Two Central Bank Rate Decisions & Key Macroeconomic Data Releases

Commentary & Expectations Over Recent & Forward Macroeconomic Data Releases.

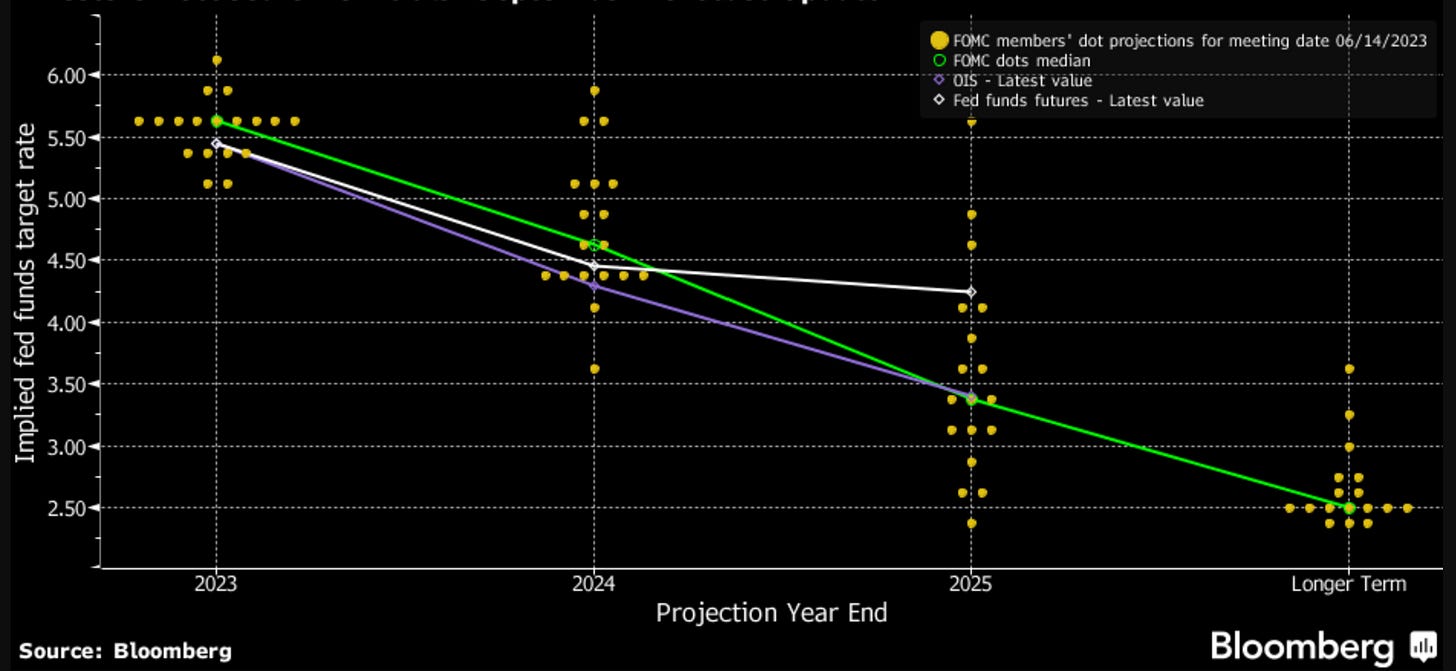

This week’s rate decisions are expected to be a hawkish hold ( i.e., pause ) in the United States, which markets expect since the "Structural Shifts in the Global Economy." symposium, and a 25 basis point hike in the United Kingdom. After the last United States inflation data release, markets priced in another rate hike, which markets undone later on in the week, as could be seen in the United States Government Treasury Yield Curve.

The United Kingdom's inflation data release the day before the Bank of England's rate decision should help the Bank of England's Monetary Policy Committee members adjust forward guidance. The United Kingdom's inflation data is expected to show the same supply-driven inflationary pressures as in the United States, which monetary policy can't control through the interest rates, as the interest rates can only control demand-driven inflationary pressures.

Positioning remains towards a hike given the fact that the United States’ supercore and core inflation ( Chart , Statistics. ) data, showed demand-driven inflationary pressures in core prices. As explained in a Twitter thread ( Do read it if you want ), those inflationary pressures can be controlled through the interest rates, unlike the supply-driven inflationary pressures reflected in the non-core inflation ( Chart , Statistics. ) data.

The probability of a 25 basis point hike in the United States is lower than the probability of a 25 basis point hike in the United Kingdom. Jerome Powell's press conference after the interest rate decision should help signal forward guidance, which, as mentioned before given the last inflation data, is something to be attentive to, due to the fact that depending on the forward rate path, the United States economy could face a Volcker-like event or not by overreacting or not to supply-driven inflation, as explained before.

Figure 1. FOMC Rate Projections.

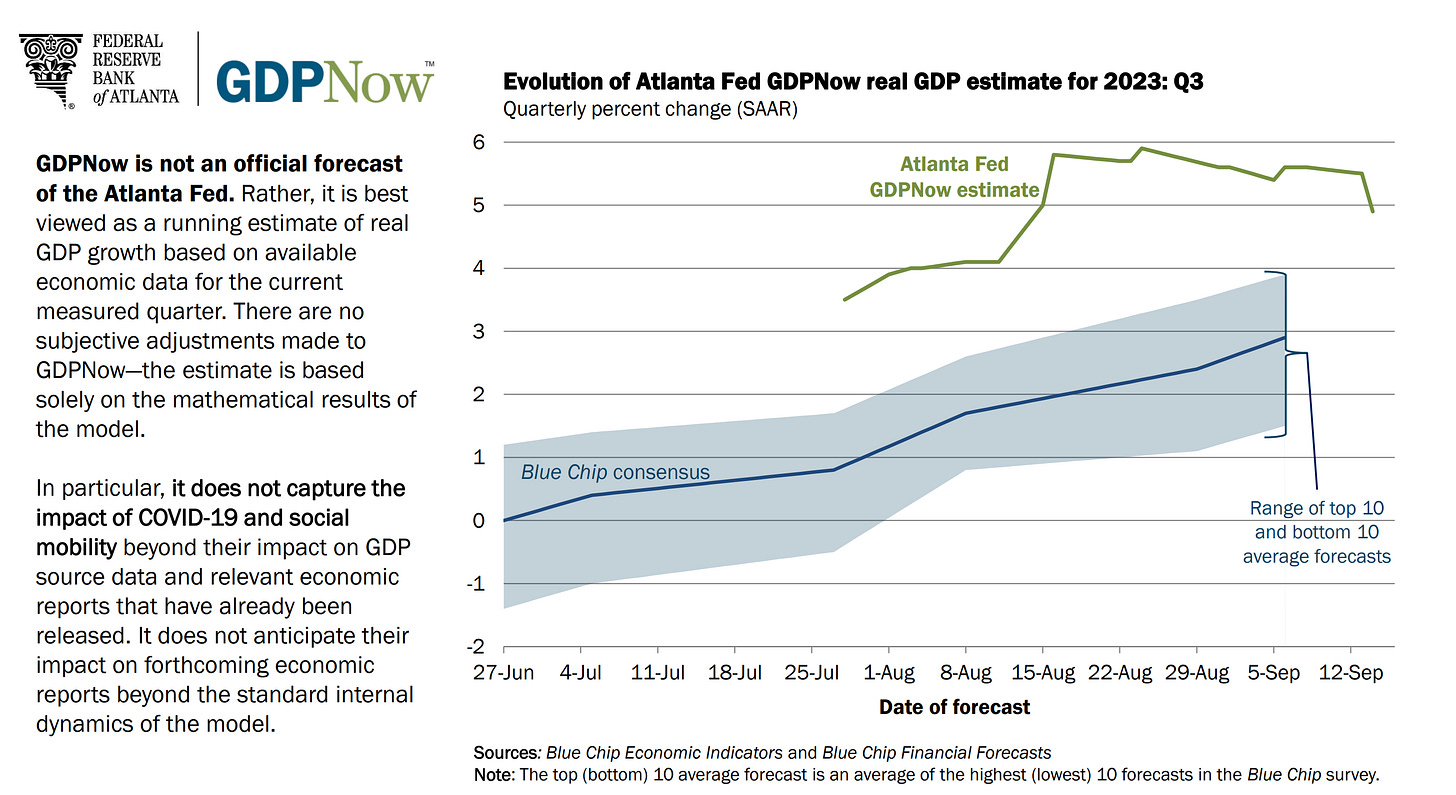

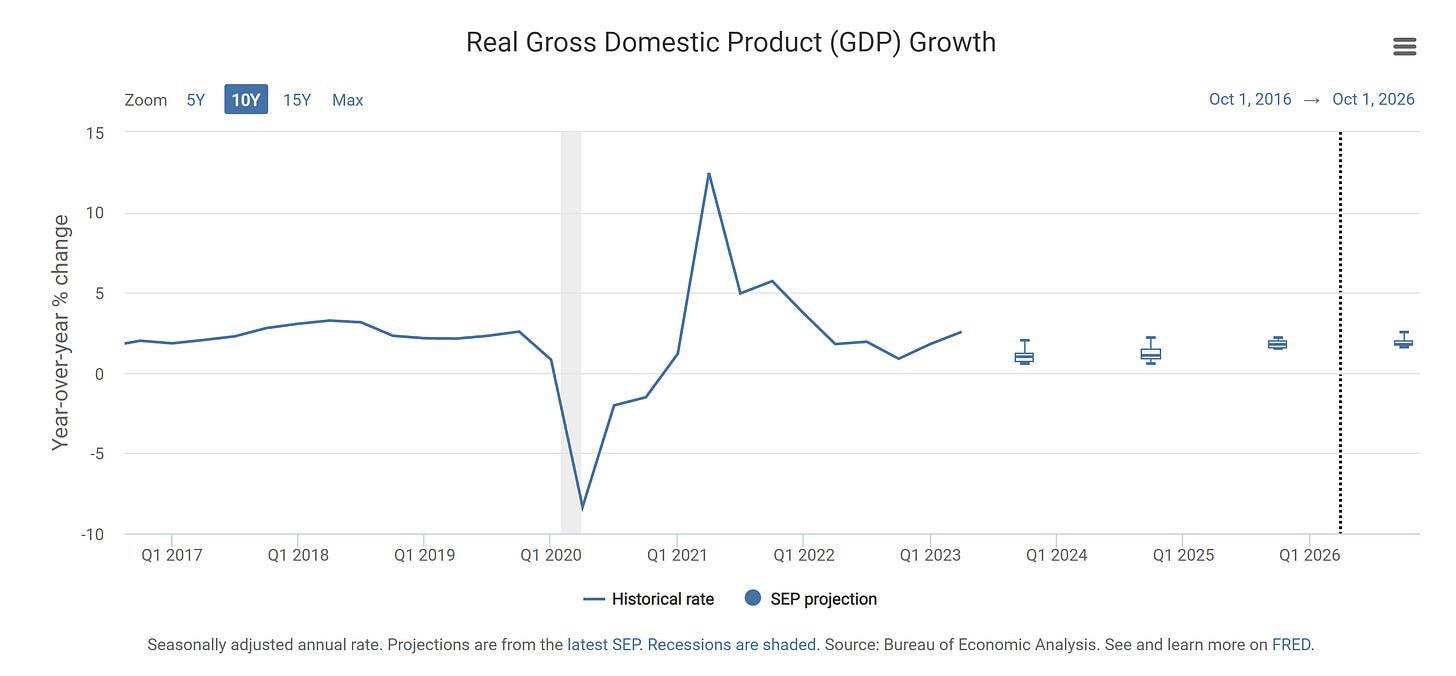

Next week’s United States’ Gross Domestic Product data release will more than likely help monetary policy adjust forward guidance based on the performance and strength of the United States economy.

Figure 2. Evolution of Atlanta Fed GDPNow real Gross Domestic product (GDP) estimate for the third quarter of 2023.

Figure 3. Real Gross Domestic Product (GDP) Growth Projections by the FOMC.

To conclude, the forward performance of the economy will be determined by the previously mentioned data releases of this week ( FOMC Rate decision and Jerome Powell's press conference after the rate decision ) and next week ( United States’ Gross Domestic Product data ). Thus far, the employment statistics indicate a robust economy with resilient consumers. However, supply-driven inflation is expected to shift consumer spending from the consumer discretionary sector to the staples and services/utilities sectors, similar to previous shifts given by supply-driven energy price inflation in 2021 and 2022 ( Document ). That shift in consumer spending should be reflected in the performance of those sectors until supply-driven inflation is controlled, which has no immediate solution, and is already being reflected.

Do feel free, as it’s free, to share, leave a comment, and subscribe to Quantuan Research Substack if you want, by using the next buttons.

It's not about the money (the research is free); it's about sending a message (delivering alpha to the reader).