:

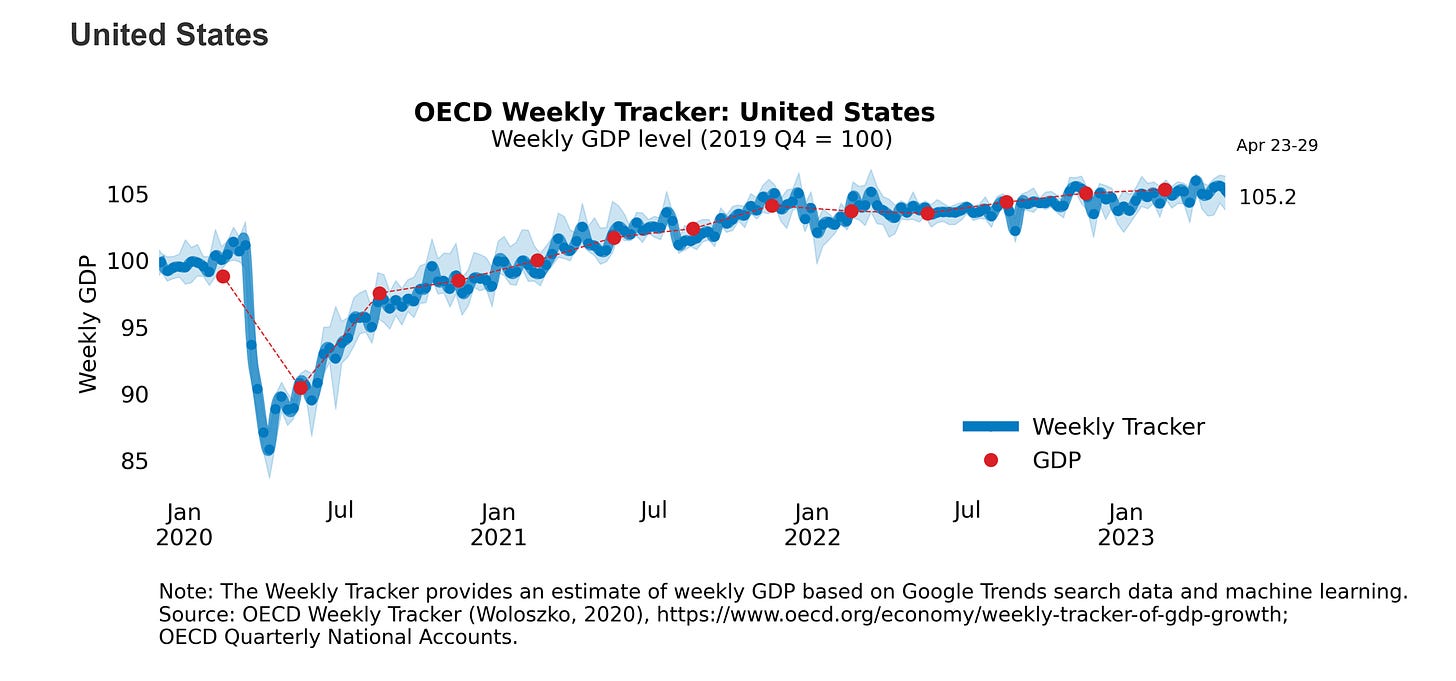

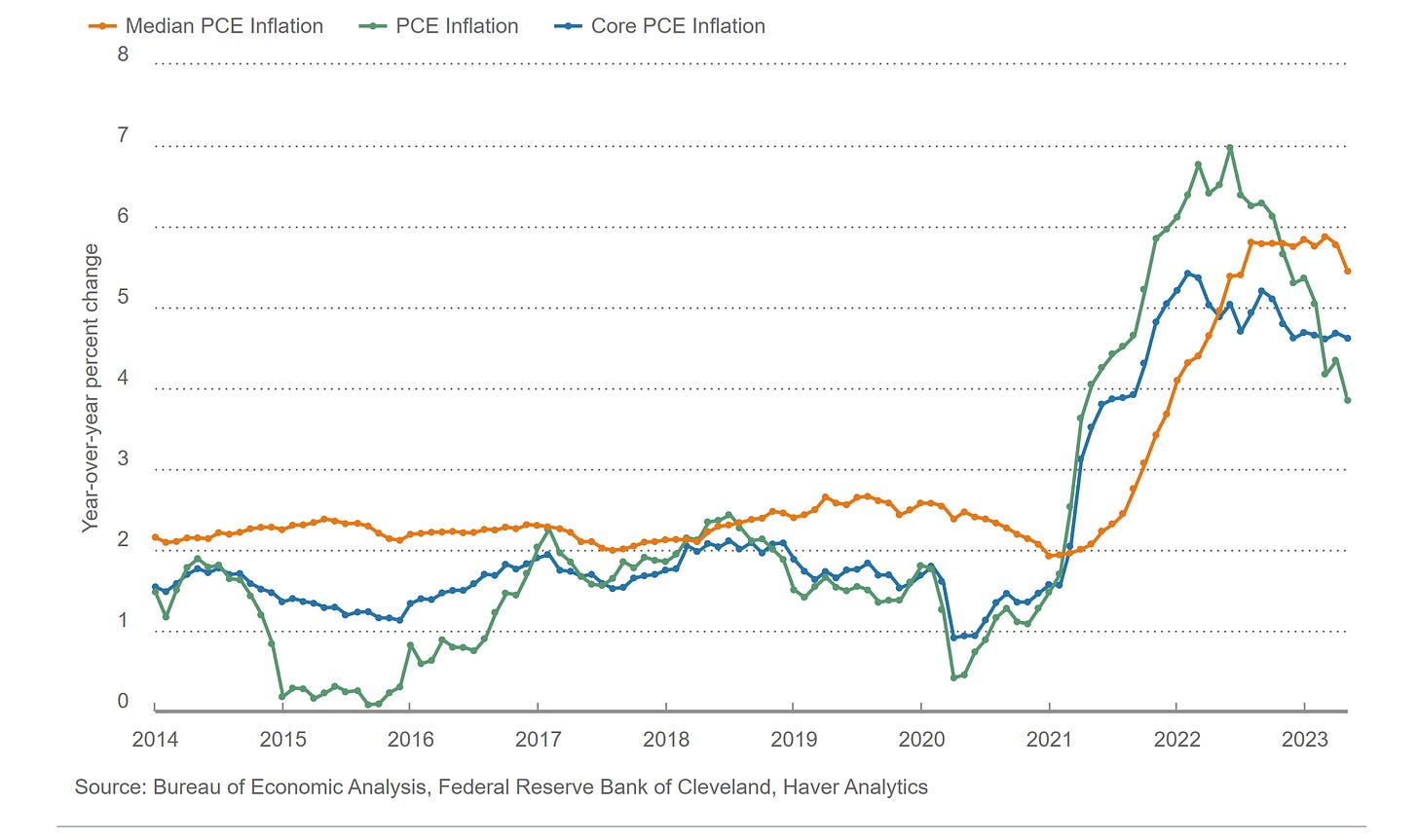

The United States inflationary pressures continue to ease in some items of the consumer and producer price indexes; this is due to monetary policy measures that have lowered demand-side inflationary pressures, along with improvements in the global supply chain pressure index that allow for lower supply-side inflationary pressures as supply and demand stabilize. Core PCE inflation remains sticky, but non-core PCE inflation trends lower, as expected; this can be seen on the next chart.

Figure 1. Median, Core and Non-Core PCE Inflation.

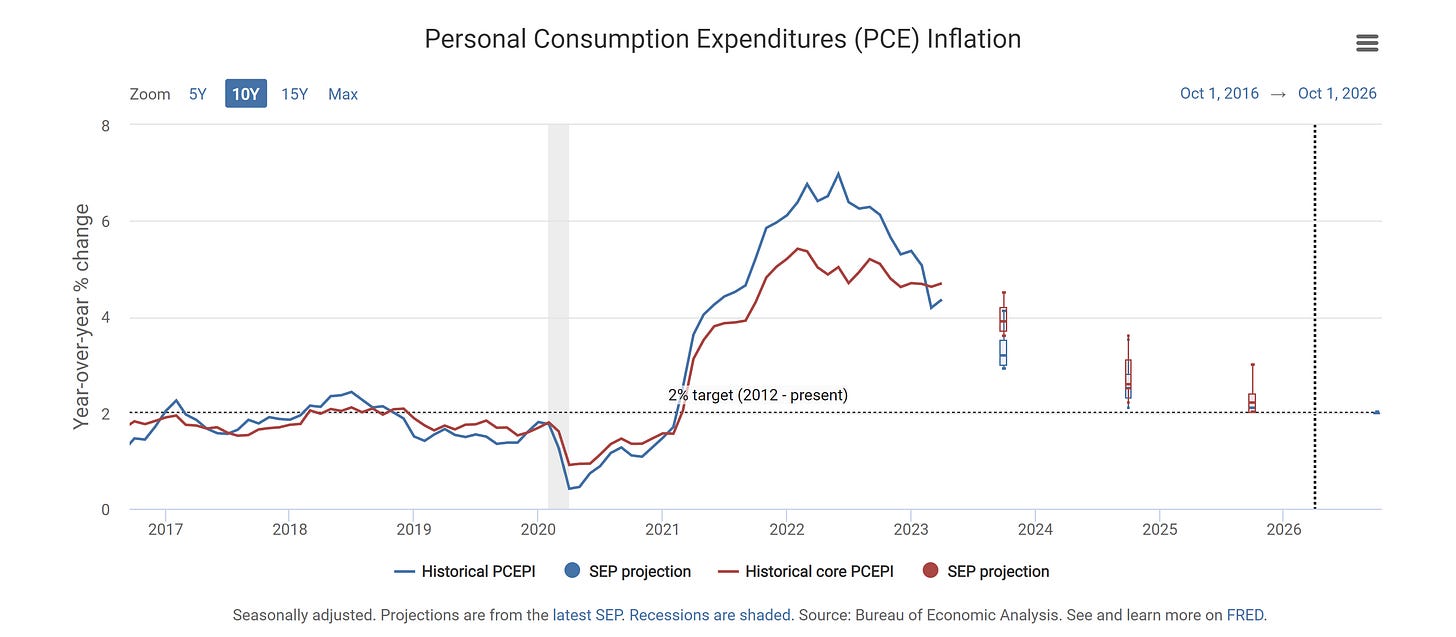

As mentioned before, inflation remains in a deflationary environment, but non-core inflation expectations are to the upside given recent price action in energy sector commodities, which is what mostly makes inflation volatile, as experienced before. Some items of the core inflation index basket's expectations are also to the upside, given the fact that monetary policy doesn't have the tools to lower supply-side inflationary pressures, which are the main driver of persistent core inflation pressures, legislative policies and fiscal policy should be implemented to reduce supply-side inflationary pressures. Although inflation is expected to keep trending lower in the long run, there is still a long way to go until inflation reaches the 2% target. The next chart shows FOMC officials’ PCE inflation projections.

Figure 2. FOMC officials’ PCE Inflation projections.

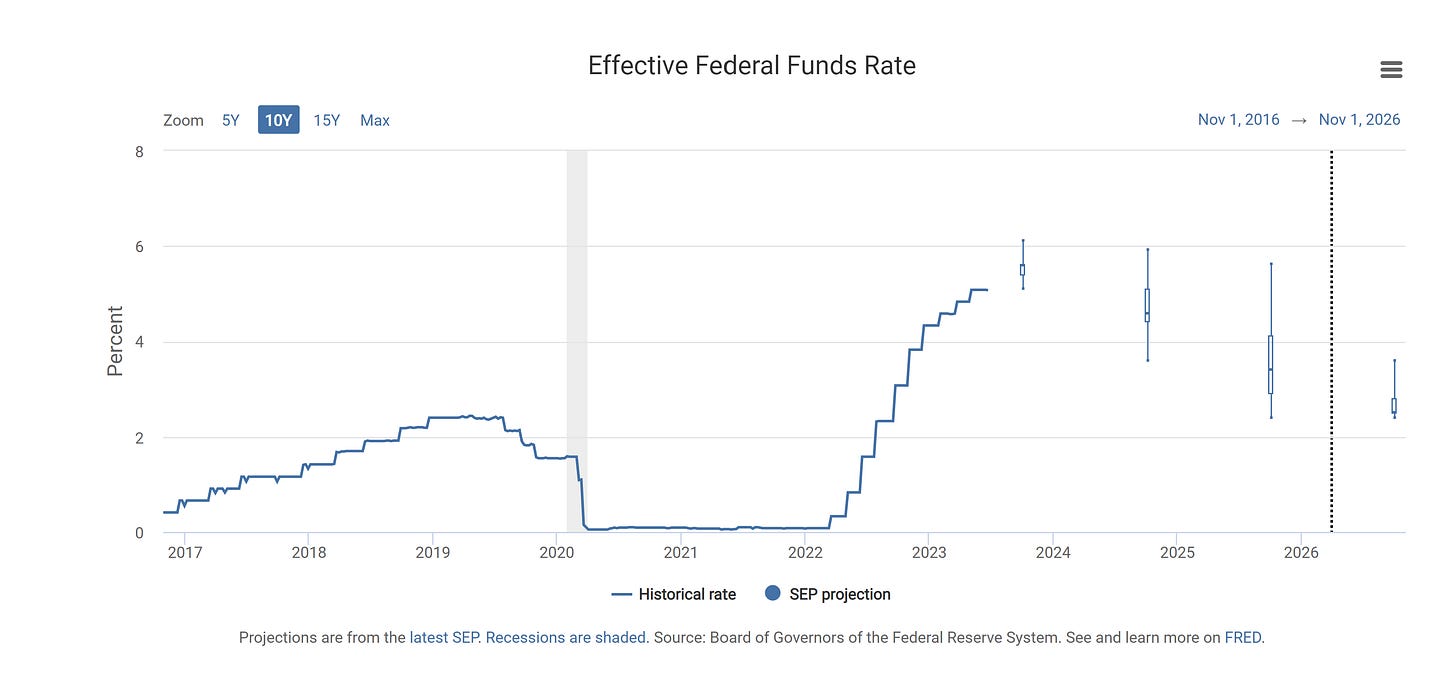

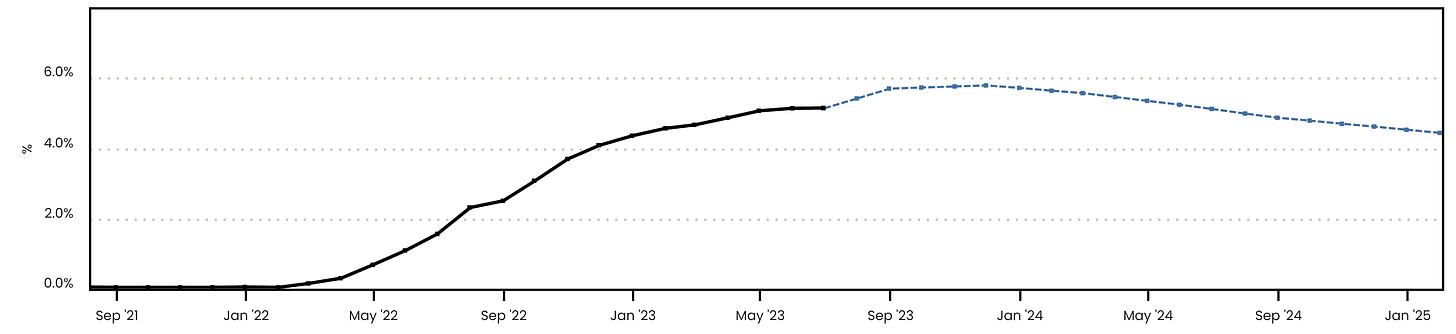

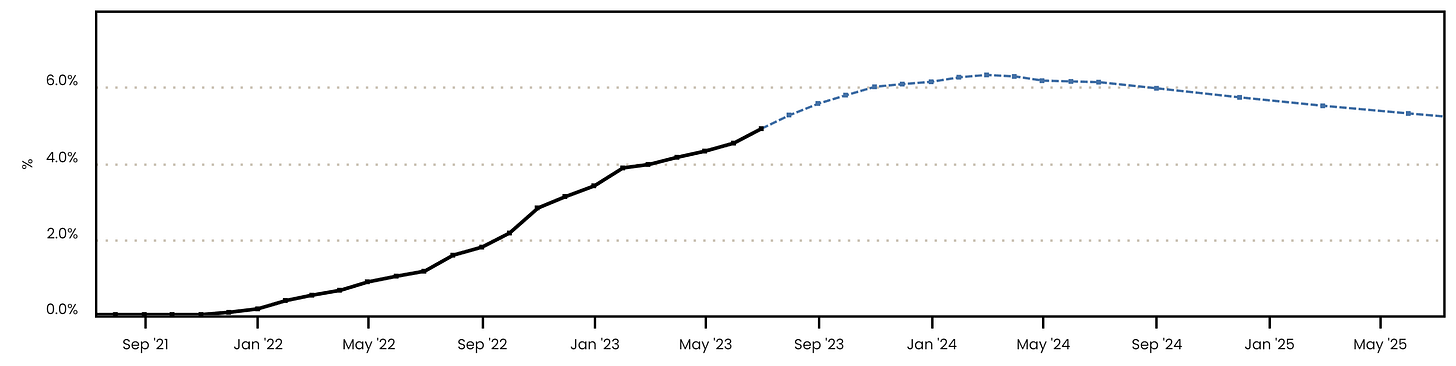

Inflation remains well above the 2% target, which is why monetary policy remains restrictive to ensure price stability. Although recent FOMC minutes indicated a pause in the rate hike path, which surprised markets given the GGBs reaction, market expectations over interest rates are in the range of FOMC projections from the Summary of Economic Projections, as can be seen in the next chart; markets frontloaded the statement from the recent FOMC minutes of further rate hikes over the year, as can be seen in the Bloomberg World Interest Rate Probability ( WIRP<GO> ) showing a peak rate nearing 6%; previously, markets priced in a 5.5% peak rate. Markets recently pricing in the higher peak rate are the main vector of recent market turmoil.

Figure 3. Effective Federal Funds Rate (Interest Rates) Projections by the FOMC.

As monetary policy remains data-dependent, the July data release with June’s inflation data will be key, as it could signal a setback in frontloading if the inflation data is cooler than expectations or further frontloading if the data is hotter than expectations. The higher for longer interest rate stance, which Jerome Powell reiterated during the European Central Bank's Forum, is expected to remain as long as the dual mandate doesn't get affected. A good thing to point out is that the higher for longer monetary policy stance, apart from ensuring price stability,has also cooled highly speculative markets, allowing consumers to have breathing room, which is reflected in the consumer sentiment.

Figure 4. Organisation for Economic Co-operation and Development (OECD) - United States - Weekly Gross Domestic Product (GDP) Tracker.

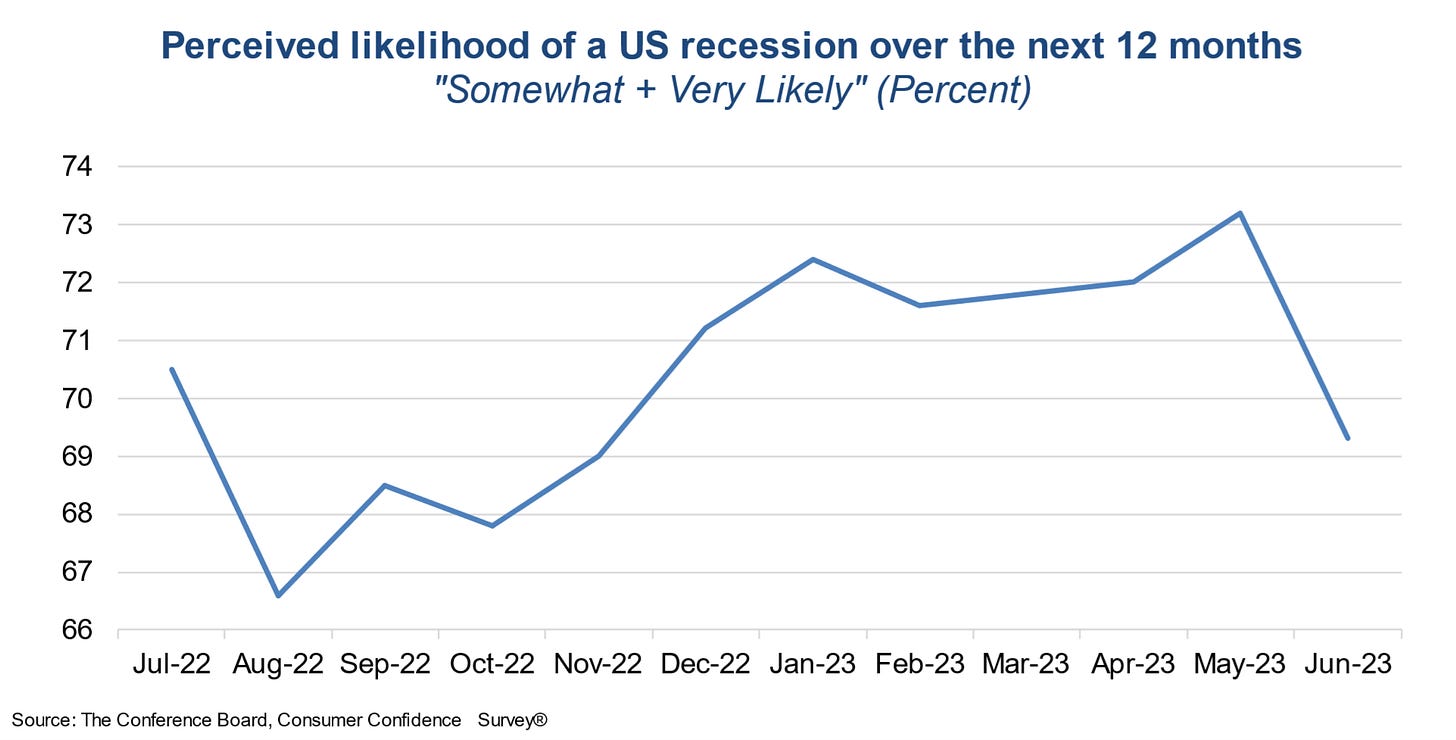

Consumers' spending remains resilient, as reflected in the PCE data; overall, the United States economy remains within the range of previously given expectations. One thing to point out is that the employment statistics show signs of slowing but maintain a steady trend. Legislative policy measures over fiscal policy have ensured that the United States doesn't enter a recession.

Figure 5. Consumers’ recession fears have eased.

As mentioned before, prospects over the dollar's performance remain the same, but recent International Monetary Fund data over the dollar made the dollar not perform as expected but shortly; moreover, legislative policy hype by markets over the Biden Administration's initiatives made so-called woke sectors such as the electric vehicle sector rally, with TSLA 0.00%↑ leading that rally, generating another mania not backed by fundamentals but rather hype, unlike the artificial intelligence mania, a mania that some have called "Potential ‘Mega Force’", with NVDA 0.00%↑ leading that rally, which is backed by fundamentals; the previously mentioned data still remains a precautionary signal over the mania.

Figure 6. The Artificial Intelligence Mania Continues.

Markets, mostly tech sector stocks, remain overvalued when it comes to price-to-earnings ratio compared to their bonds, but the potential growth of some tech sector companies stocks counteracts overvaluation worries. There are clear signals from markets that value and fundamental investing are outperforming hype, like in 2018; this is due to increases in the cost for speculation given the higher interest rates, which makes market allocation more rational as risk-on becomes more expensive than risk-off, which is good because it lowers bubble worries in the short and long run.

A higher cost for speculation also decreases highly speculative price action in highly speculative markets, such as the digital asset market, which has fully deflated, and the housing market, which is starting to deflate and is expected to keep that trend. Bonds are still something that markets aren't really hedging, but credit has rallied since October of last year, and with credit agencies enhancing credit ratings, positioning remains the same as expectations haven't changed much as the United States performs in the range of expectations.

Central Bank Digital Currency implementation is nigh as mentioned before. Given the fact that the Federal Reserve's FedNow is already in early adaptation, some point to the end of publicly traded digital assets once Central Bank Digital Currencies are fully implemented, due to the fact that they provide the same features but are government-backed, which makes Central Bank Digital Currencies more stable and secure than publicly traded digital assets that have very low regulation. China has the lead over Central Bank Digital Currencies with the People's Bank of China Digital yuan. The integration of the digital yuan (e-CNY) in China made publicly traded digital assets like Bitcoin and Ethereum tumble, given the replacement of those blockchains to transact with the digital yuan (e-CNY). Although over time China has enhanced its policies towards allowing Chinese consumers to transact and speculate on digital assets such as Bitcoin and Ethereum, the digital asset market reaction is expected to be the same as when China implemented the digital yuan (e-CNY).

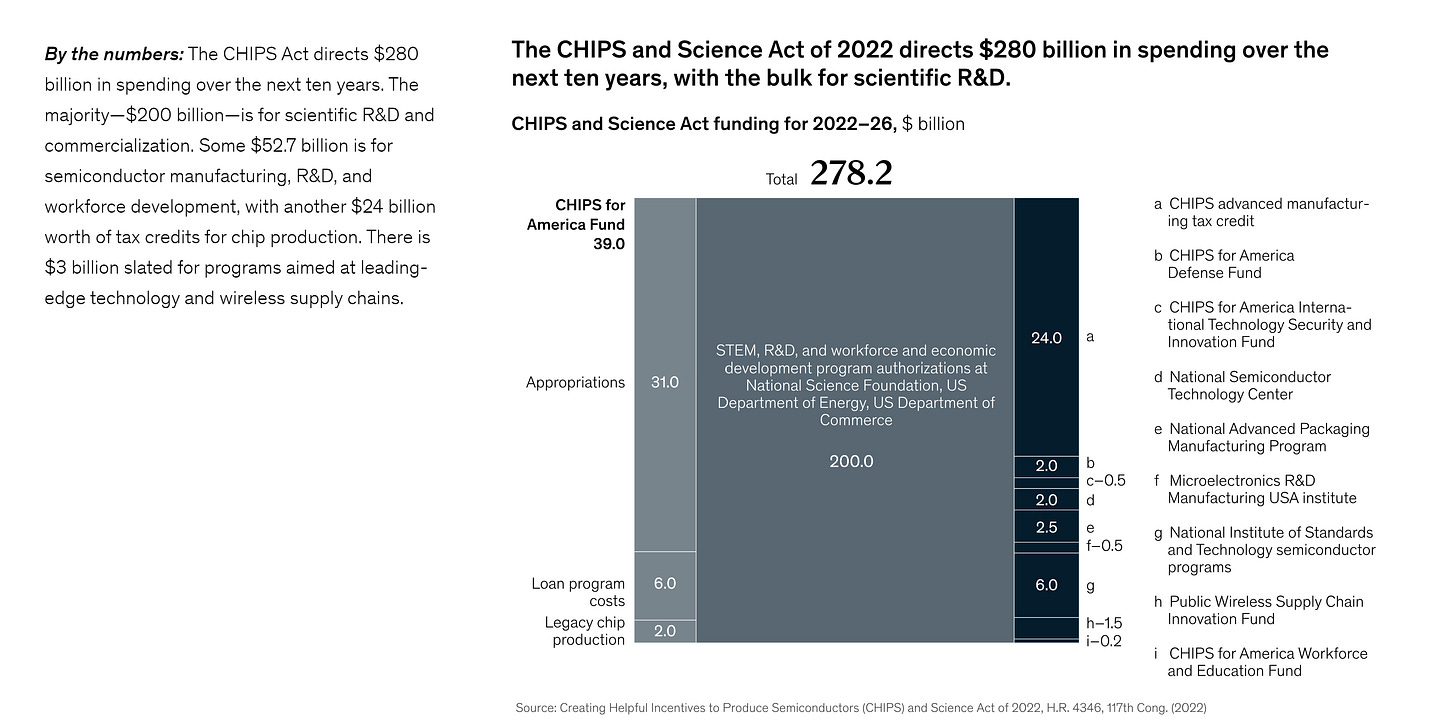

Hedging defensive remains a top priority as risks remain the same and geopolitical tensions remain high; diplomatic measures have tried to ease tensions, but probabilities remain almost unchanged from previously given data, with China sanctioning United States' defense sector companies ( which have nothing to do with hedging defensive) and China recently restricting key semiconductor supply-chain commodities to the United States, which was expected to happen a thing that the United States has prepared for with the CHIPS and Science Act of 2022 (§4346).

Figure 7. CHIPS and Science Act of 2022 (§4346) infograph.

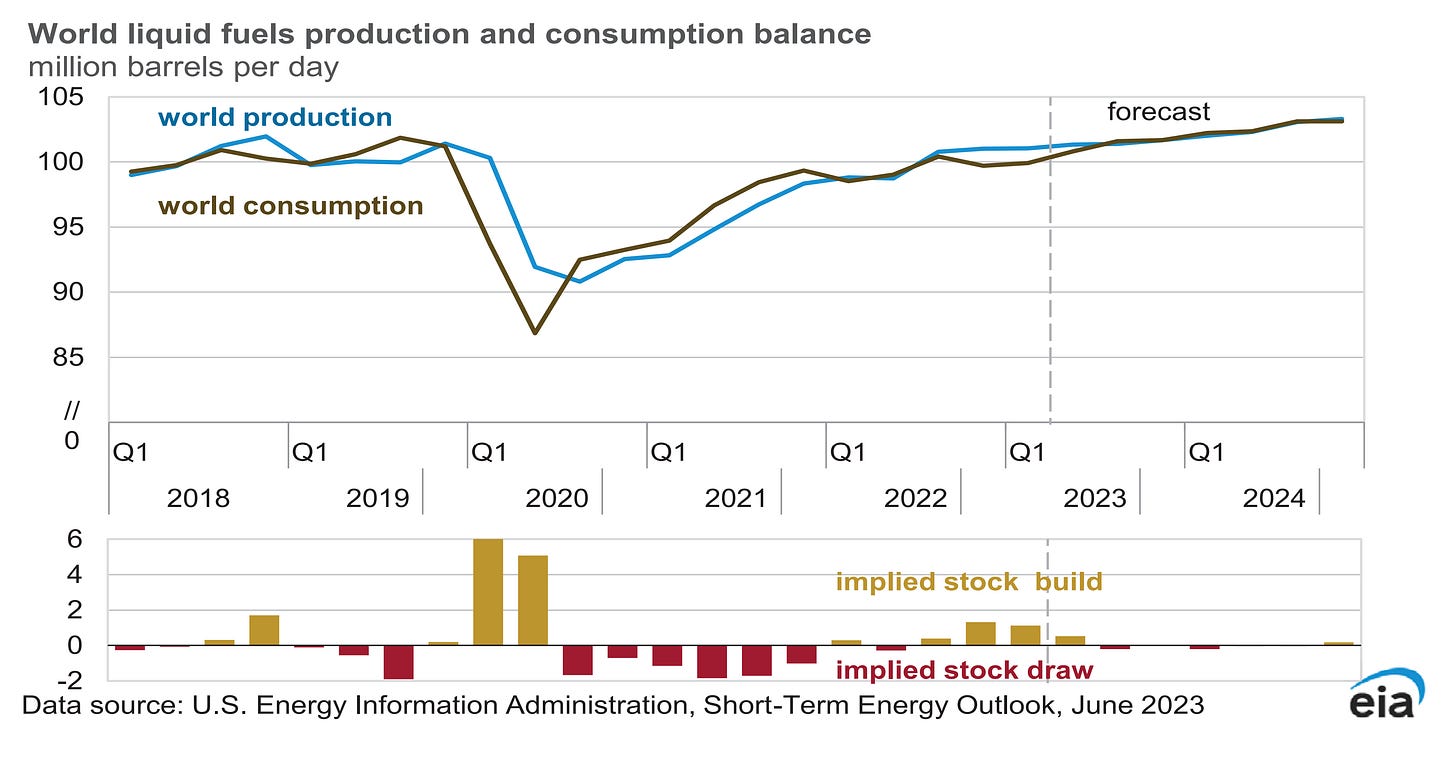

Something to point out is that commodity prices keep being volatile, metals because of more than probably central bank's price controls, and energy prices because of OPEC+ output cuts. The United States' Department of Energy's Strategic Petroleum Reserve operations have kept lowering the impact of those OPEC+ output cuts, but the United States' lower energy sector commodity production expectations and the United States' Department of Energy's Strategic Petroleum Reserve replenishment statement caused energy commodities to have upside due to simple supply and demand dynamics. World liquid fuel production is expected to be lower than world liquid fuel consumption, as reflected in the next chart. This has made the energy price disinflation fears realize with the prospects of energy price reflation given the previously explained reasons; how to hedge it has been explained before for the folks that more than likely will ask how to hedge it.

Figure 8. World liquid fuels consumption is expected to exceed world liquid fuels production by the end of the year.

All of these supply-side inflationary pressures in energy prices might cause a more hawkish stance by the end of the year that could send interest rates to double digits if the energy price inflation spirals out of control if the government doesn't ensure stable supply to the market from production rather than from emergency reserves such as the Department of Energy's Strategic Petroleum Reserve instead of reducing production. As explained before, it's not OPEC+'s problem that the United States doesn't ensure stable supply from production to the market to avoid generating supply-side inflationary pressures.

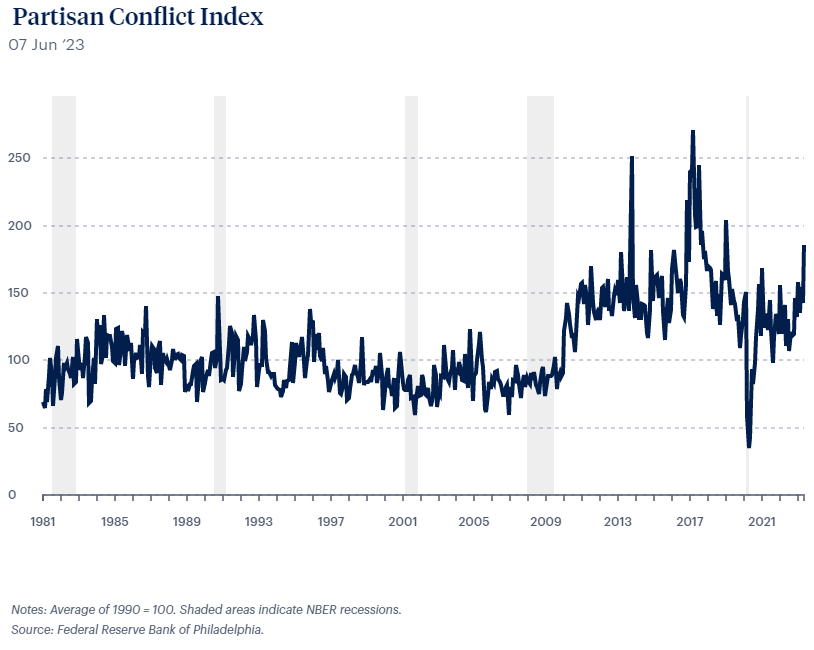

Figure 9. Partisan Conflict Index

To conclude, the recent increase in the partisan conflict index has increased uncertainty over monetary policy also given energy price inflation adhered to government measures that generate supply-side inflationary pressures puts at risk the United States economy as the Federal Reserve could overreact to the forward-expected supply-side inflationary pressures that can't be lowered through monetary policy as monetary policy tools can just lower demand-side inflationary pressures; an overreaction could cause a recession by generating an extreme demand destruction through super sized interest rate hikes that nobody wants as it could cause a Volcker-like event, which is why the government must focus on ensuring production towards lowering supply-side inflationary pressures; wage-price spiral risks are lower than supply-side energy price reflation.

Europe:

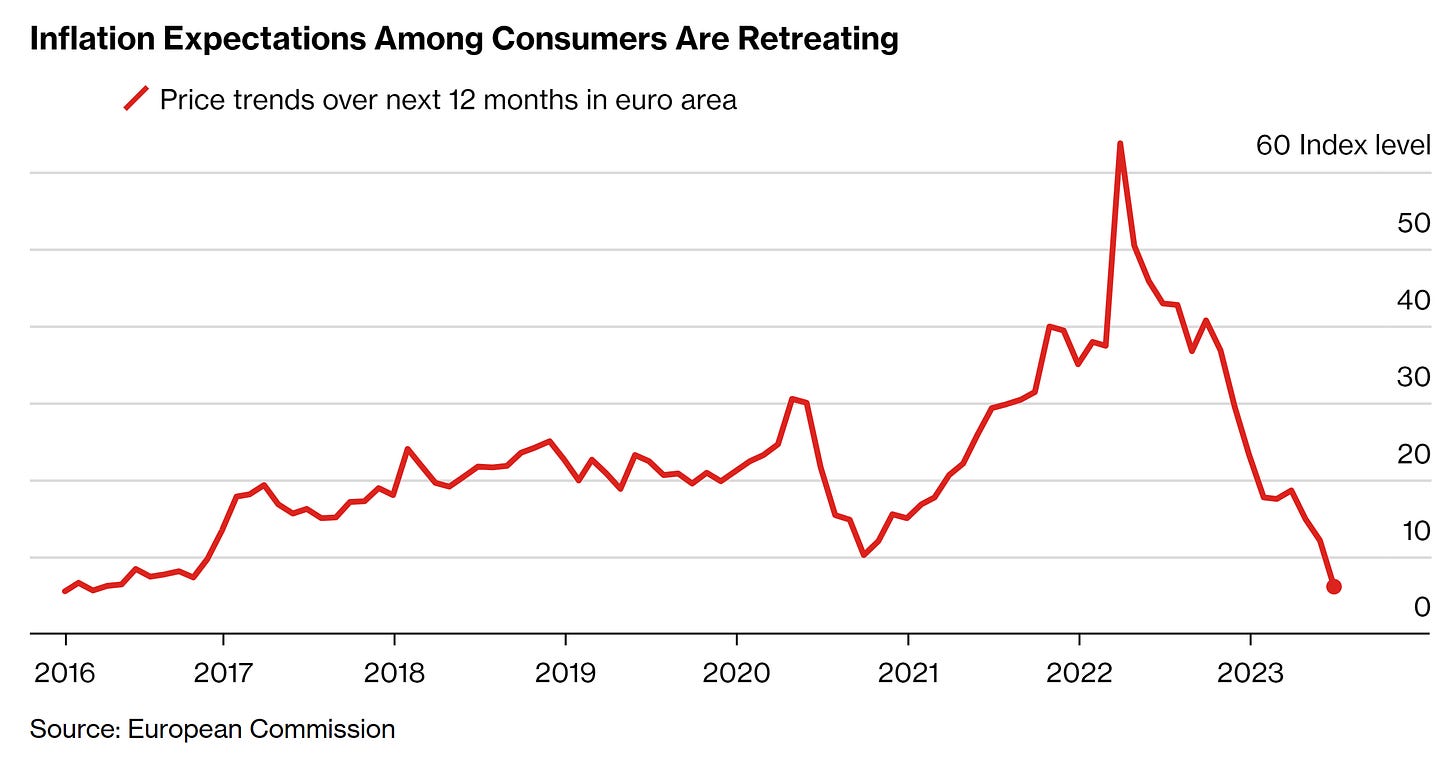

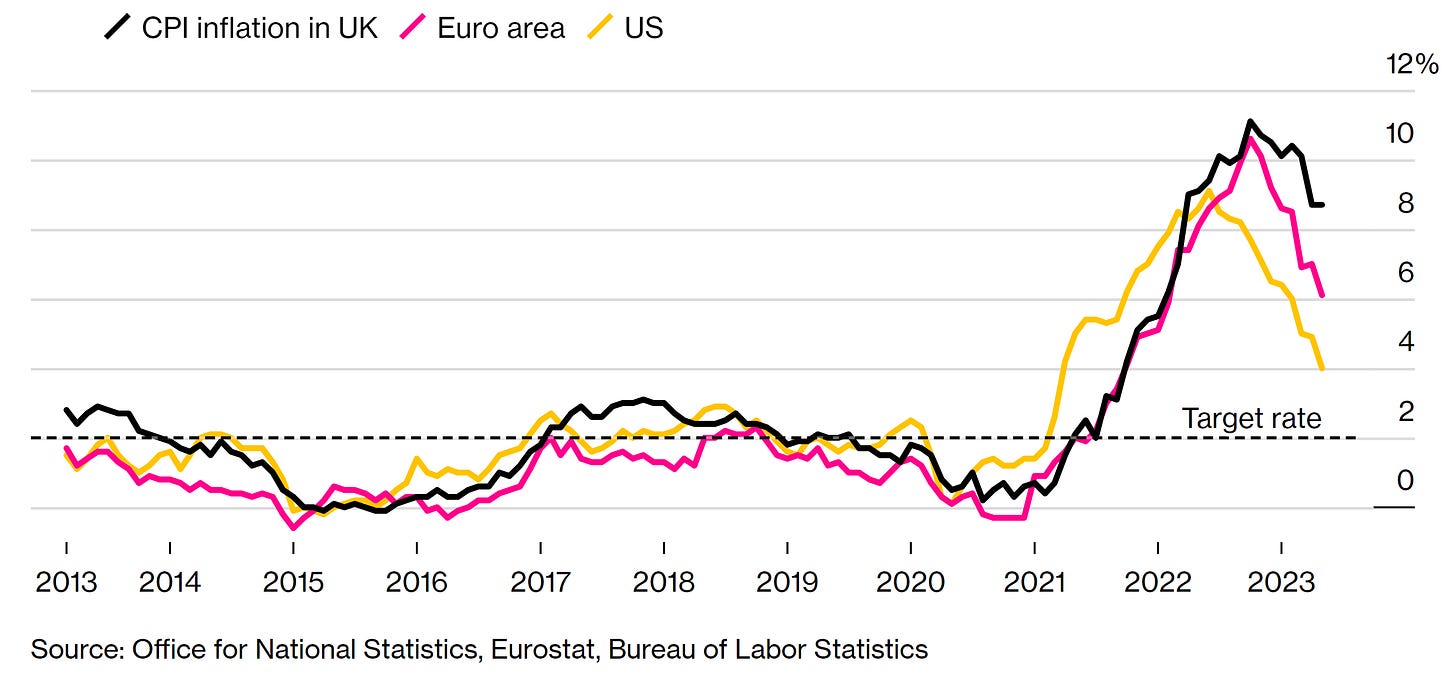

The Eurozone's inflation data keeps trending in the expected direction; this is due to the European Central Bank's monetary policy measures, which have and are ensuring price stability. The Eurozone's inflation is trending better than its G7 peers, such as the United Kingdom. Inflation expectations among European consumers have hit a seven-year low.

Figure 10. Lower forward inflation expectations are a signal of trust from consumers to the European Central Bank measures.

The Eurozone's inflation is slowly but steadily approaching the 2% target, although energy price inflation risk is high given the previously explained reasons that generate supply-side inflationary pressures in energy prices. Energy grid security in the Euro Area remains stable with Norwegian energy projects that have and will ensure a stable supply of energy to Europe. These are some of the few reasons why supply-side energy price inflation risk in the Eurozone is lower than in the United States.

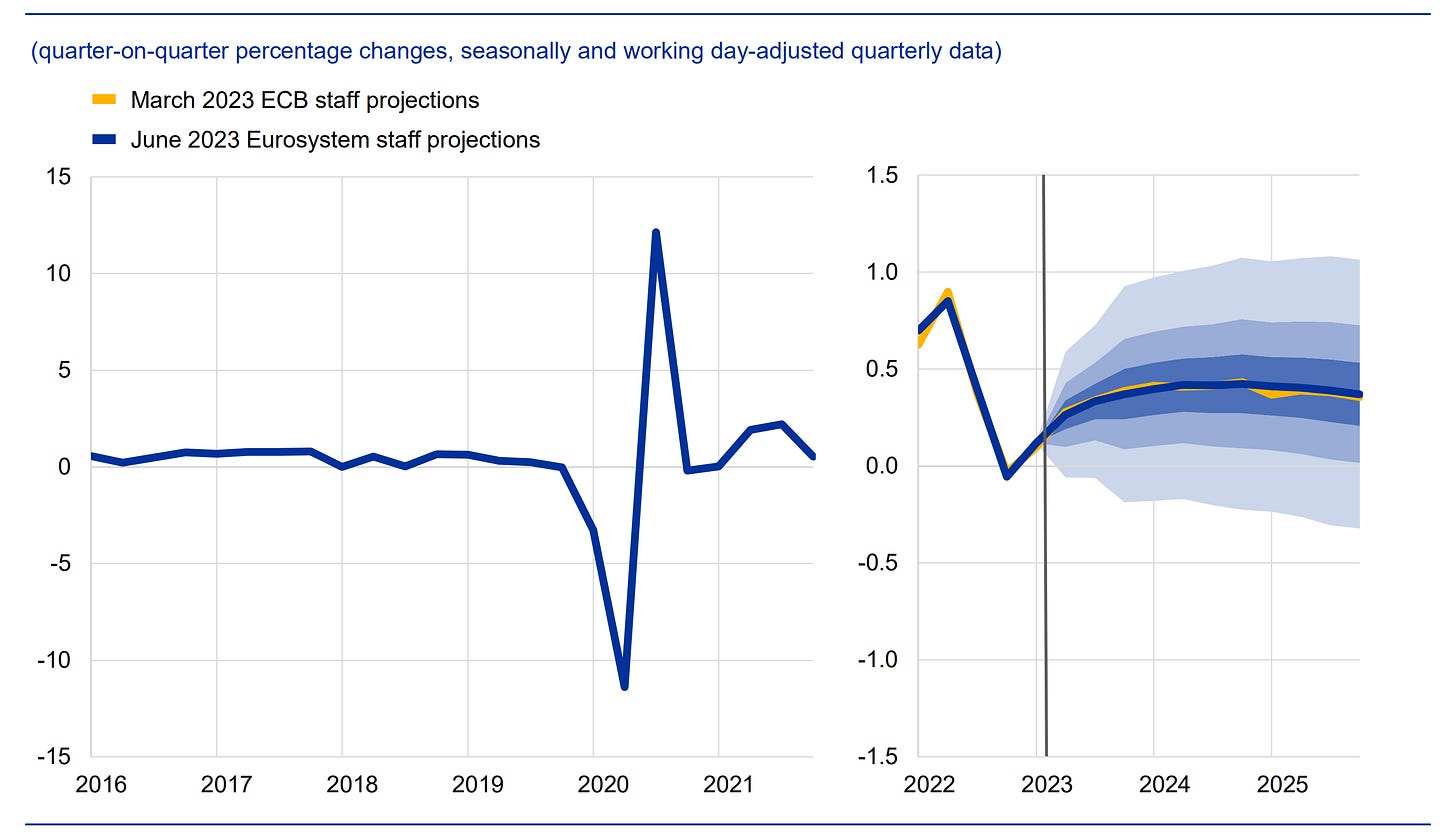

The "macroeconomic stabilisation in a volatile inflation environment" remarks by Ms. Lagarde during the European Central Bank's Forum proved to show how attentive the European Central Bank is to key developments towards framing the issues that monetary policy is facing given the persistent inflation. The European Central Bank's projections are realistic rather than pessimistic or overoptimistic, as can be seen in the next chart.

Figure 11. European Central Bank’s Euro area real Gross Domestic Product Growth projections.

Ms. Lagarde's first and foremost priority is to maintain price stability; which is in line with previously given statements; lower inflationary pressures but persistent underlying inflation are what generate uncertainty, but thus far, the European Central Bank's soft-landing path remains stable, and wage price spiral risks remain contained; therefore, expectations remain the same, although previously explained forward expectations over supply-side inflationary pressures in energy prices are an obstacle to the soft-landing. To conclude, markets priced in a peak rate of almost 6%.

Figure 12. Euro area rate market consensus forecast.

Similar to the United States’ peak rate but lower than the United Kingdom's peak rate, which is above 6%. Positioning remains the same as previously explained.

United Kingdom:

The United Kingdom's economy is under pressure given the stubborn inflation; the United Kingdom is the only major economy where inflation is still rising. This is the main reason why markets frontloaded a peak rate of almost 7%, but the peak rate stabilized above 6% as a signal to the Bank of England that the Monetary Policy Committee might more than likely be behind the curve, as UK inflation is way above the Bank of England’s 2% target and keeps trending higher.

Figure 13. The United Kingdom has worse inflation than its major G7 peers.

The United Kingdom's Inflationary pressures are mostly supply-side related, as the boomerang effect of 2016's Brexit still takes effect, the United Kingdom's government must focus legislative and fiscal policies on lowering supply-side inflationary pressures.

Figure 14. United Kingdom rate market consensus forecast

As the Bank of England doesn't have the tools to lower supply-side inflationary pressures but rather reduce demand-side inflationary pressures, which is why markets repriced the peak rate from almost 7% to above 6%, as monetary policy can't lower supply-side inflationary pressures. Positioning remains the same as previously explained.

Asia:

China:

China's recovery from the pandemic is still facing worries with continuing slowdowns in manufacturer data and industrial activity, a slowdown that has no quick fix that Chinese top officials pledge for speedy measures. Xi Jinping, president of the world's second-biggest economy, is facing worrisome prospects for the People's Republic of China, although the People's Bank of China's measures are ensuring that China doesn't enter recession at the cost of currency devaluation. The People’s Bank of China measures towards stabilizing the Yuan as the Yuan was depreciating towards levels not seen since the pandemic lockdowns.

Figure 15. People’s Bank of China takes measures towards stabilizing the Yuan.

To conclude, the next Gross Domestic Product and employment data will be key to evaluate whether China recovers or slows further. The strong commitment by the Chinese government towards ensuring a strong and steady Chinese economy recovery is what keeps the Gross Domestic Product forecast to the upside. As explained before, geopolitics are also a main driver of price action in China's mainland and non-mainland markets, and expectations over geopolitics remain nearly unchanged; thus, positioning remains the same. Congratulations to Pan Gongsheng on his new position as People's Bank of China governor.

Japan:

The non-improvement in global geopolitical tensions keeps making global speculators flee from Chinese markets to Japanese markets, as explained before. Recent comments from the Bank of Japan's governor Ueda, enhanced the Japanese Yen's value as he mentioned a plausible shift in monetary policy, which was welcomed as good news by market speculators. Recent Japanese inflation data made global speculators worry; given Tokyo inflation and Japan's core-core inflation exceeding the Bank of Japan's 2% target, Japanese markets are pricing a plausible shift in monetary policy in Japan towards ensuring price stability, although positioning remains the same.

Do feel free to share, leave a comment, and subscribe to Quantuan Research Substack if you want, by using the next buttons.