Wealth, War, and Wisdom.

Analysis of microeconomic data, macroeconomic data, political data, geo-political data and monetary policy with commentary on it.

Note: Like in Barton Biggs’ book Wealth, War and Wisdom, in this post the current scenario is explained from a historical perspective along with statistics.

United States:

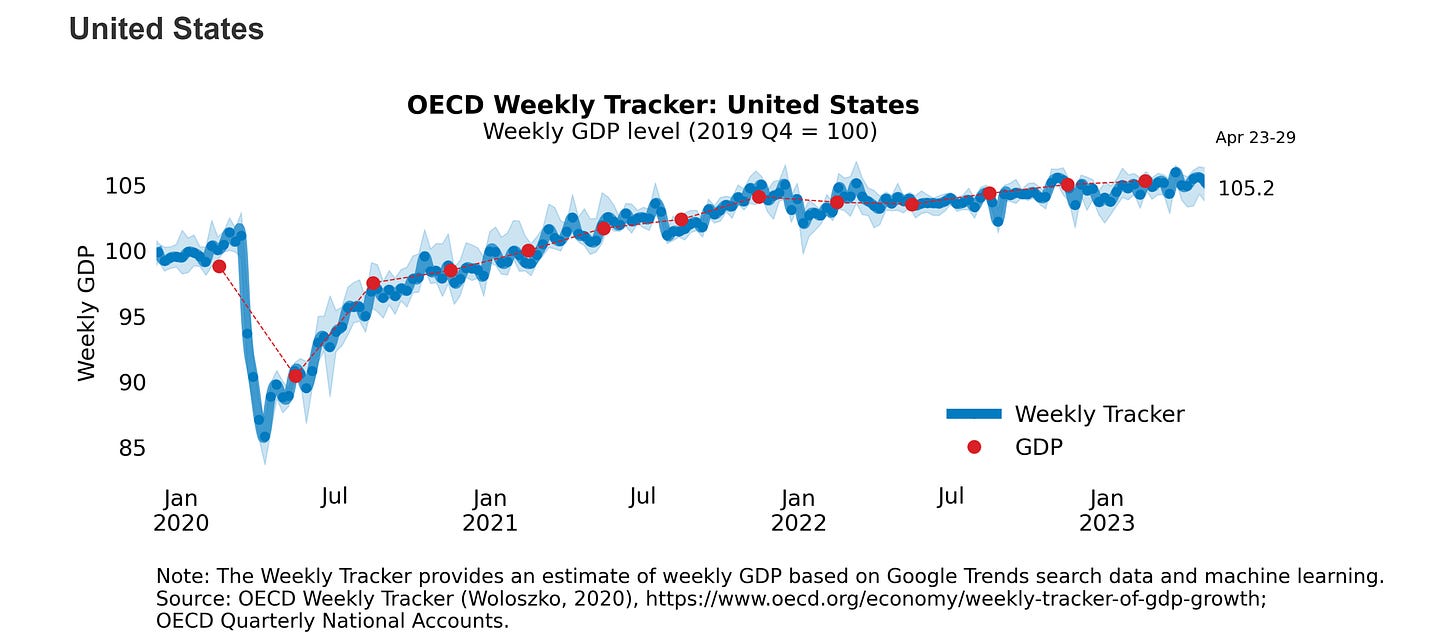

The United States inflationary pressures have eased towards deflationary levels. Import and export inflation statistics, which are leading indicators of inflation, along with the M2 statistics change, show a deflated America within at least one quarter relative to the consumer price inflation statistics, but expectations over inflation of fully achieving the inflation target in the consumer price inflation within the next two quarters, i.e., by the end of the year ( if the government debt ceiling crisis is resolved ), as some have pointed out. As explained before, the more M2 is supplied, the higher the prices will be; thus, the less M2 is supplied, the lower the prices will be. The consumer price index is two quarters behind the near-real-time inflation statistics ( Which are: import, export, and M2 statistics change ).

Figure 1. Inflation chart updated from the previous chart showing the laggard effect of monetary policies on inflation.

The chart shows the lagged effect of Quantitative Tightening (QT) which reduces M2 supply change, thus reducing the quantity of M2 going after goods and thus lowering demand-side inflationary pressures as there is less demand for goods due to less M2, which affects first imports and export price statistics, with one to two quarter(s) of a lagged effect, as can be clearly seen on the chart.

The Consumer Price Index shows deflation caused mainly by lower energy prices; these decreases in energy prices are due to increases in production by OPEC and non-OPEC members. Thus, those production increases have lowered supply-side inflationary pressures. The OPEC+ still controls the oil market, but those production increases by OPEC and non-OPEC members have allowed the United States Department of Energy's measures to have more effect on markets as supply exceeded demand for oil in markets on various days, making oil prices more volatile.

Figure 2. OPEC and Non-OPEC liquid fuels production.

Apart from the United States Department of Energy's measures over the Strategic Petroleum Reserves, these are the main vectors of the lower supply-side inflationary pressures; the main vector of the lower demand-side inflationary pressures is monetary policy. As monetary policy maintains the hawkish but nimble stance.

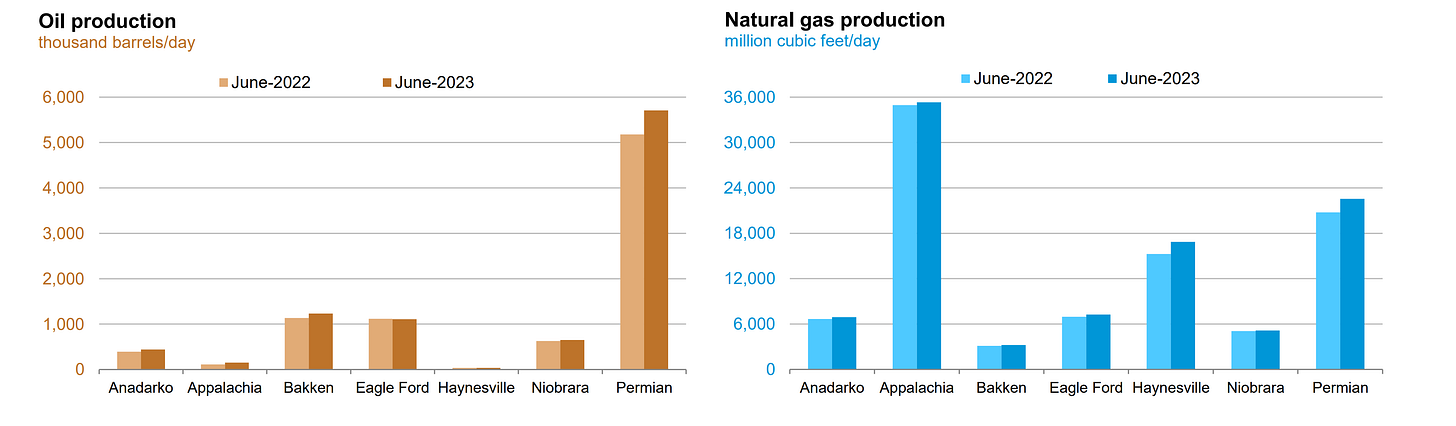

Figure 3. United States Oil and Natural Gas Production.

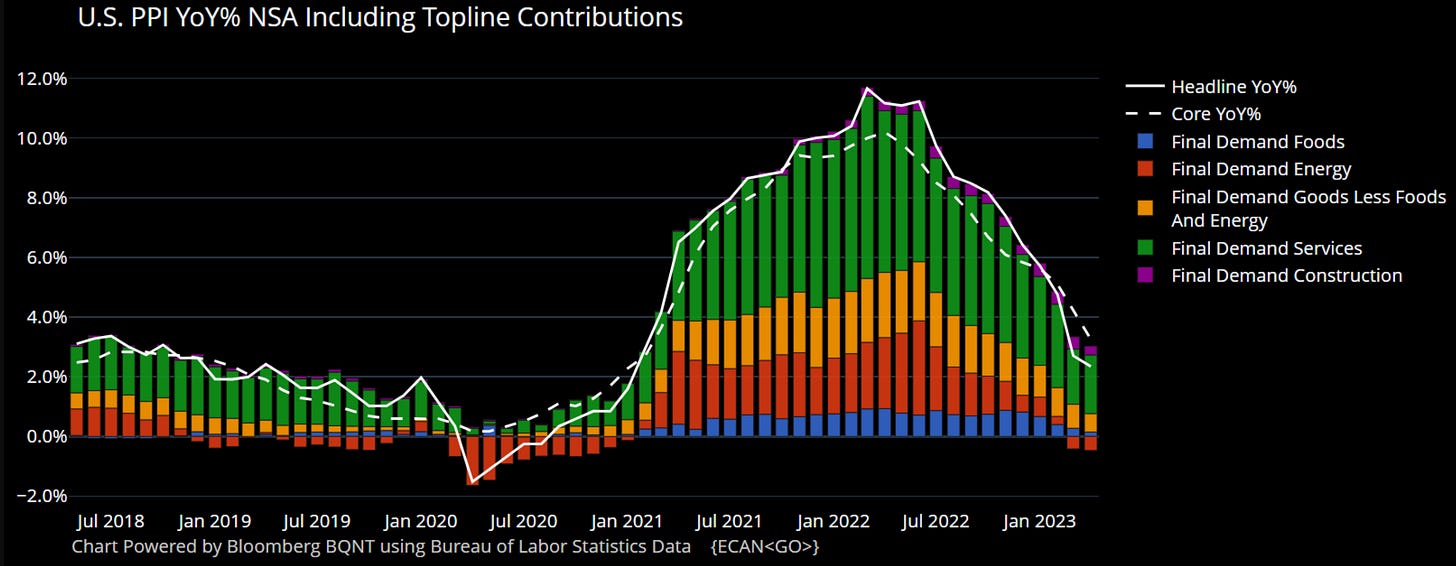

Those measures taken by the United States Department of Energy and the monetary policy measures taken by the Federal Reserve have lowered inflationary pressures in consumer and producer price indexes, to the point that the producer price index is at 2.3%, while the consumer price index is at 4.9%. Price stability is almost achieved as inflation approaches to the 2% target.

Figure 4. United States Producer Price Index, Year-over-Year Percentage Change (YoY%), Not Seasonally Adjusted (NSA), Topline Contributions.

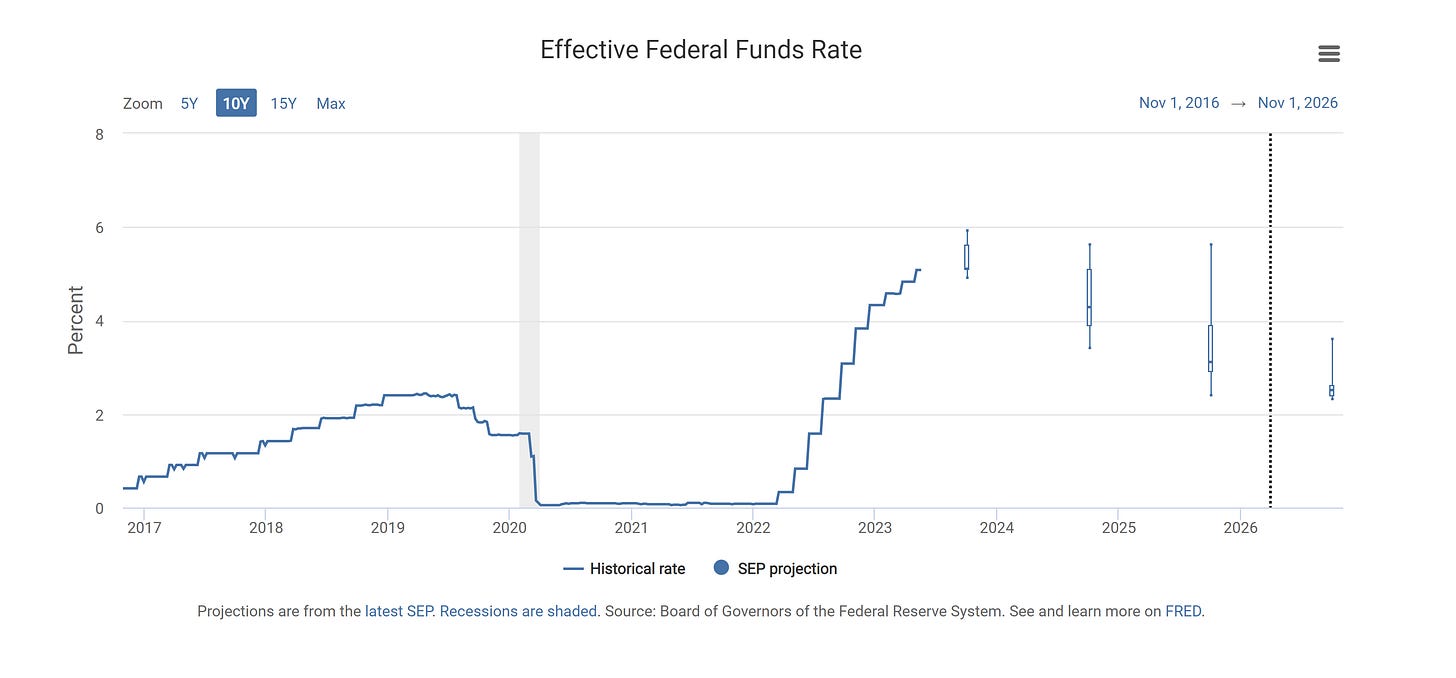

As many FOMC officials of the Federal Reserve have signaled in the Summary of Economic Projections (SEP) interest rates are expected to peak in the 6% range. The forward expectations over monetary policy remain the same, but a rate hike pause might be appropriate after two more interest rate hikes, which is what the market is pricing, while increasing the pace of Quantitative Tightening as it can replace rate hike increases until after inflation gets to the 2% target. The higher for longer interest rate stance is expected to remain as long as the Federal Reserve’s dual mandate doesn’t get affected, which is not expected to change as the employment data keeps a strong trend, thus not making monetary policy focused on maximum employment but rather on price stability.

Figure 5. Effective Federal Funds Rate (Interest Rates) Projections by the FOMC.

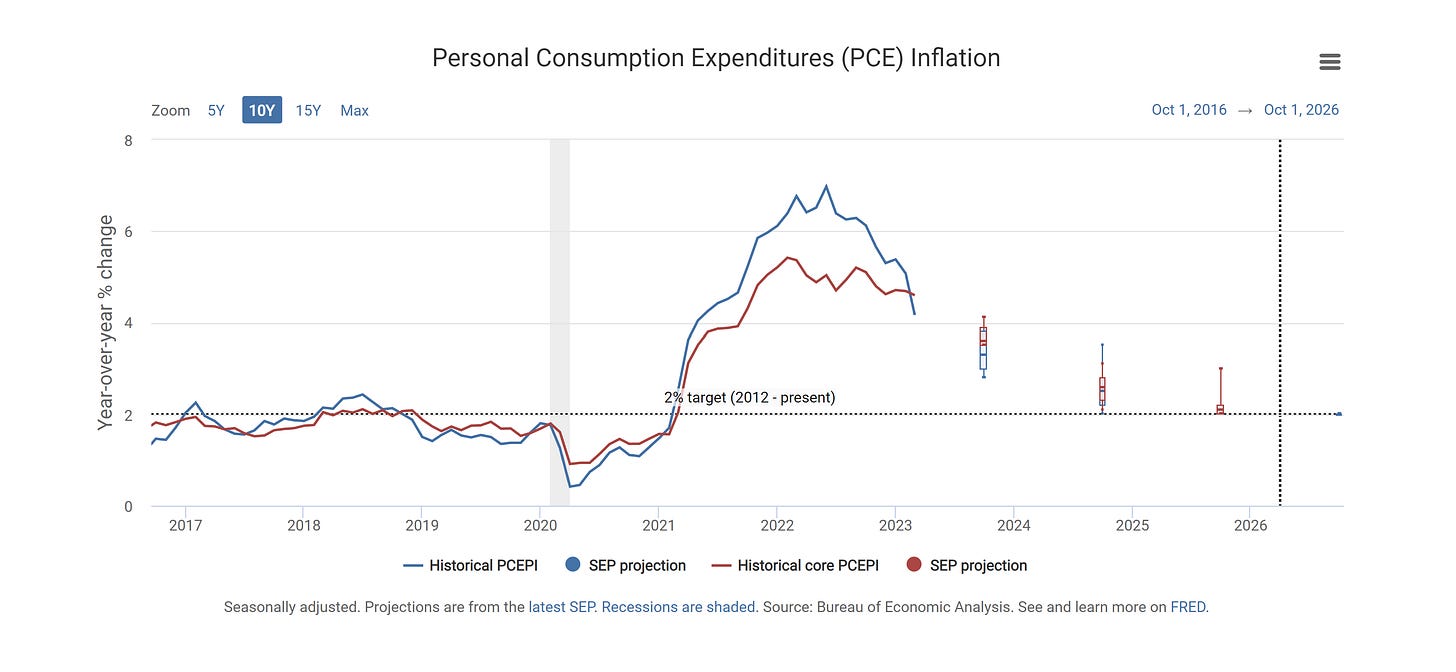

Learning from history, pivoting too soon on monetary policy is quite a big error, which is something that many FOMC officials have stated on various occasions. Inflation remains too high, as many FOMC officials have said in many statements, but thus far, the monetary policy tightening path has ensured price stability. With inflation approaching target and employment data remaining strong, the soft-landing path is almost achieved; as mentioned before, the government debt ceiling crisis is what complicates the soft-landing path.

Figure 6. Personal Consumption Expenditures (PCE) Inflation Projections by the FOMC.

The employment statistics in the United States show a strong America with no bad surprises; recent increases in unemployment data were regulated given irregularities. With the unemployment rate at 3.4%, participation rate at 62.6% and inflation statistics approaching the 2% target, America remains strong.

Figure 7. The Employment Situation in the United States.

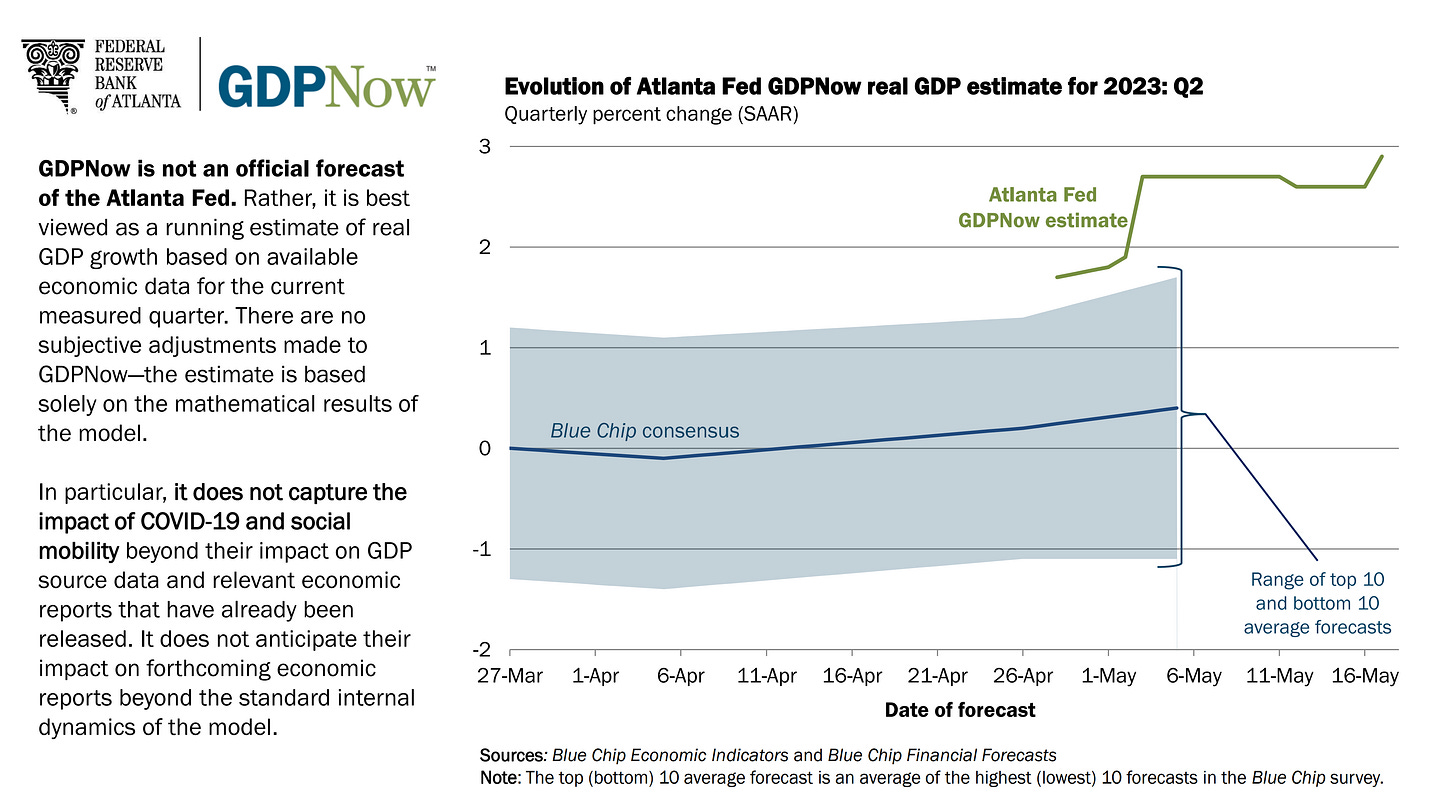

Expectations over the performance of the United States economy remain the same, but prudent given the government debt ceiling crisis, as monetary policy can't do anything about the debt ceiling crisis but wait for Congress to pass a resolution, as monetary policy doesn't have the tools to resolve the current United States government debt ceiling crisis without causing more inflation, as the United States dollar can't devalue further than it already has due to fiscal policy expansion given by the United States previous administrations. As mentioned before.

Figure 8. Evolution of Atlanta Fed GDPNow real Gross Domestic product (GDP) estimate for the second quarter of 2023.

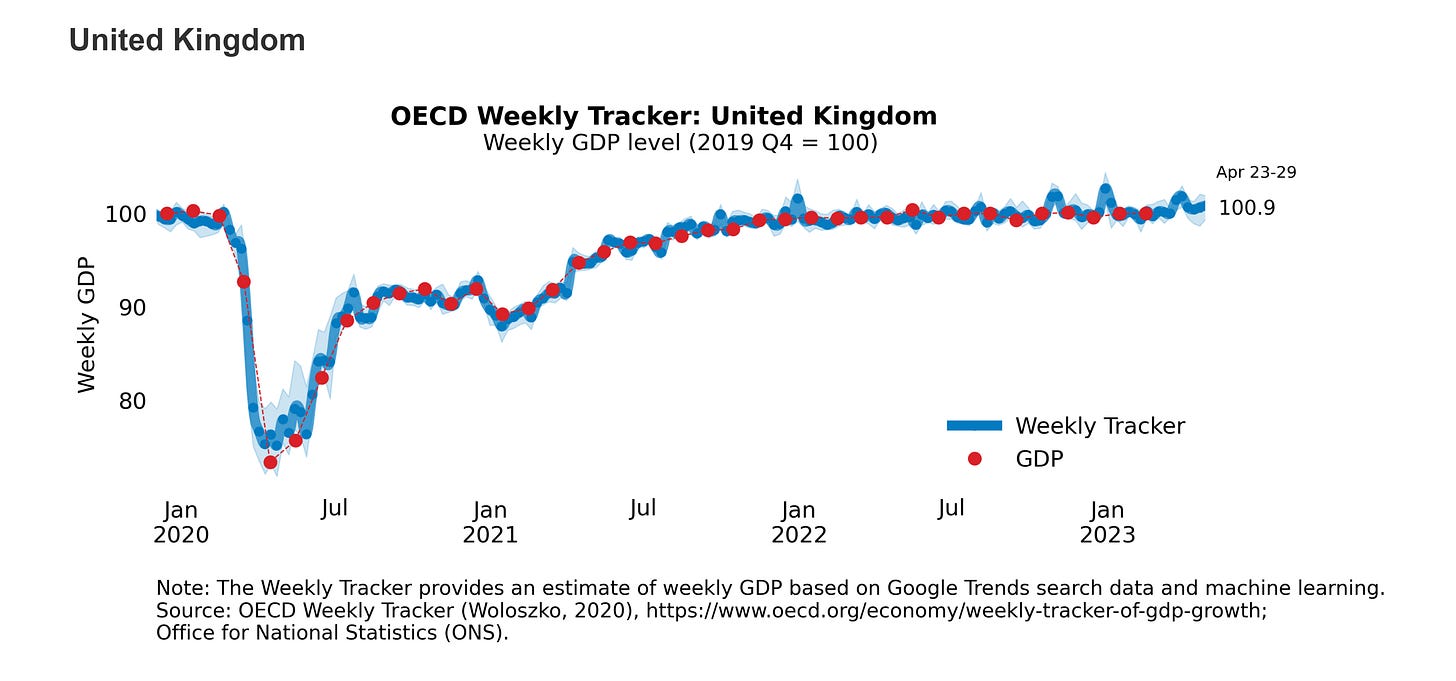

Figure 9. Organisation for Economic Co-operation and Development (OECD) - United States - Weekly Gross Domestic Product (GDP) Tracker.

The last time the United States faced a similar scenario, France sent warships to the East Coast of the United States to be paid. Looking at the forward World War, which is vectored by Taiwan, as explained before, the United States must choose not to reduce its advantage over other nations by defaulting. As risks of hyperinflation are high given the government default, it is coherent to stay prudent when it comes to hedging United States markets. Emerging markets remain a safe haven until the government sets an outcome for the debt ceiling crisis. The current scenario is different from the previous time the United States government faced a debt ceiling crisis, as explained before, but there is faith that the United States government can manage the government debt ceiling crisis. Given the fact that the government has a very small timeframe to address the government debt ceiling crisis, many folks have asked, "Is it over for the United States?" Well, the answer depends on the outcome of the debt ceiling crisis: whether America ends its leadership over the world or remains the same, if the government defaults, it's over, as the United States dollar would hyperinflate given the fact that what backs the United States dollar would be 0.

Europe:

(Previous Analysis 1 (Dec 18, 2022))

(Previous Analysis 2 (Nov 5, 2022))

(Previous Analysis 3 (Oct 31, 2022))

(Previous Analysis 4 (Mar 28, 2023))

The European Central Bank's monetary policy measures through the interest rates and Quantitative Tightening have lowered inflationary pressures in the Euro Area, along with measures taken by the United States Department of Energy and monetary policy measures taken by the Federal Reserve, which have facilitated the decline in inflation in the Euro Area. As producer and consumer inflation statistics approach deflationary levels but still remain above the European Central Bank's 2% inflation target, it is convenient for the European Central Bank to keep a hawkish but nimble monetary policy stance in place. The higher for longer monetary policy stance is expected to remain until after price stability is achieved; thus, expectations over rate hikes remain the same as developments in the Euro Area remain within the range of expectations.

Thus far, the economies of the Euro Area are behaving well. With the Euro Area unemployment rate at 6.5% and the number of unemployed reaching 1995 lows in a deflationary environment, the European Central Bank can and must maintain a hawkish but nimble stance towards achieving price stability, and Ms. Lagarde has said that all measures will be taken to bring inflation to 2%, which is coherent given the high inflation.

(...)"We will take all the measures in order to bring inflation back to 2%. We will do it, no question about it." (...) - European Central Bank's Christine Lagarde

Recent developments in the United States financial sector have made people move towards European markets as a safe niche, which is coherent. Until the United States government debt ceiling crisis is resolved, emerging markets remain a safe haven.

United Kingdom:

(Previous Analysis 1 (Dec 18, 2022))

(Previous Analysis 2 (Nov 5, 2022))

(Previous Analysis 3 (Oct 31, 2022))

(Previous Analysis 4 (Mar 28, 2023))

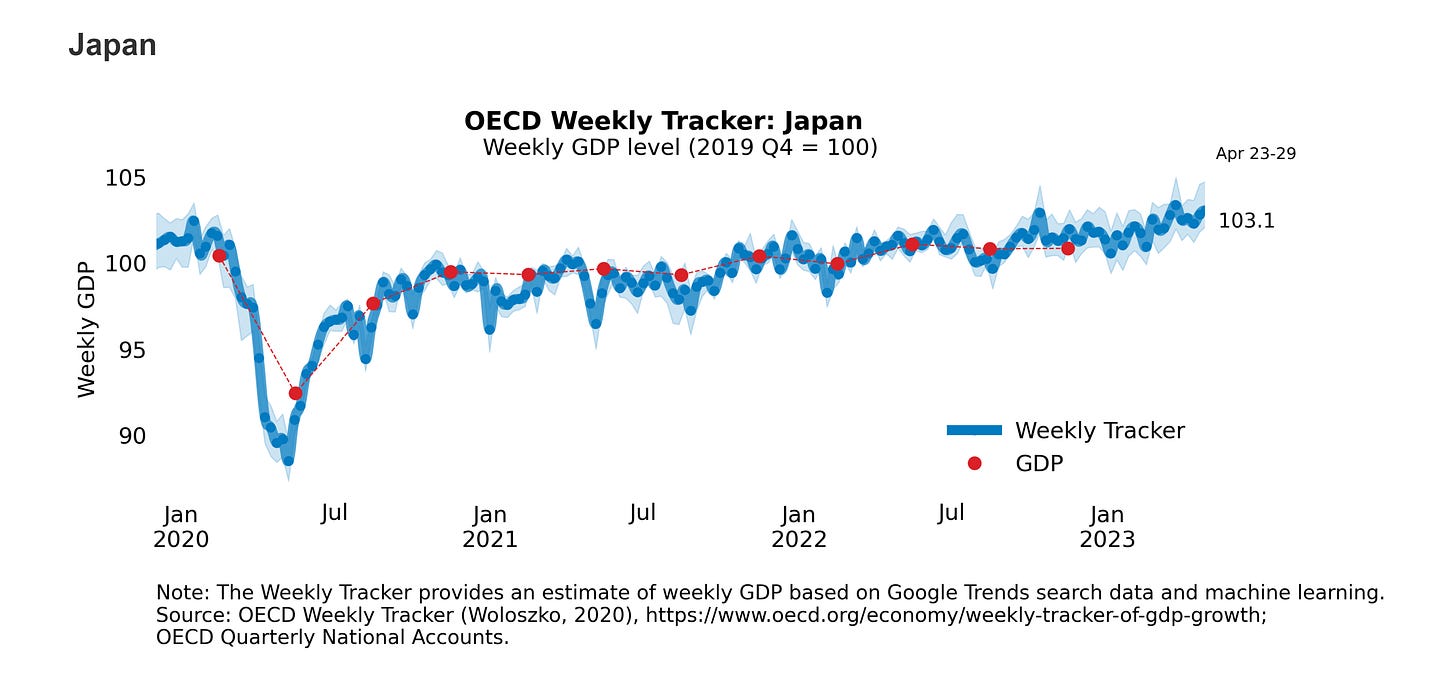

The measures taken by the Bank of England over the interest rates and Quantitative Tightening have lowered inflationary pressures in the United Kingdom. Recent comments by Bank of England's Monetary Policy Committee member Ramsden have proven to show how attentive the Bank of England is toward using monetary policy tools to lower the still high inflation. The United Kingdom economy remains strong given by legislative and fiscal policy measures, which are prudent and have ensured stability in society, along with monetary policy measures that have and are ensuring price stability. There is a long path until inflation in the United Kingdom gets towards the Bank of England's 2% target, which is why it is convenient for the Bank of England to stay focused on price stability as employment and growth in the United Kingdom remain resilient even with the still high inflation.

Figure 10. Organisation for Economic Co-operation and Development (OECD) - United Kingdom - Weekly Gross Domestic Product (GDP) Tracker.

Wage-price spirals and energy price disinflation are some of the risks that the United Kingdom's economy is facing, which legislative and fiscal policy measures taken by PM Rishi Sunak have counteracted, along with the Bank of England’s monetary policy measures that have lowered demand-side inflationary pressures. Measures taken in the United States by the United States Department of Energy have also helped the United Kingdom alleviate energy prices. Overall inflation in the United Kingdom remains too high, which is why further rate hikes are expected along with a plausible increase in the Quantitative Tightening pace, which would allow a faster path towards a deflationary environment as Quantitative Tightening increases can replace super-sized rate hike increases. As inflation lowers due to monetary policy measures and measures taken by the United Kingdom government, the United Kingdom's government-granted bonds enhance their value, as mentioned before.

Asia:

China:

(Previous Analysis 1 (Dec 18, 2022))

(Previous Analysis 2 (Nov 5, 2022))

(Previous Analysis 3 (Oct 31, 2022))

(Previous Analysis 4 (Mar 28, 2023))

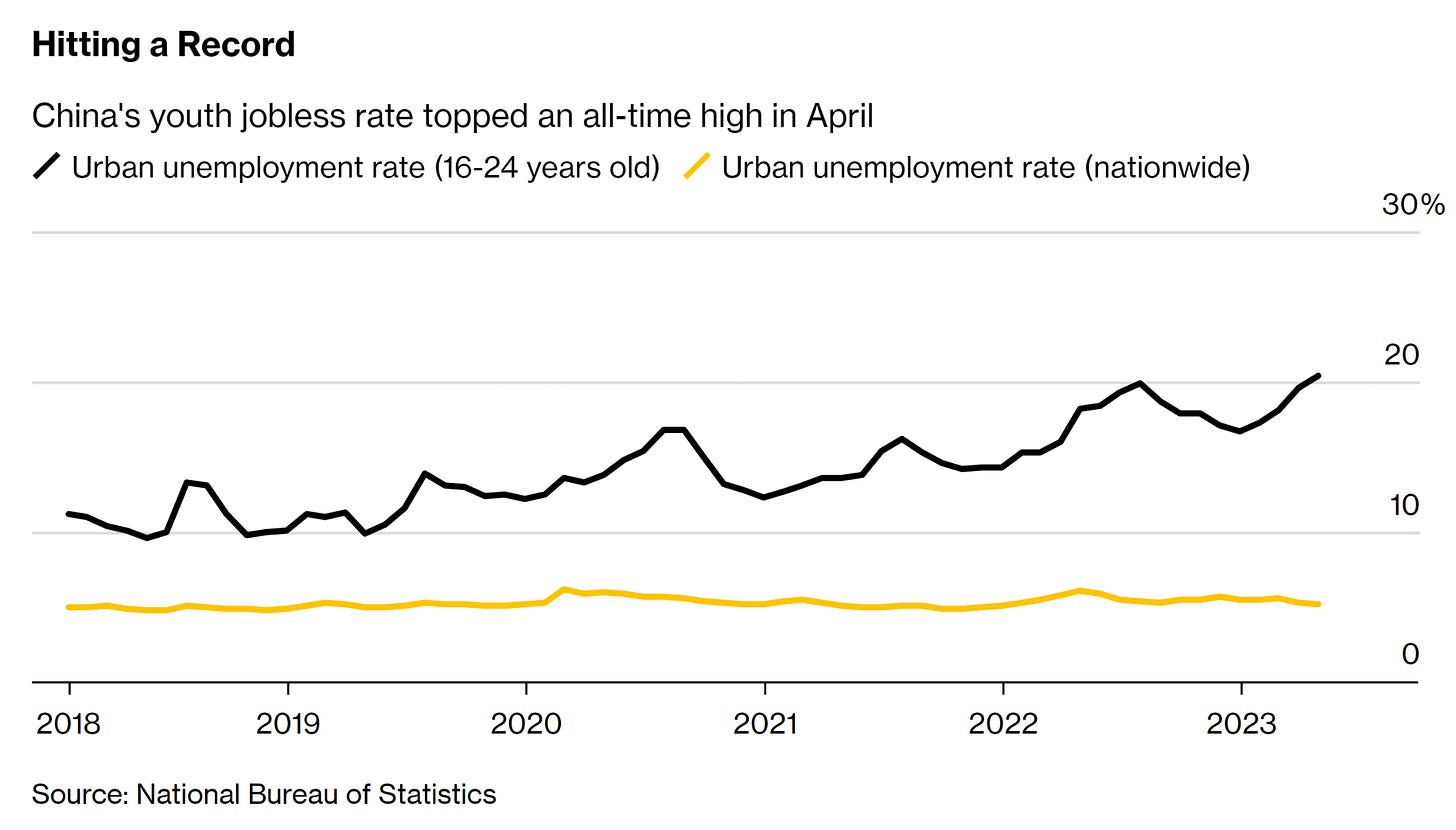

The People’s Bank of China (PBoC) monetary policy stance has not changed, the structural monetary policy guidance remains in place, and the previously mentioned reopening of the Chinese economy enhanced China's Gross Domestic Product (GDP), as China's economic activity increases given the reopening, the world experiences inflationary pressures, which has made countries in APAC suffer bigger inflationary shocks. But given China’s employment data, which is alarming, markets are worried about China’s reopening. The People’s Bank of China (PBoC) is expected to shift its monetary policy further because China's forward Gross Domestic Product (GDP) data depends on it. Geopolitics is the main theme for 2023/24 given Taiwan and the One China Principle. China's markets and economy expectations have been fogged by the China’s alarming employment data.

Figure 11. China's youth jobless rate statistics.

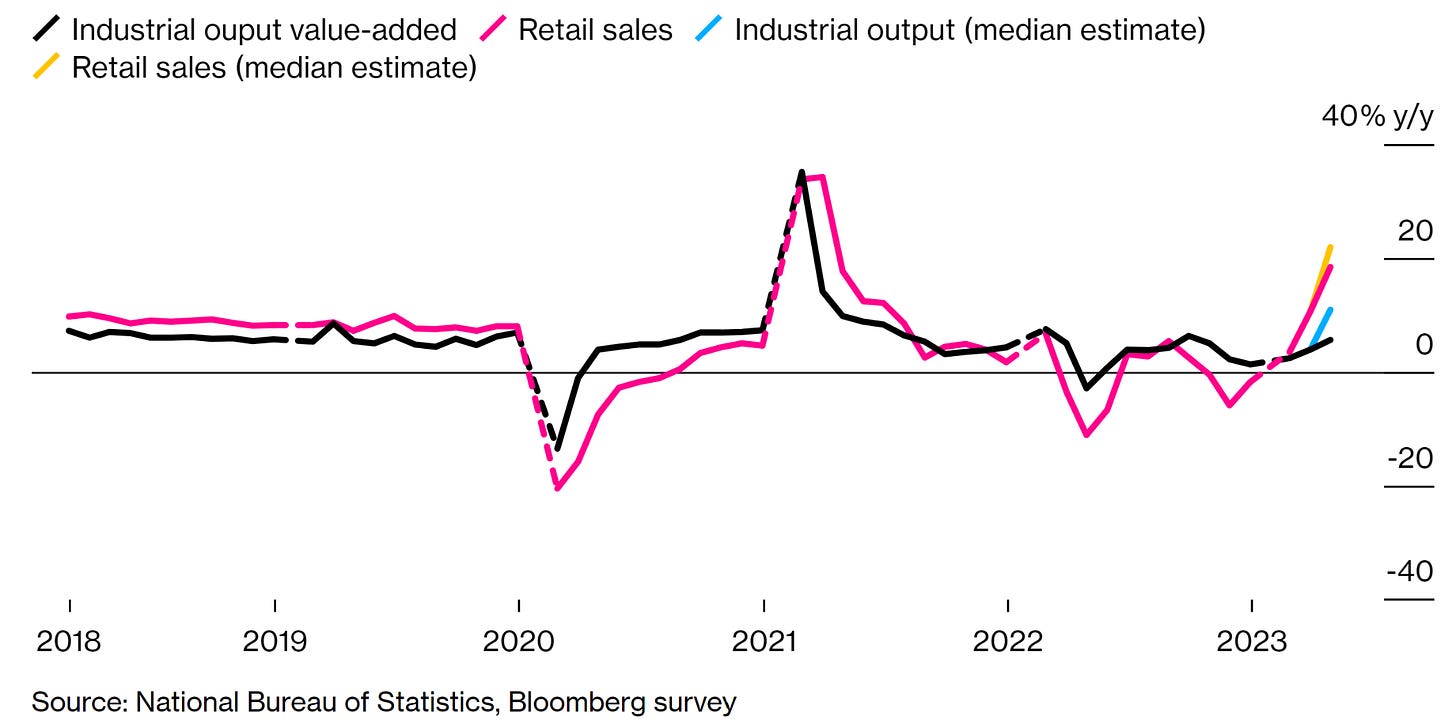

Rather than being China's reopening, it's more China's recovery given the industrial and retail statistics of the Chinese economy, which show a weak Chinese economy, which is why expectations in China’s monetary policy are expected to shift towards supporting the Chinese economy.

Figure 12. China's April retail statistics, industrial output statistics show a weaker than expected Chinese economy.

Japan:

(Previous Analysis 1 (Dec 18, 2022))

(Previous Analysis 2 (Nov 5, 2022))

(Previous Analysis 3 (Oct 31, 2022))

(Previous Analysis 4 (Mar 28, 2023))

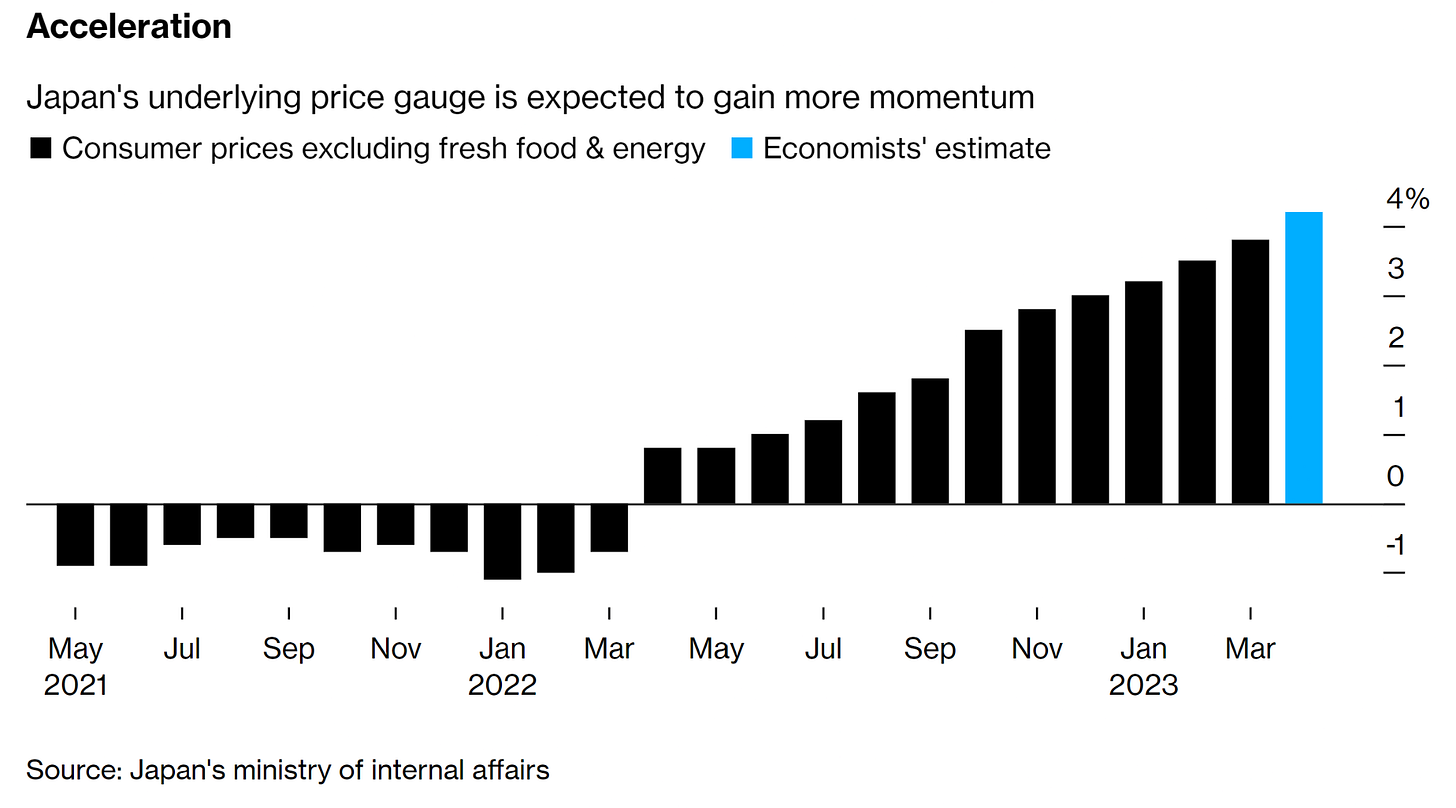

The increase in economic activity in China has had an effect on the Japanese economy, making the Japanese price inflation statistics reach levels not seen in decades, Japanese food prices increased the most since August 1976, with core inflation, way above the Bank of Japan’s 2% target, which proves that the Bank of Japan has to take measures to lower inflationary pressures as the current measures are not taking effect in the Japanese economy.

Figure 13. Japan's Core Consumer Price Expectations.

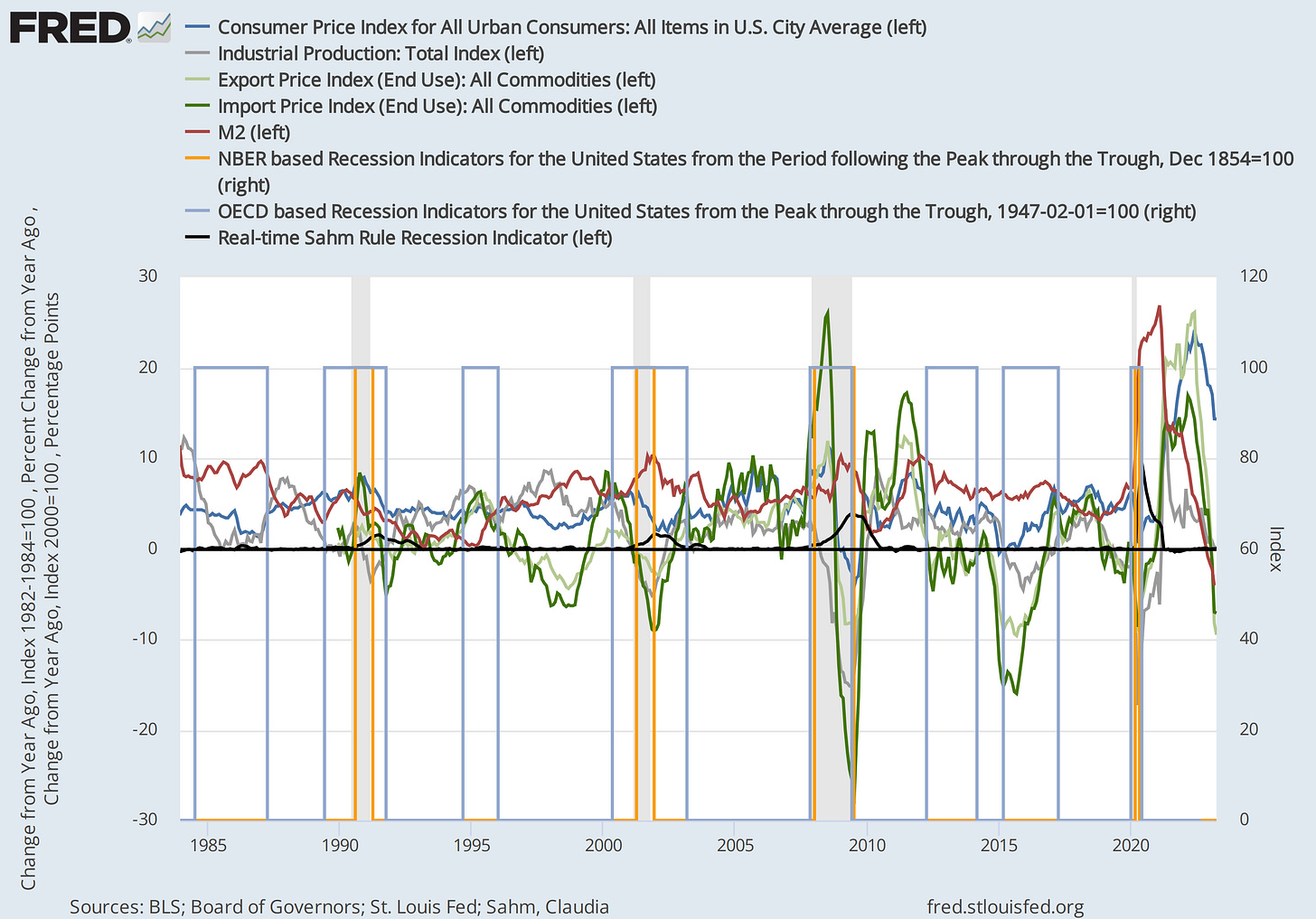

Markets seem to not care about inflation in Japan; in fact, there has been a shift by markets during the seasonal portfolio rebalancing, and market sentiment over Japanese markets is bullish. Given the Japanese Yen devaluation due to the Bank of Japan’s monetary policy measures, Japanese stock markets are cheap relative to valuations in Euro or Dollar currencies, which is something that some don’t like and others do.

Figure 14. Organisation for Economic Co-operation and Development (OECD) - Japan - Weekly Gross Domestic Product (GDP) Tracker.

Overall, the Japanese economy behaves way stronger than expectations, despite the Japanese currency devaluation and the Japanese inflation rate.

Do feel free to share, leave a comment, and subscribe to Quantuan Research Substack if you want, by using the next buttons.