Note: This should’ve been posted yesterday before the market open as scheduled. By the time I fixed the audio software issue, it was too late. As the podcast was getting a bit too lengthy I divided it in two parts. I noticed now that I left my music on while doing the podcast, I didn't notice with the noise cancellation headset. 😂

🌎

United States:

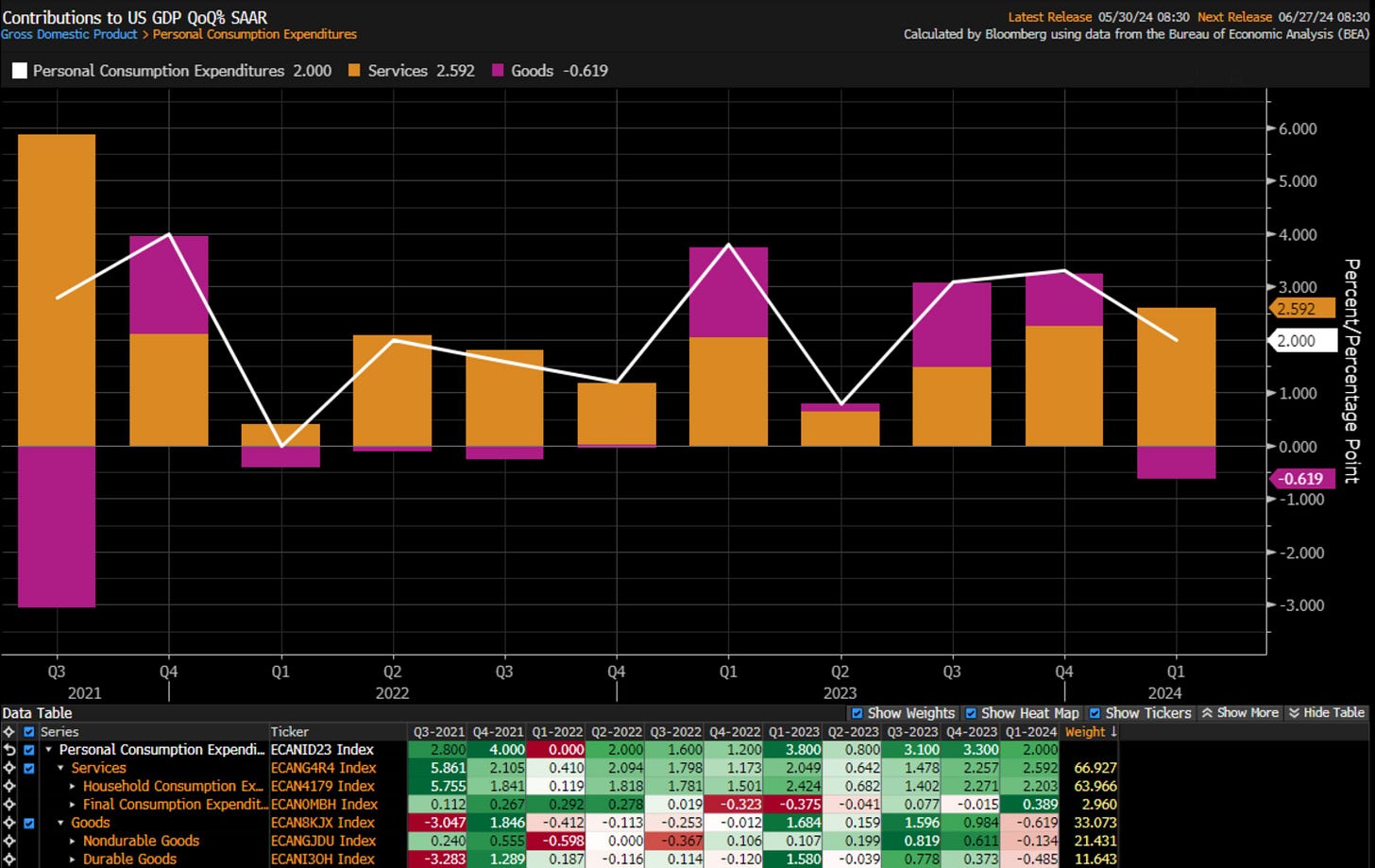

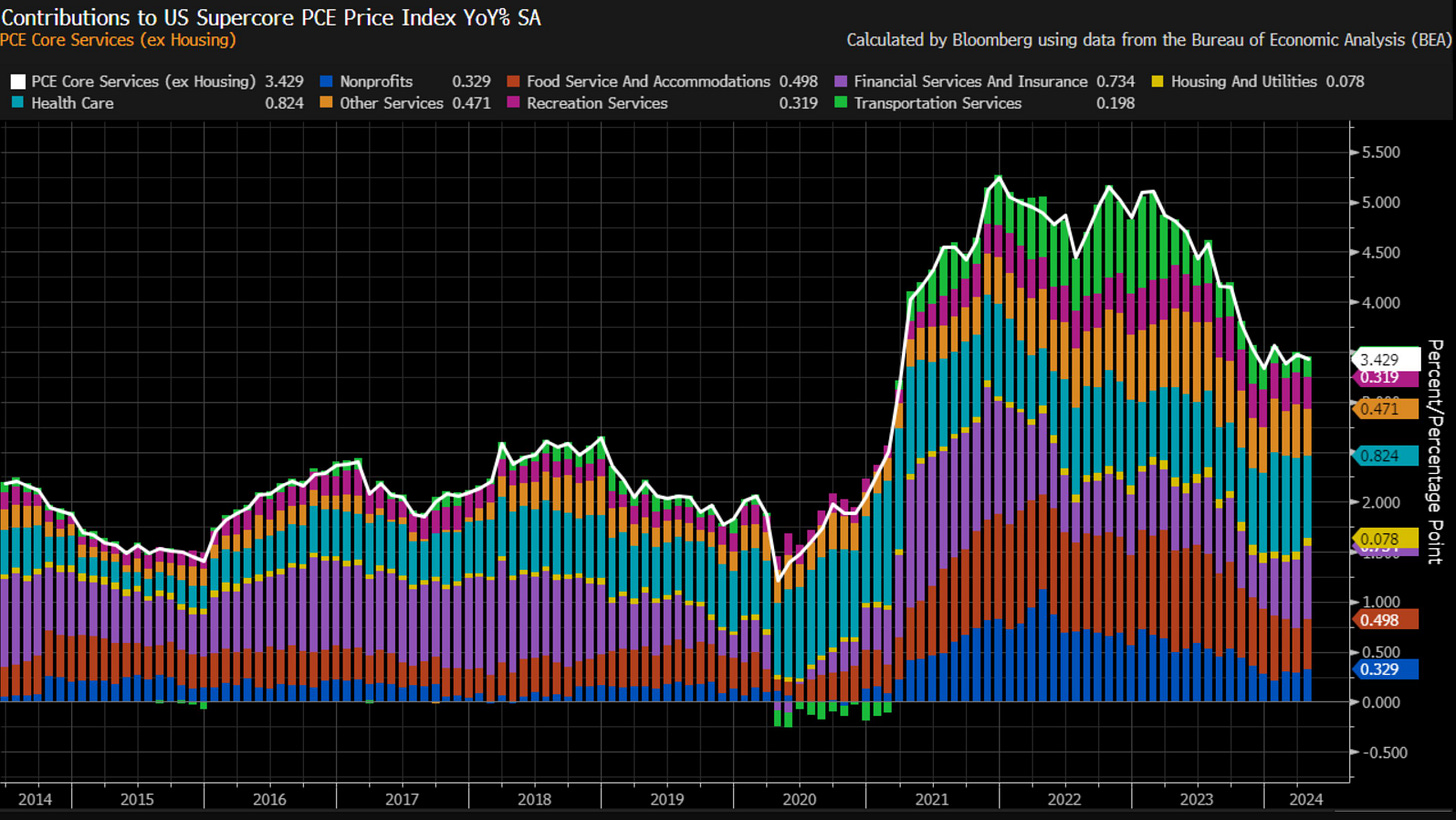

Recent statistics suggest that the United States is in a stagflation scenario. The slowing Gross Domestic Product (GDP) growth and an inflation rate that hasn't reached the Federal Reserve's price stability goal make monetary policy decide between stimulating the Gross Domestic Product (GDP) growth or ensure price stability.

Figure 1. The United States Gross Domestic Product (GDP) Growth Is Stagnating.

Figure 2. Stubborn Inflation In The United States Still Higher Than The Price Stability Goal.

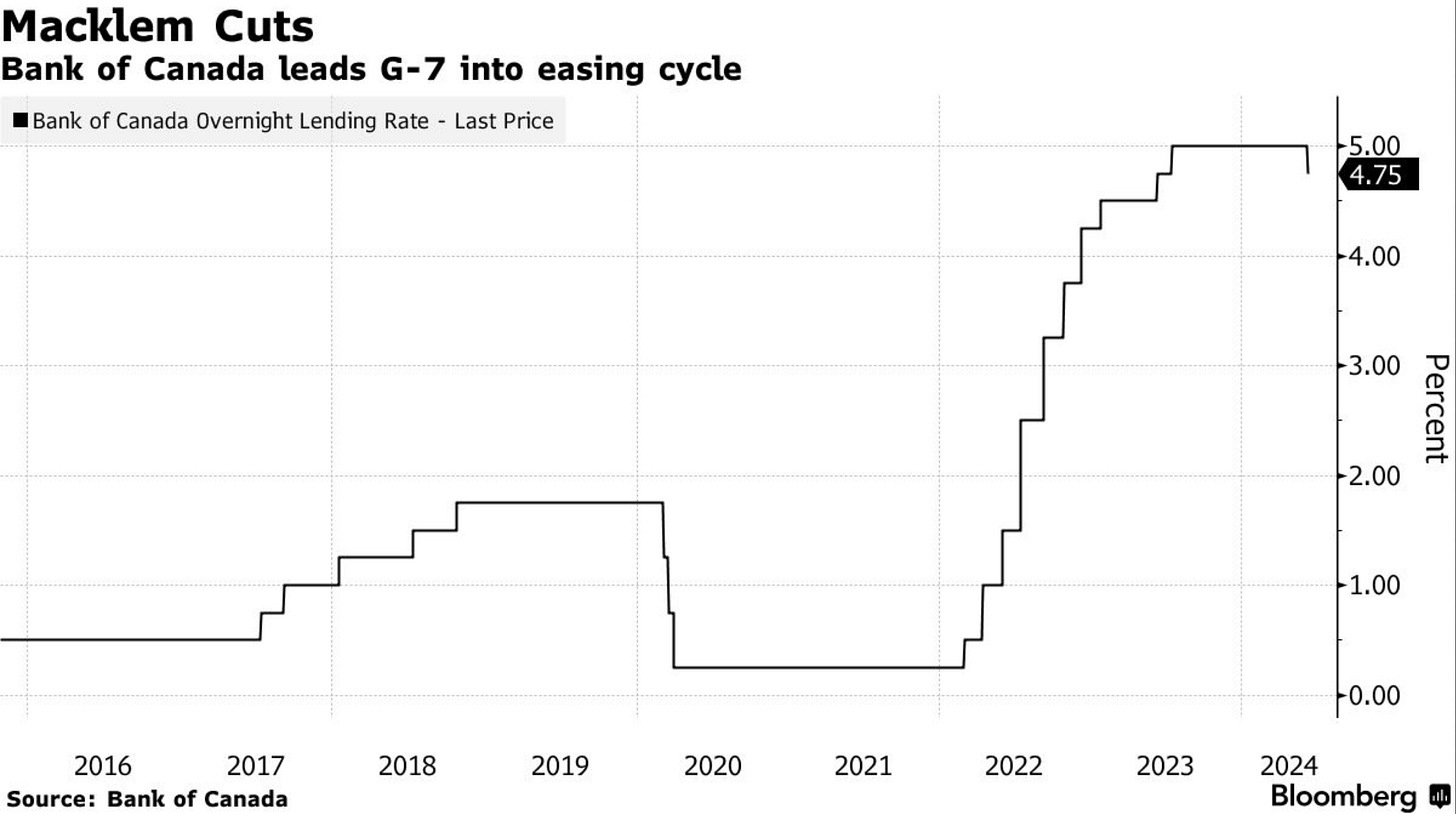

Some Central Banks like the ECB and the BoC have already started cutting rates to address their stagflationary environment, meaning that they're focusing on economic stability rather than price stability, which is an inflationary monetary policy measure that will likely make monetary policy shift hawkish again next year. Prospects over inflation were already inflationary given warfare factors that generate supply-side inflationary pressures that can't be addressed through monetary policies, but now have to be added the rate cut factor that generates a quantified one to two percent inflation increase in the near-term and long-run.

The resilient yet slowing labour market growth is sustained by temporary jobs that are correlated to the rise in foreign population statistics; these factors will likely slow down into the year-end as they are temporary, and will more than likely make the unemployment rate rise; the main reason of recent uptick in the unemployment rate is the recent and consistent employment cost rise, which has raised the wage-price spiral risk, something not seen in a while, which is something that FOMC officials should be attentive to.

Americans have fully reduced discretionary and cyclical spending, which is reflected in those sectors' earnings reports and consequently in their market performance. The latest statistics show that Americans have high price sensitivity, meaning that prices are quite elevated, making consumers not spend, which is directly reflected in the economic growth of the country. These factors suggest that the United States may be stagnating into recession; monetary policy is in a quite complicated scenario that quite literally ends in hyperinflation or long-term recession if not well addressed. The last time the FOMC faced a scenario like the current one, Paul Volcker was the chairman of the Federal Reserve, and everyone has studied his mistakes.

The government should cut discretionary spending and focus on essential spending and momentarily cut taxes, but that tax cut is offset by the cut in discretionary spending, which would enhance economic activity and consequently generate real-growth based on economic activity rather than debt-fueled spending economic growth. This was the 1980s Reagan Administration strategy to address the stagflation of the time. Government measures were effective, but the monetary policy measures of Paul Volcker generated a recession at the time, which is why Jerome Powell shouldn't repeat Paul Volcker mistakes; cutting rates at current levels of inflation is a mistake, and hiking with current Gross Domestic Product (GDP) growth is a mistake; keeping rates at current levels and using open market operations to stimulate growth is the correct measure, it may generate reflation, but in the short-term; this is the ideal monetary policy measure in the current stagflation scenario.

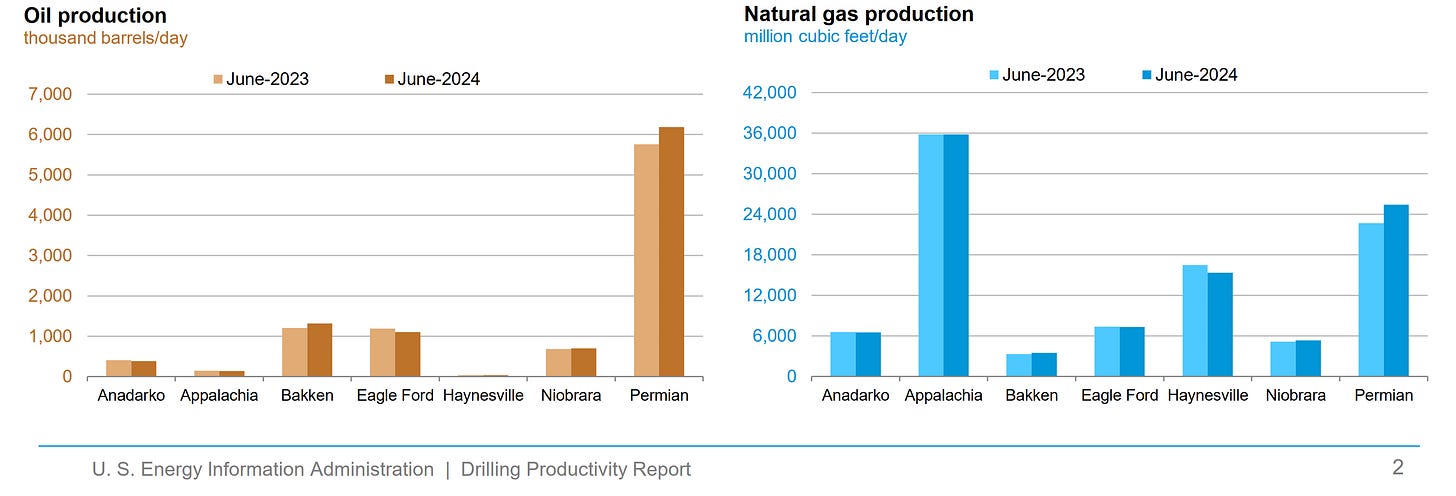

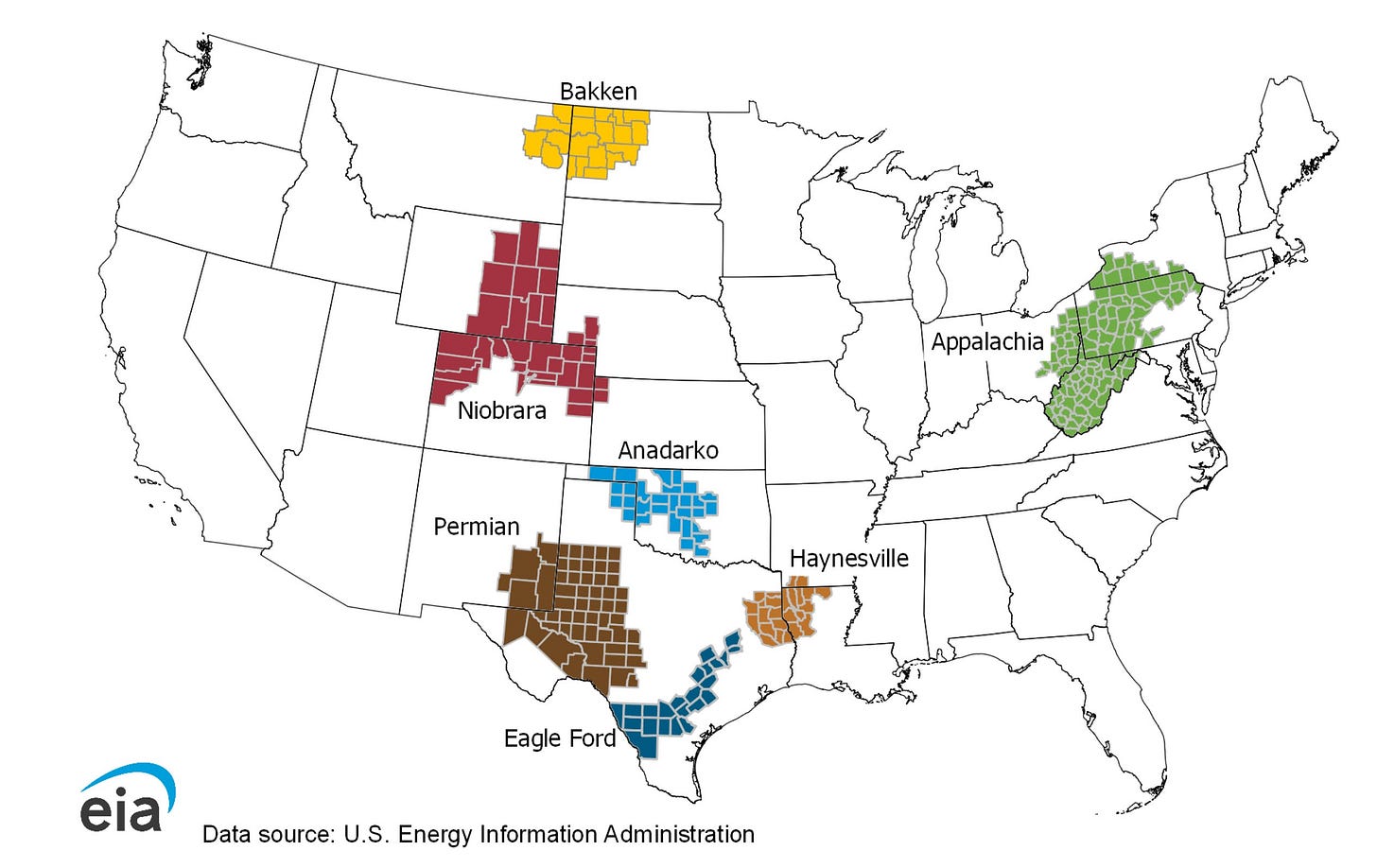

The main difference between then and now is the record oil production, mainly because Permian region oil production has increased; the rest of the regions haven't reached pre-pandemic oil production growth.

Figure 3. United States' Oil & Shale Gas Regions.

Figure 4. United States Oil & Gas Production By Region.

Figure 5. Record Oil Production In The Permian Region Keeps Oil Prices At The Current Range.

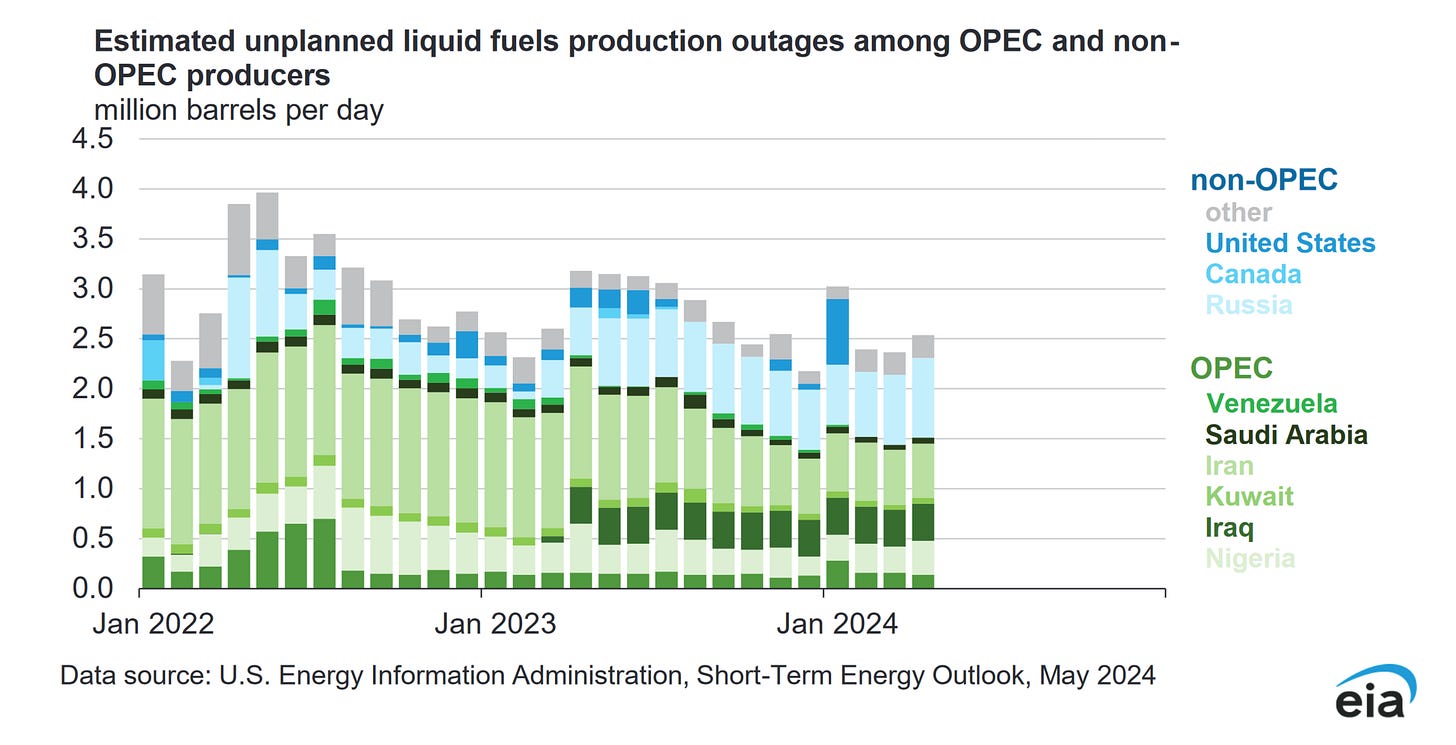

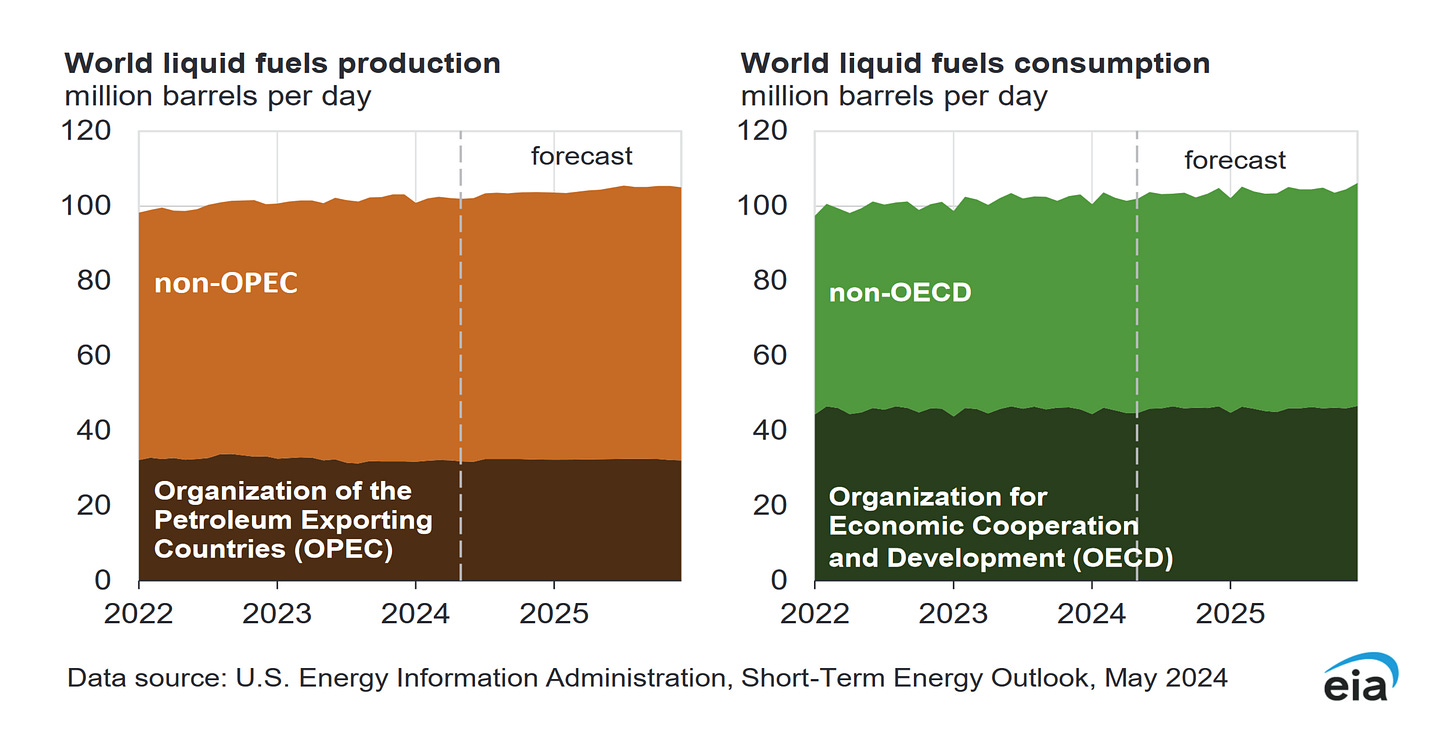

The record oil production keeps oil prices at the current range rather than elevated; OPEC+ supply cuts have kept oil market fundamentals stable.

Figure 6. OPEC & Non-OPEC Liquid Fuels Production Outages.

Figure 7. World Liquid Fuels Production & Consumption.

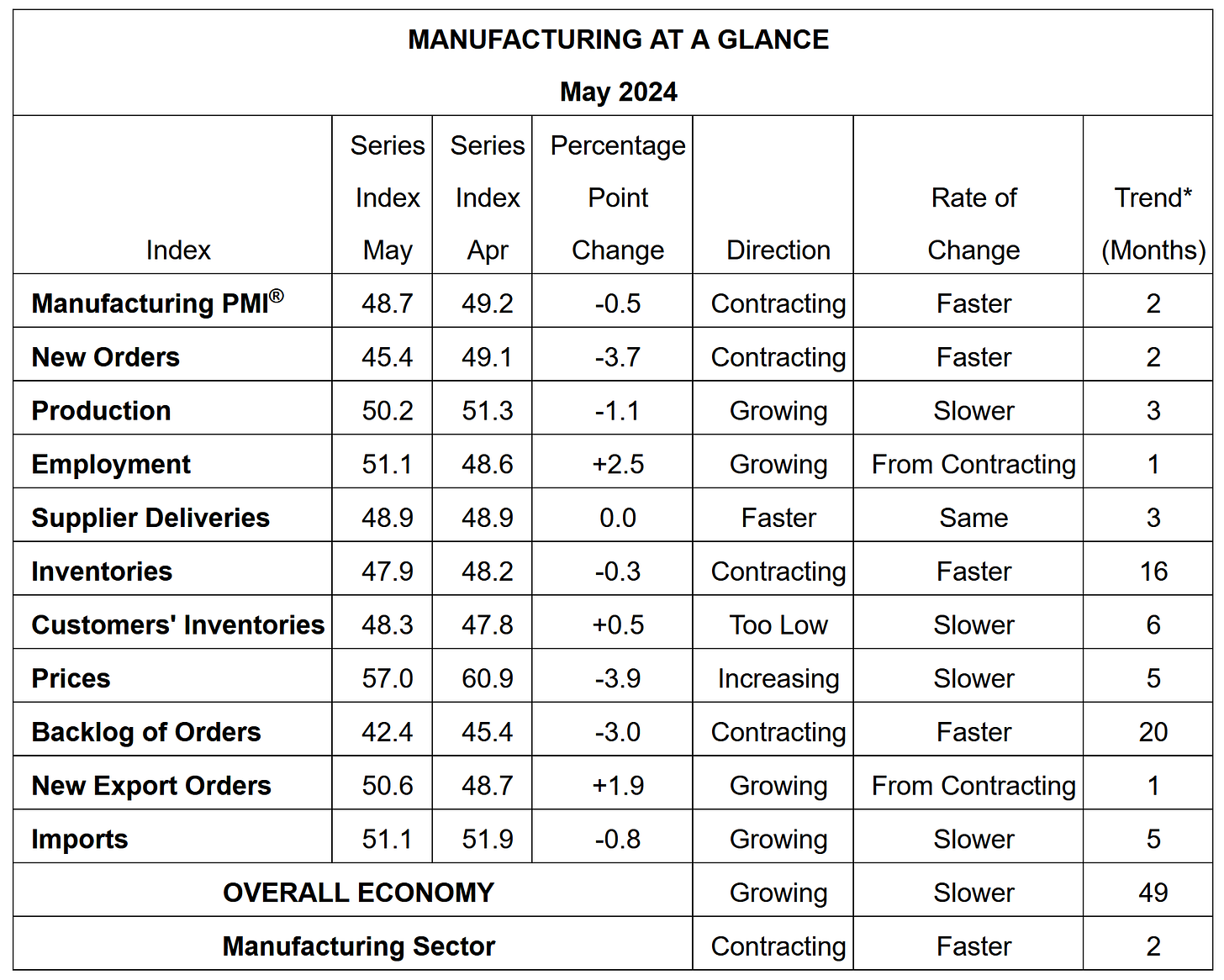

Americans' distillate fuel consumption statistics suggest a manufacturing activity slowdown despite the fact that S&P manufacturing PMI was recently revised higher. Although ISM manufacturing PMI data showed a contracting economy with growing employment and slowing prices.

Figure 8. Manufacturing Slowdown With Growing Employment & Slowing Prices.

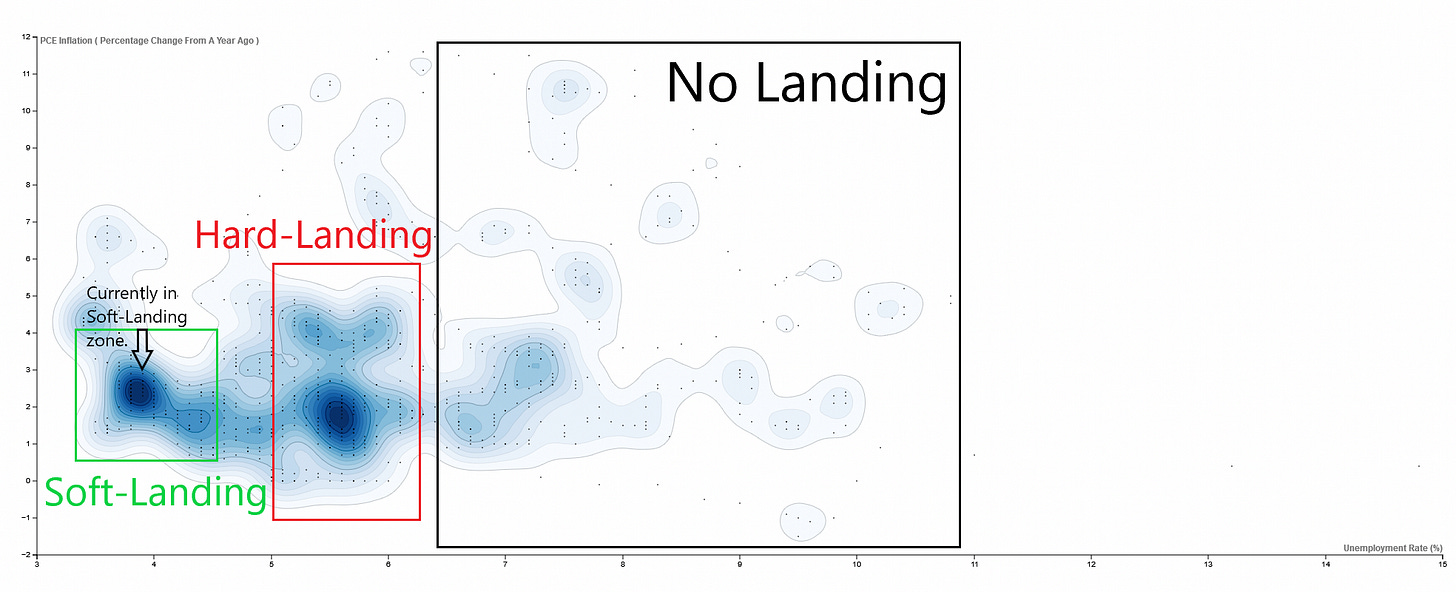

Most economists remain optimistic about the soft-landing outcome given the fact that the United States' Phillips curve is still in a soft-landing range and has not yet drastically drifted towards the hard-landing range, I emphasize the yet.

Figure 9. United States' Phillips Curve Remains In The Soft-Landing Range.

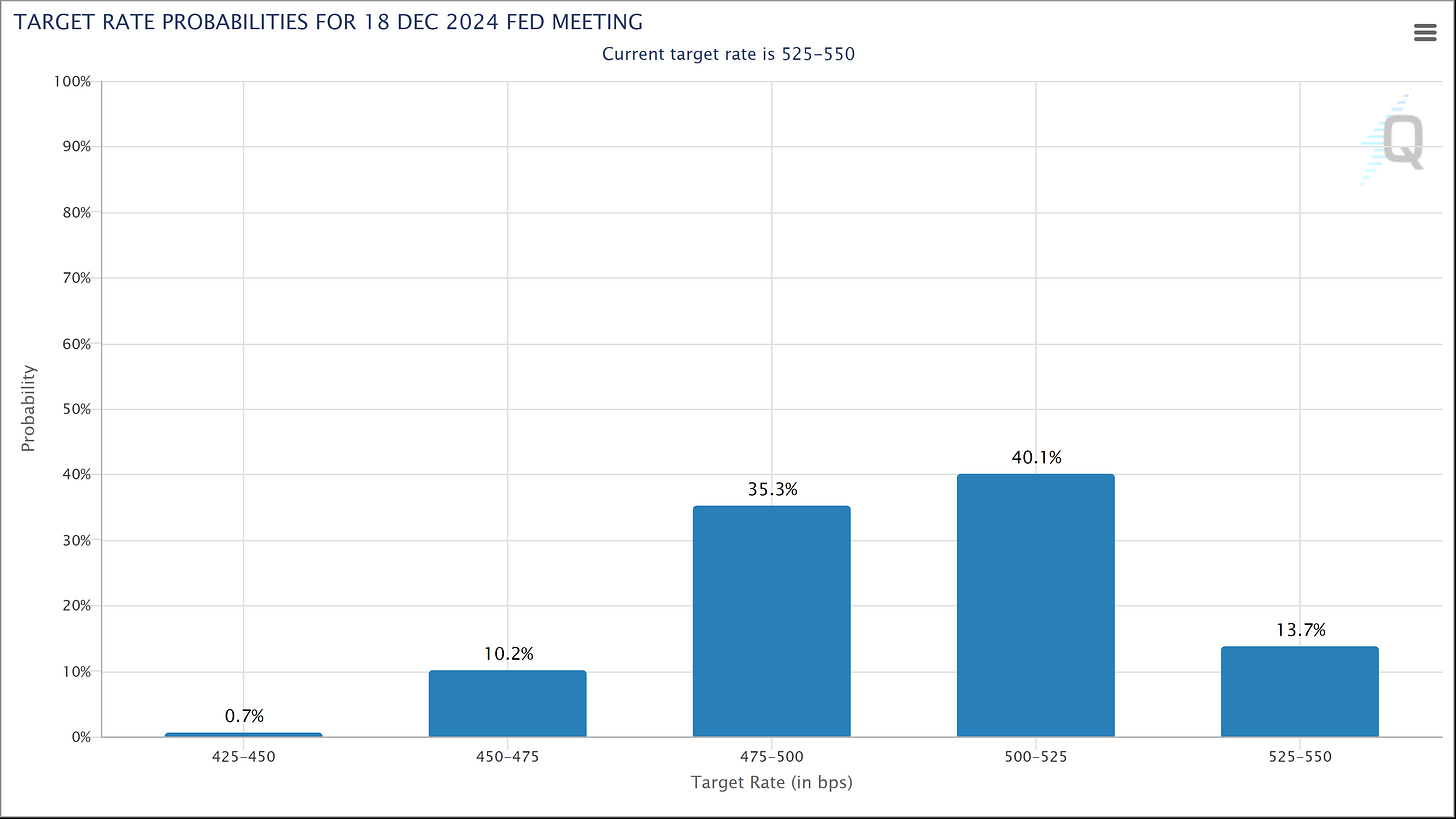

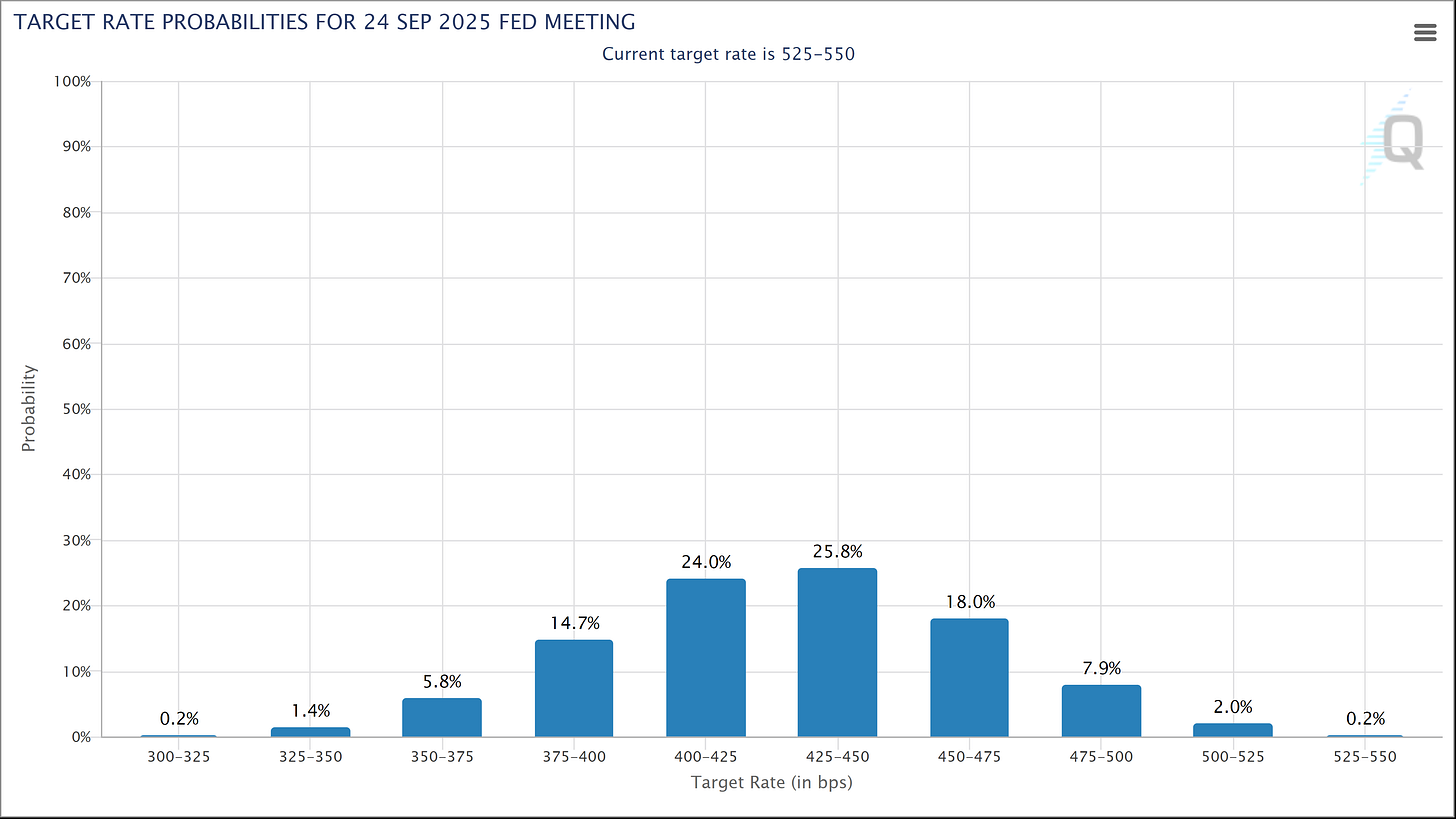

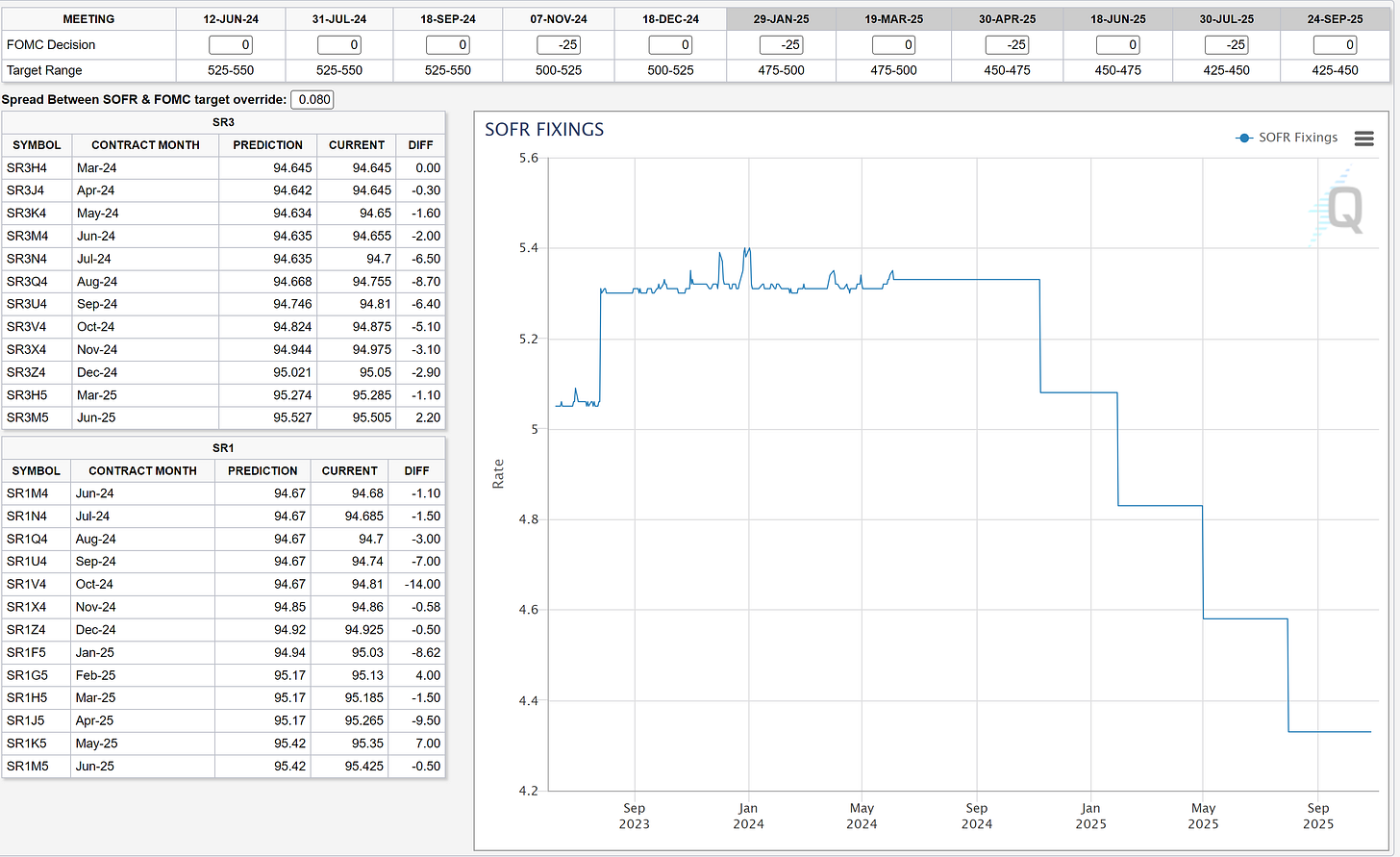

Meanwhile, markets aren't optimistic about the soft-landing outcome, which is why there have been dovish bets going on; now markets are betting on just one rate cut for this year's November FOMC rate decision and three rate cuts next year; this year's market-priced fourth quarter target range is between 5% to 5.25% and next year's market-priced third quarter target range is between 4.25% to 4.5%, which is within the range of FOMC officials' projections.

Figure 10. Just One Rate Cut Priced-In For This Year. ( Rate cuts data as of 06/07/2024 market close. )

Figure 11. First Rate Cut In November, Earlier Than The FOMC Projection.

Figure 12. This Year's Fourth Quarter Market-Priced Target Range. ( 5% to 5.25% )

Figure 13. Next Year's Third Quarter Market-Priced Target Range. ( 4.25% to 4.5% )

Basically, markets are positioned for hard-landing while frontrunning hypothetical rate cuts with bullish bets in speculative markets, which is why markets are either at all-time-highs or have recently reached all-time-highs.

Figure 14. DB Gross US Tech Equity Futures ER Index.

[ Left Y-axis: Index data. (🟦) | Right Y-axis: Volatility of the index. (🟥) ]

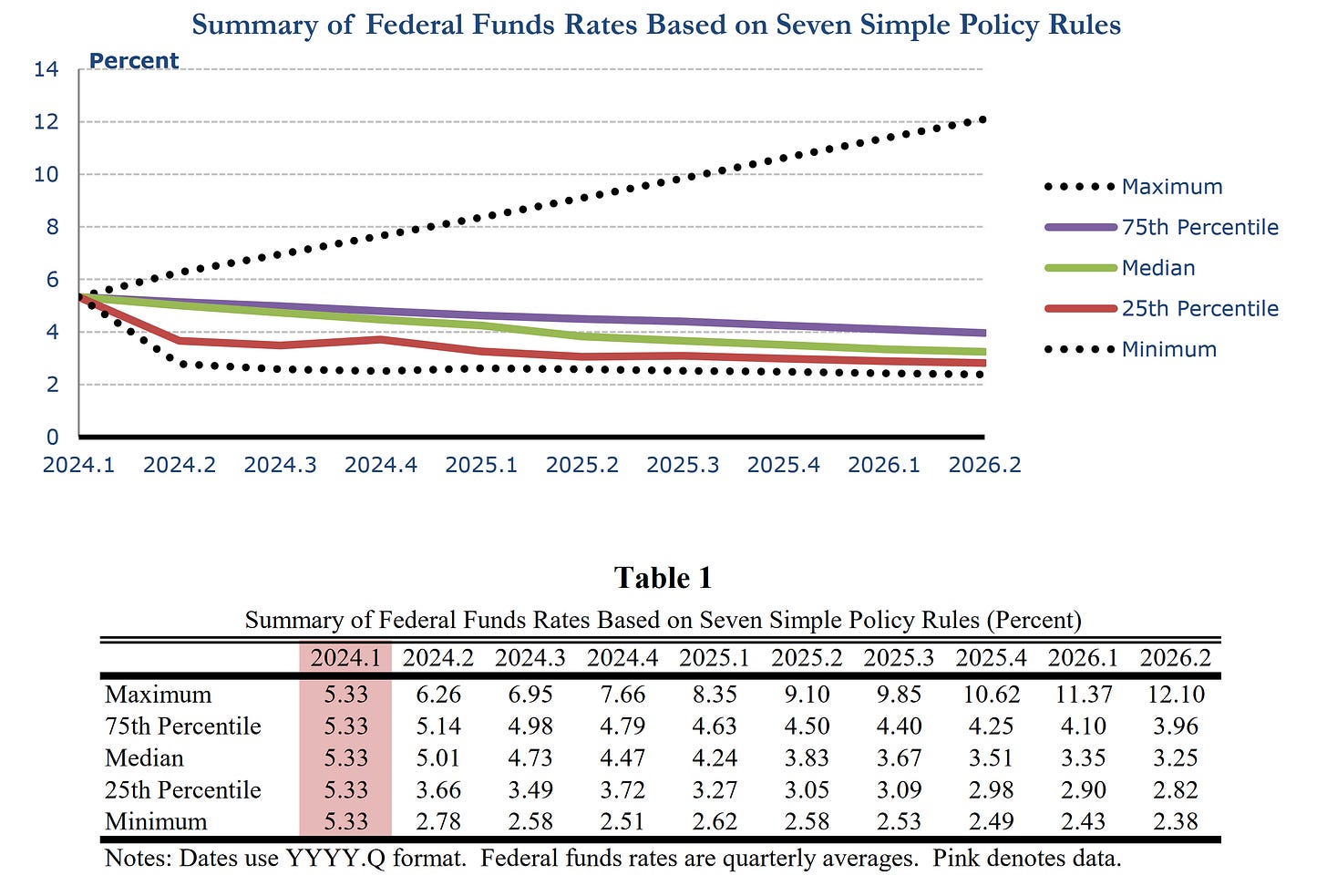

These factors, in particular the dovish R-star, have made risk-off sectors rise over the past few months, with commodities and EM rising; recent price action in the TSY market suggests short-covering rather than dovish hedging given the fact that the higher for longer positioning remains in markets. Nevertheless, rate forecasting models indicate that rates have peaked.

Figure 15. Summary Of Federal Funds Rates Based On Seven Simple Monetary Policy Rules.

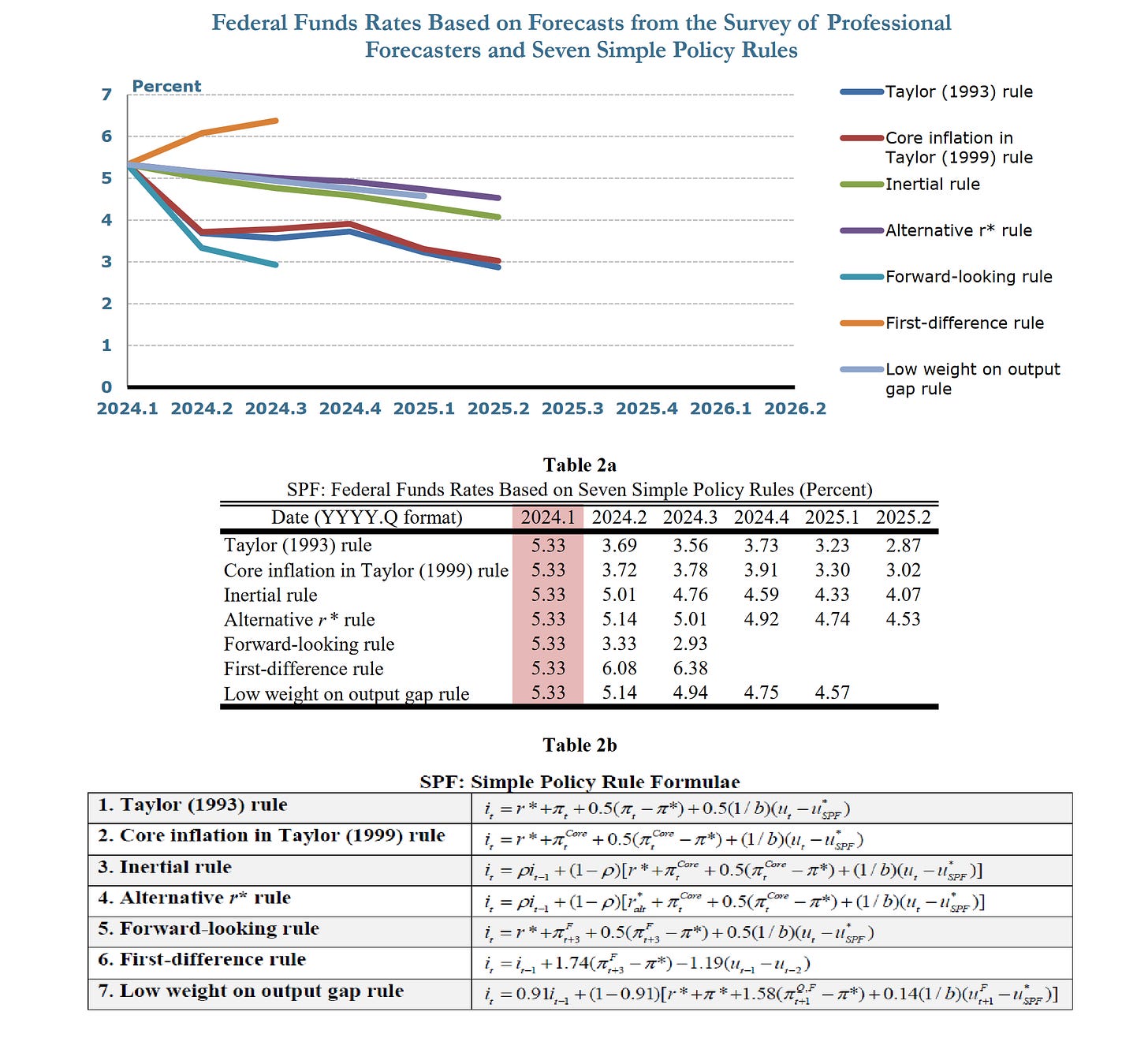

Figure 16. Federal Funds Rates Based on Forecasts from the Survey of Professional Forecasters and Seven Simple Policy Rules.

Table 2a provides the results from seven simple monetary policy rules conditional on forecasts from the Survey of Professional Forecasters. The Survey of Professional Forecasters provides forecasts for Personal Consumption Expenditures (PCE) inflation, core Personal Consumption Expenditures (PCE) inflation, and the unemployment rate. Because they do not estimate the output gap, construct a proxy for the output gap using Okun’s coefficient and the unemployment gap. The forecast horizon is shorter than that of other forecasts included here, extending 4 quarters into the future, which limits results coming from the rules.

Table 2b provides the formulae used to calculate each policy rule based on forecasts from the Survey of Professional Forecasters.

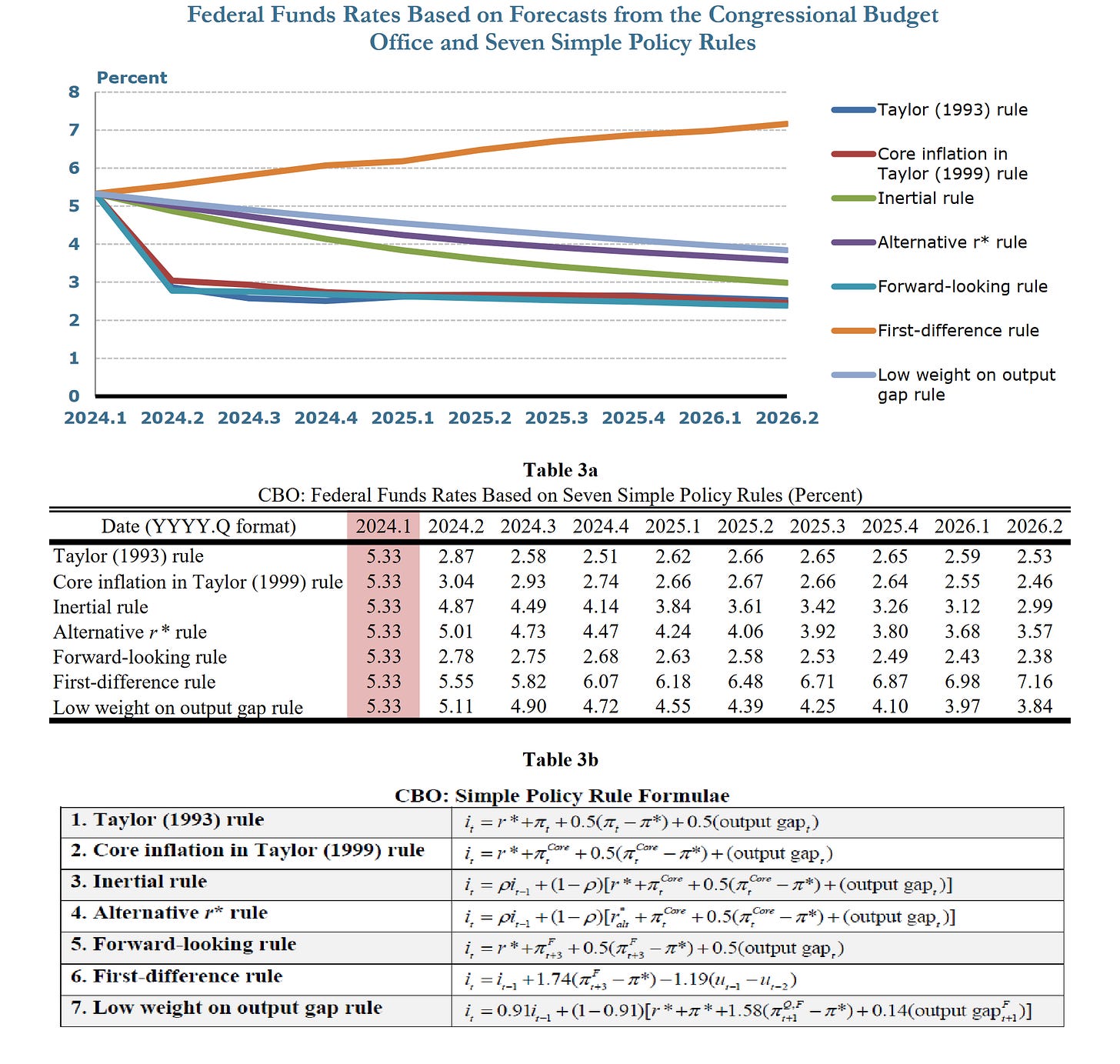

Figure 17. Federal Funds Rates Based on Forecasts from the Congressional Budget Office and Seven Simple Policy Rules.

Table 3a provides the results from seven simple monetary policy rules conditional on forecasts from the Congressional Budget Office (CBO). The Congressional Budget Office (CBO) provides forecasts for Personal Consumption Expenditures (PCE) inflation, core Personal Consumption Expenditures (PCE) inflation, the unemployment rate, and the output gap.

Table 3b provides the formulae used to calculate each policy rule based on forecasts from the Congressional Budget Office (CBO).

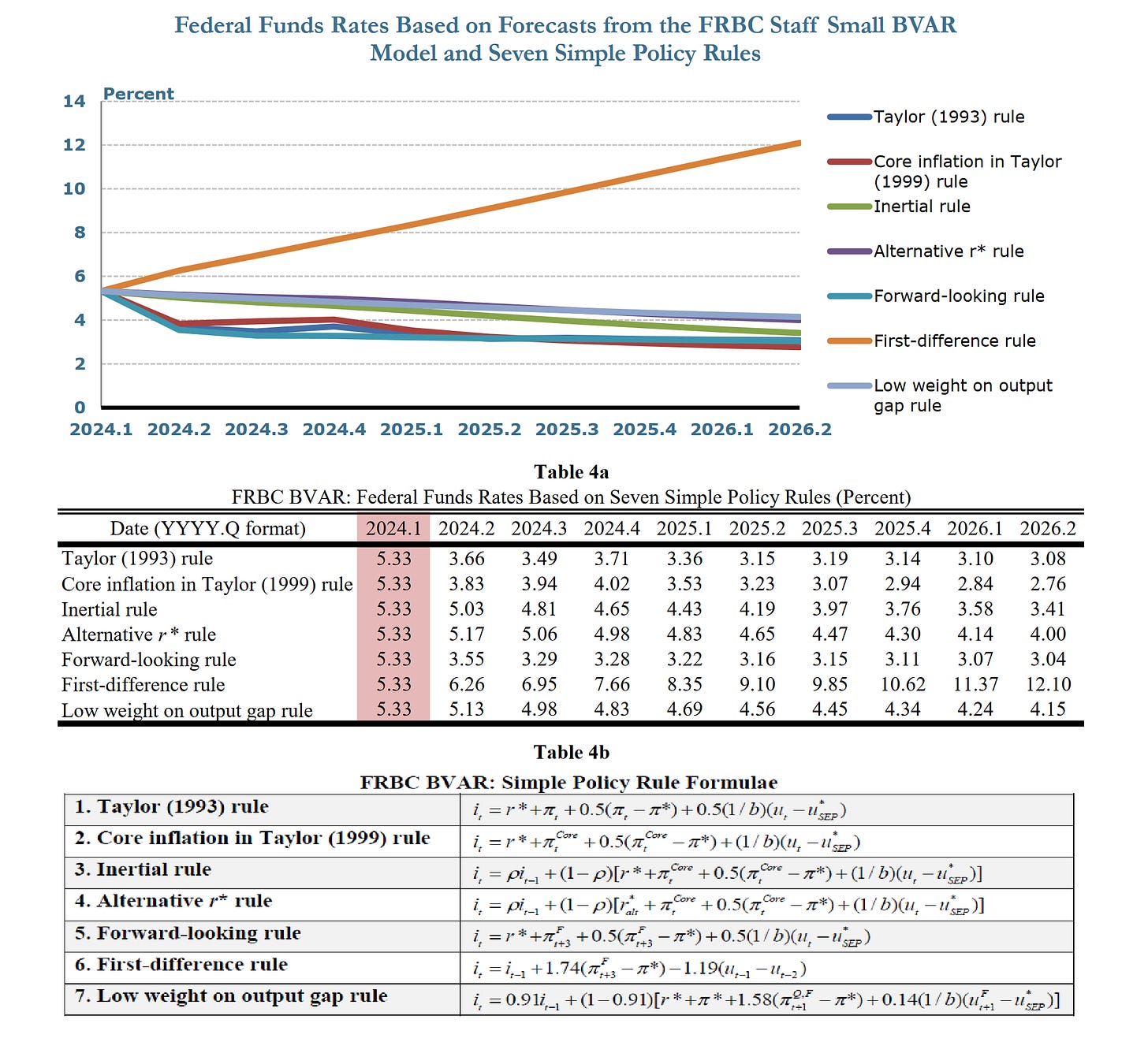

Figure 18. Federal Funds Rates Based on Forecasts from the FRBC Staff Small BVAR Model and Seven Simple Policy Rules.

Table 4a provides the results from seven simple monetary policy rules conditional on forecasts from a small statistical Bayesian Vector Autoregression model consulted by staff at the Federal Reserve Bank of Cleveland (FRBC BVAR). Because the Cleveland Fed staff consult a variety of forecasting models, the FRBC BVAR model forecast does not necessarily represent the official forecast of Cleveland Fed staff or the president of the Cleveland Fed. The Bayesian Vector Autoregression model consulted by staff at the Federal Reserve Bank of Cleveland (FRBC BVAR) provides forecasts for Personal Consumption Expenditures (PCE) inflation, core Personal Consumption Expenditures (PCE) inflation, and the unemployment rate. Because it does not provide an estimate of the output gap, construct a proxy for the output gap using Okun’s coefficient and the unemployment gap.

Table 4b provides the formulae used to calculate each policy rule based on forecasts from the Bayesian Vector Autoregression model consulted by staff at the Federal Reserve Bank of Cleveland (FRBC BVAR).

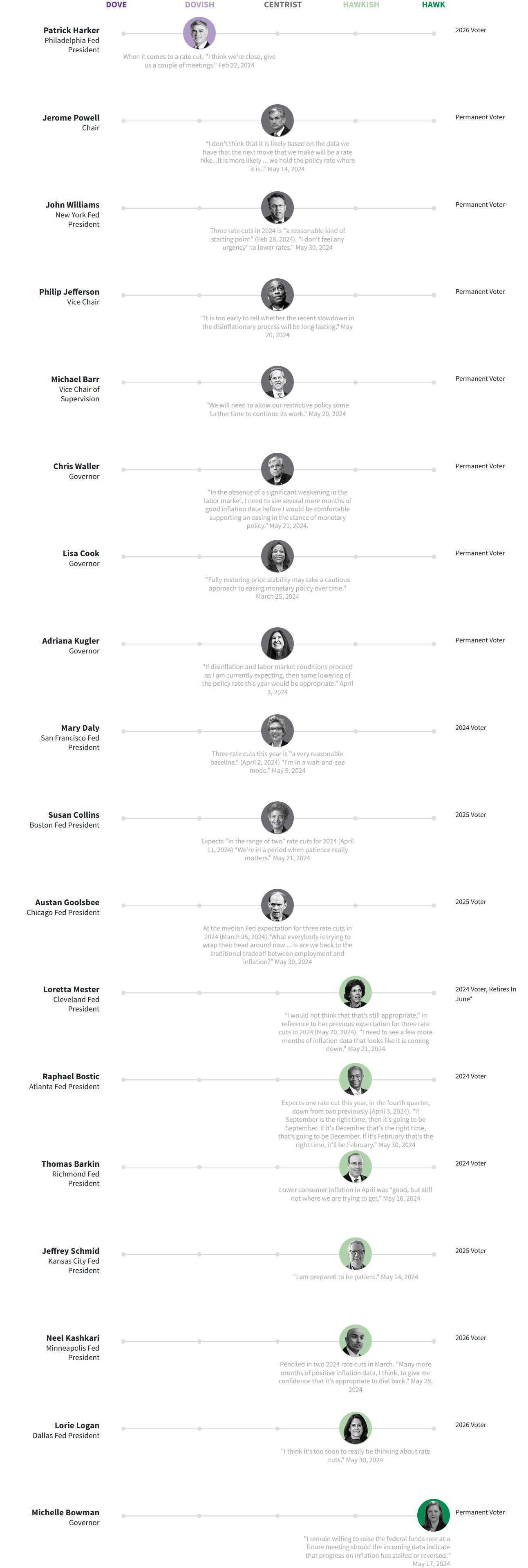

FOMC officials' stance remains remarkably hawkish-nimble despite markets' dovishness.

Figure 19. Monetary Policy Keeps A Hawkish-Nimble Stance, FOMC Harker Is The Only Dove, The Rest FOMC Officials Are Either Neutral Or Hawkish.

FOMC Patrick Harker was an early advocate of a pause, and his warnings against overtightening policy mark him as more sensitive to the risks to the labor market than some of his colleagues.

Chairman Jerome Powell does not want to be remembered as the Fed chair who failed to bring down inflation; now that there has been quite a bit of progress, he has pivoted to a more centrist position, emphasizing the need to move “carefully” and to minimize the economic damage from the inflation fight.

FOMC John Williams as vice chair of the Fed’s policy-setting committee, Williams helped Powell lead the most aggressive round of rate hikes in 40 years. Of late he has said the Fed has likely hiked rates enough, but with inflation still high, is not about to cut them.

FOMC Philip Jefferson like many of his colleagues, has been disappointed in inflation readings this year. Although in February he said policy easing would likely come later this year; he has since avoided any mention of the timing of a rate cut.

Vice Chair of Supervision Michael Barr’s remit is primarily financial regulation. When he does speak about monetary policy he has signaled he feels the Fed’s rate hikes are done.

FOMC Chris Waller was an early skeptic of the idea that inflation would be “transitory” and a supporter of frontloading interest-rate hikes, marking him a hawk. In recent months, as inflation has cooled, he has supported moving more carefully, in line with Powell.

FOMC Lisa Cook sees risks to both the Fed’s price stability mandate and its mandate to foster full employment.

FOMC Adriana Kugler joined the Fed in September 2023 and says her views on the policy rate path are consistent with the majority of her colleagues.

FOMC Mary Daly: A labor economist by training, Daly has repeatedly called for fighting inflation, but as gently as possible.

FOMC Susan Collins has said she sees risks nearer to balanced, but like many of her colleagues has been disappointed by first-quarter inflation readings.

FOMC Austan Goolsbee says now that inflation has come down as far as it has, the Fed should pay more attention to its mandate to foster maximum employment.

FOMC Loretta Mester has said she sees somewhat more persistent inflation than most of her fellow Fed policymakers. She hits mandatory retirement age in June, and if a successor is not yet appointed, Goolsbee would vote at each meeting starting in July until one is.

FOMC Raphael Bostic is less sure than he had been that inflation is trending downward, and has pared his expectation for policy easing this year to be far less than the median three-cut view.

FOMC Thomas Barkin's remarks continue to show he is worried about high inflation.

FOMC Jeffrey Schmid: In embracing a patient approach on policy and no eagerness to cut rates, Schmid appears to be the latest in a long line of Kansas City Fed Presidents with a hawkish outlook.

FOMC Neel Kashkari swung from being the Fed’s most dovish policymaker in 2021 to its most hawkish a year later. He no longer appears to be the most hawkish, but he has not retreated much.

FOMC Lorie Logan says the Fed needs to take financial conditions into account as it sets rates, and her worries about excess inflation remain palpable.

FOMC Michelle Bowman has backed away from her previously held view that another rate hike will likely be needed. Even so, she regularly mentions that she would support further tightening if needed.

Source: Reuters

Given the geopolitical scenario, with the world war storm close.

World War Probabilities:

· Prob. War:

· War Probabilities:

| - Probabilities of War: 99% (±0.5)

· Non-War Probabilities:

| - Probabilities of Non-War: 1% (±0.5)

· Vectors:

| - Taiwan [~85% (±0.5)], Ukraine [~14% (±0.5)], Else: [~1% (±0.5)].It's quite complicated to assume a certain outcome; nevertheless, the soft-landing scenario probability has gone from 85.2% probability to 19.1% probability in the past two quarters, despite the fact that the United States' Phillips curve is in soft-landing range.

Soft-landing Probabilities:

· Prob. Soft-landing:

· Soft-landing Probabilities:

| - Probabilities of Soft-landing: 19.1% (±0.5)

· Hard-landing Probabilities:

| - Probabilities of Hard-landing: 80.9% (±0.5)

· Vectors:

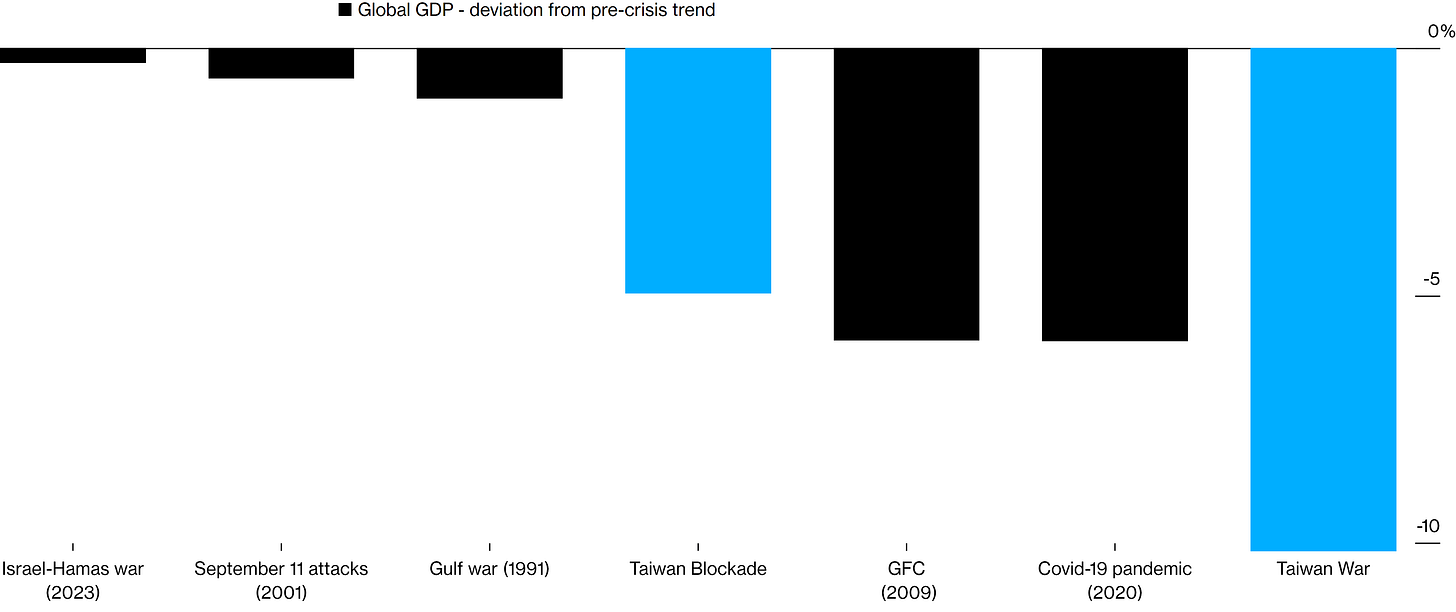

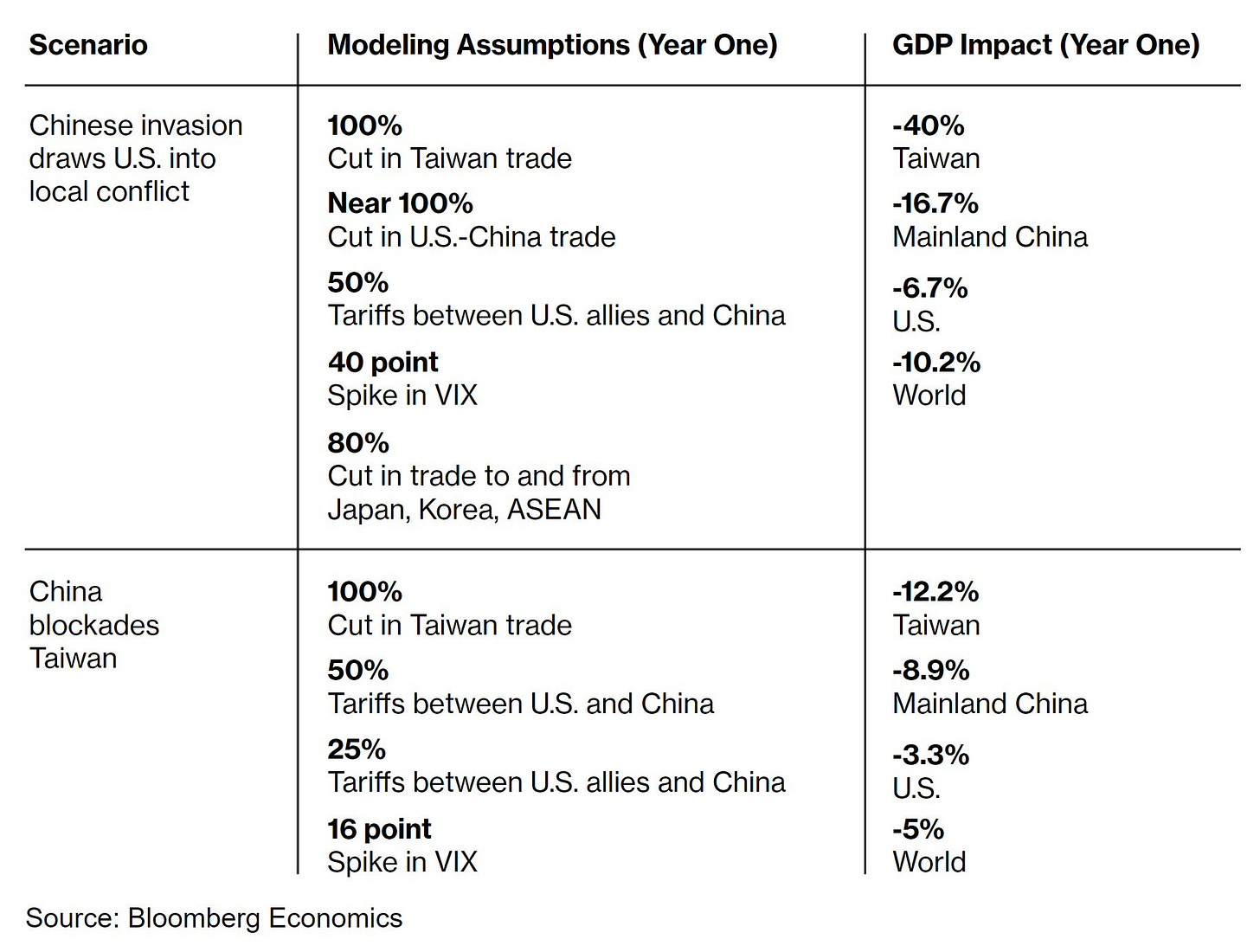

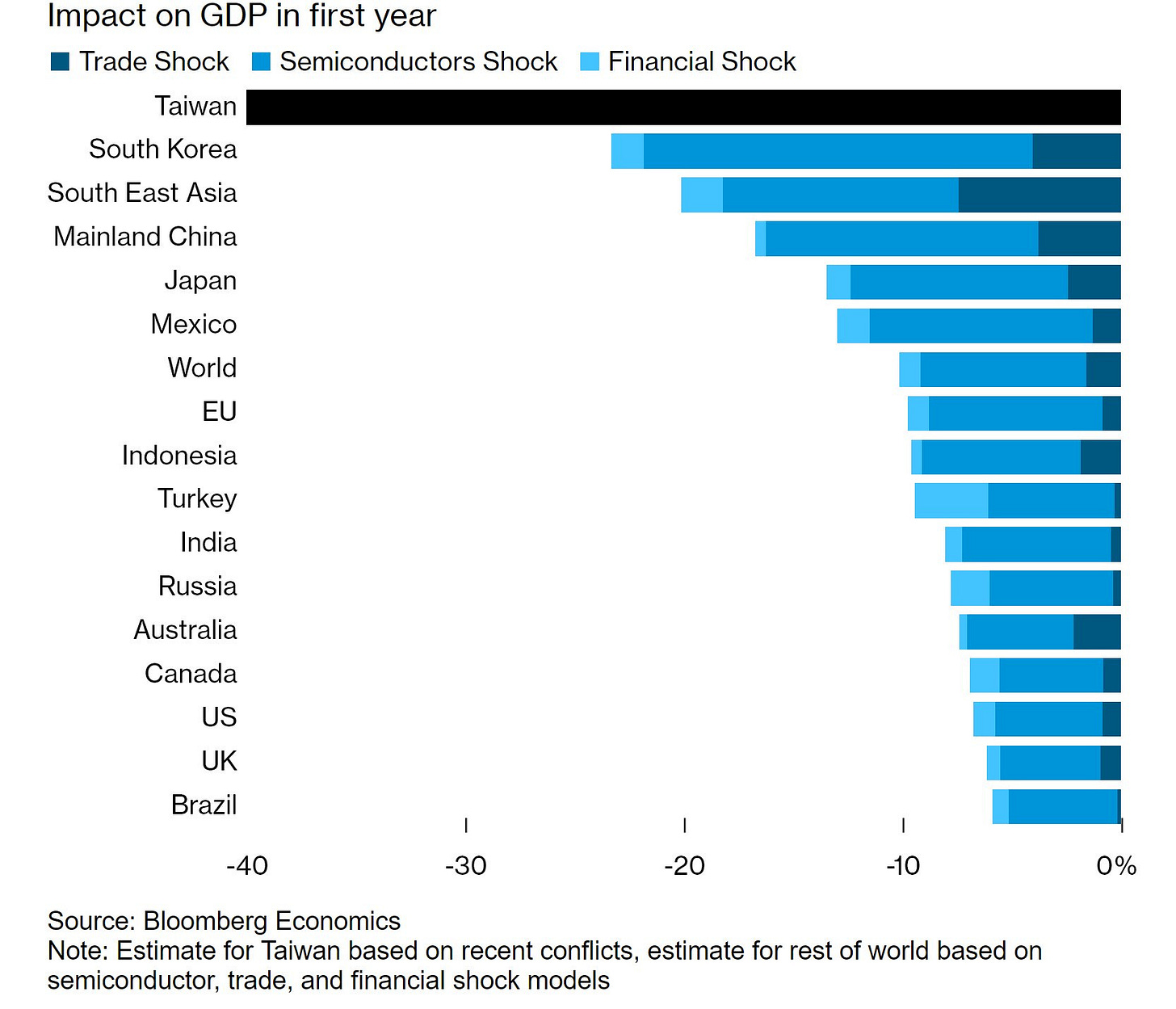

| - World War [~80% (±0.5)], Stagflation [~10% (±0.5)], Overreaction: [~10% (±0.5)].I don't downplay these statistics as past outcomes have been anticipated, the Ukraine war is the most recent one. Reminding once again the consequences of the Taiwan war, which is a global recession worse than the Global Financial Crisis of 2008 and worse than the recent 2020 pandemic recession.

Figure 20. Reminding Again That The Taiwan War Global Gross Domestic Product (GDP) Impact Is Bigger Than The Global Financial Crisis Of 2008. Bigger Than The Impact Of The 2020 Pandemic & Bigger Than Current & Recent Geopolitical Conflicts/Events.

Figure 21. Reminding Again The Two Scenarios To Keep In Mind.

Figure 22. Reminding Again Countries’ Gross Domestic Product (GDP) Impact Of The Taiwan War.

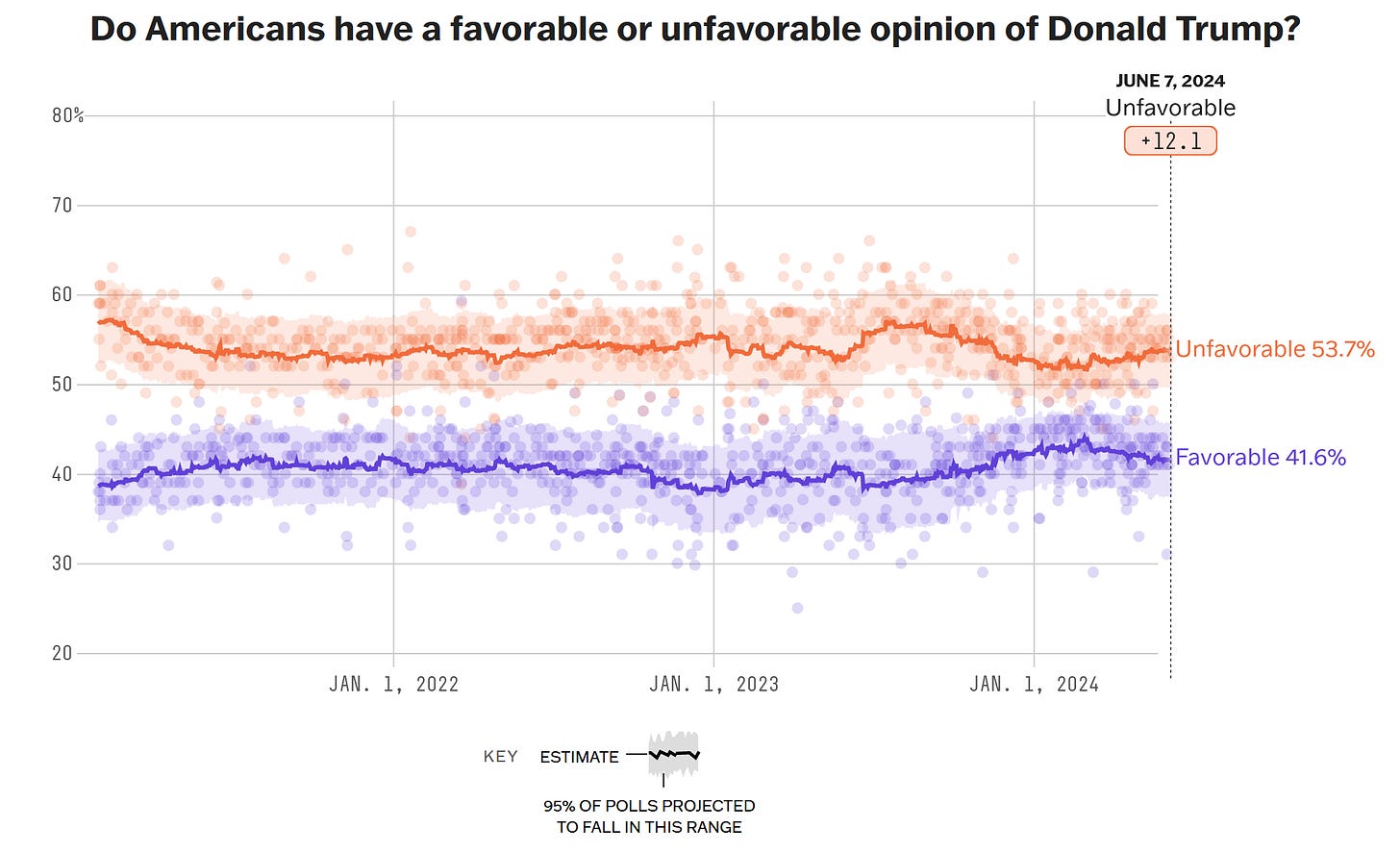

When it comes to politics, both election candidates Trump and Biden face an unfavorable view of Americans.

Figure 23. Americans Have An Unfavorable Opinion Of Donald Trump.

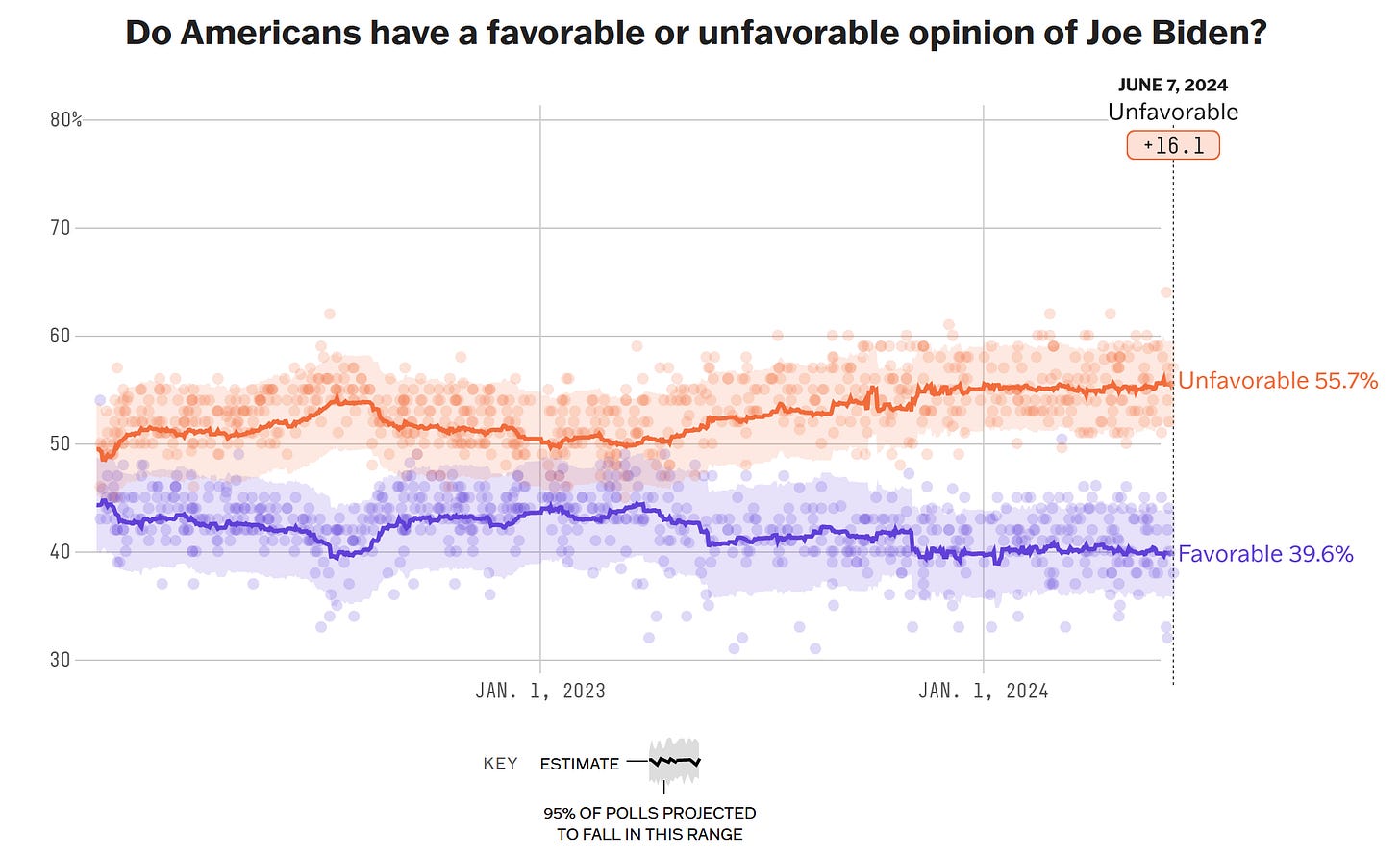

Figure 24. Americans Have An Unfavorable Opinion Of Joe Biden.

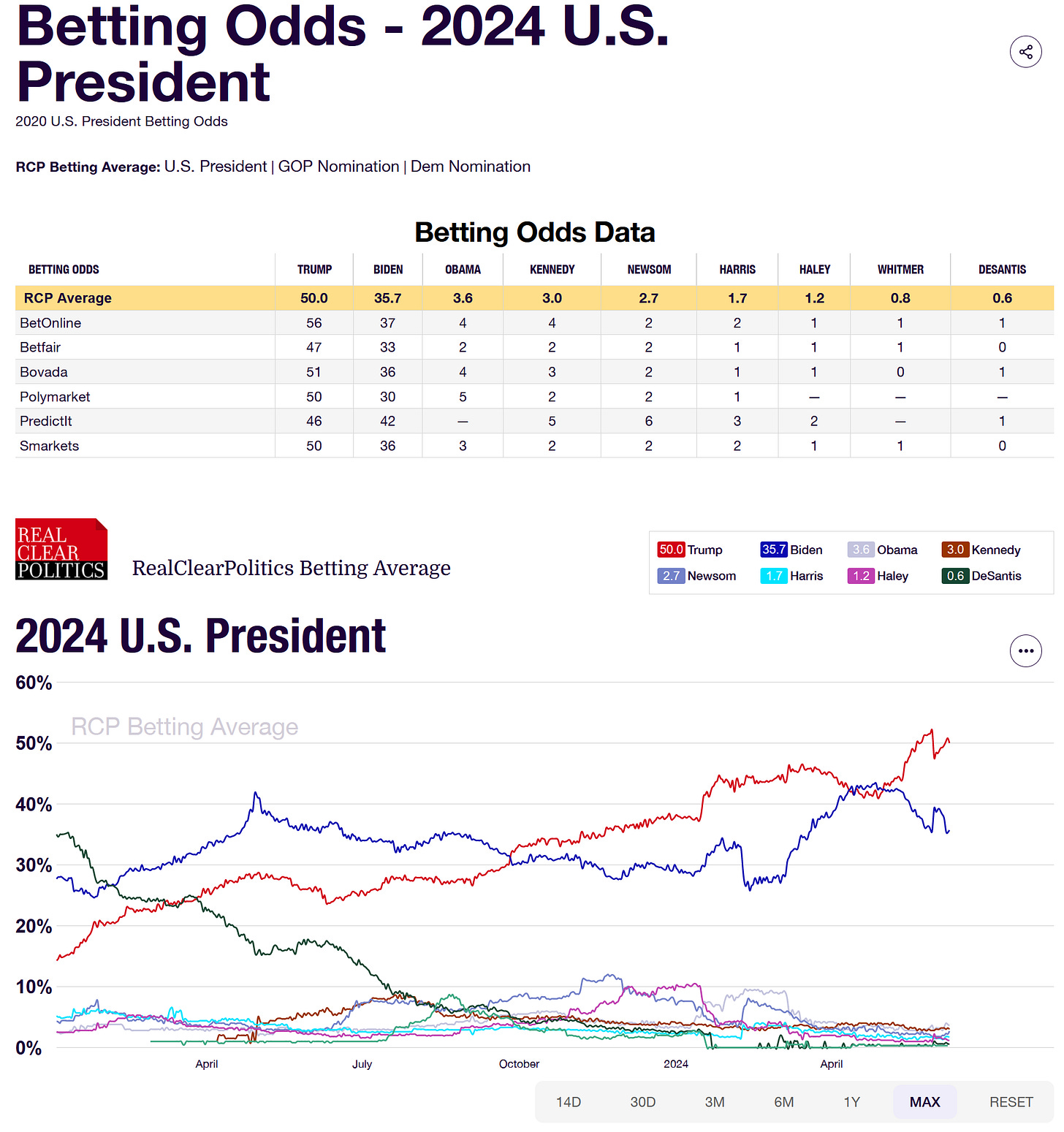

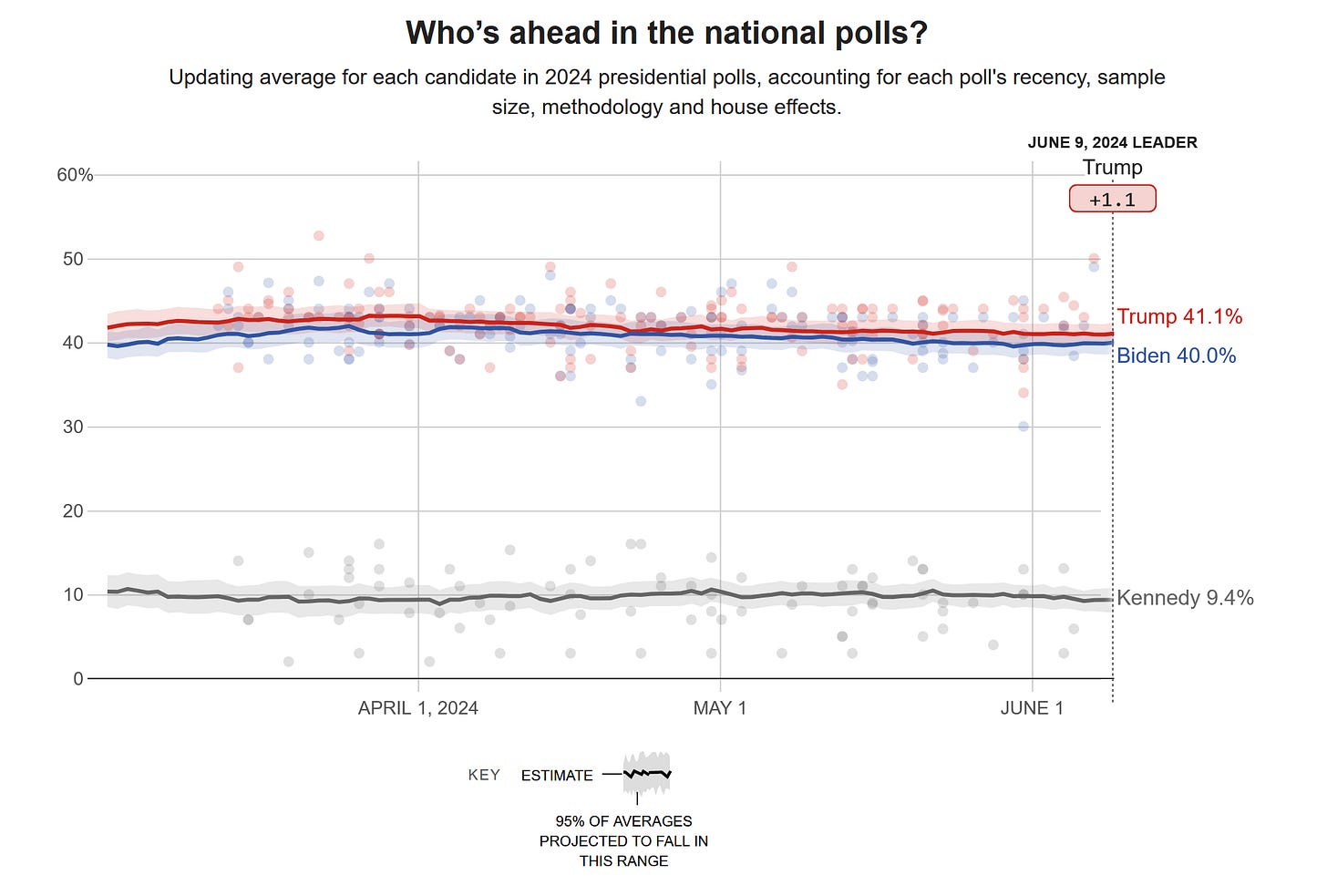

Polls are slightly Republican-leaning; speculators temporarily reduced Trump reelection bets after recent news. President Biden's reelection betting odds did a reversal at the beginning of last month; Trump's reelection betting odds are 50%, while President Biden's reelection betting odds are 35%.

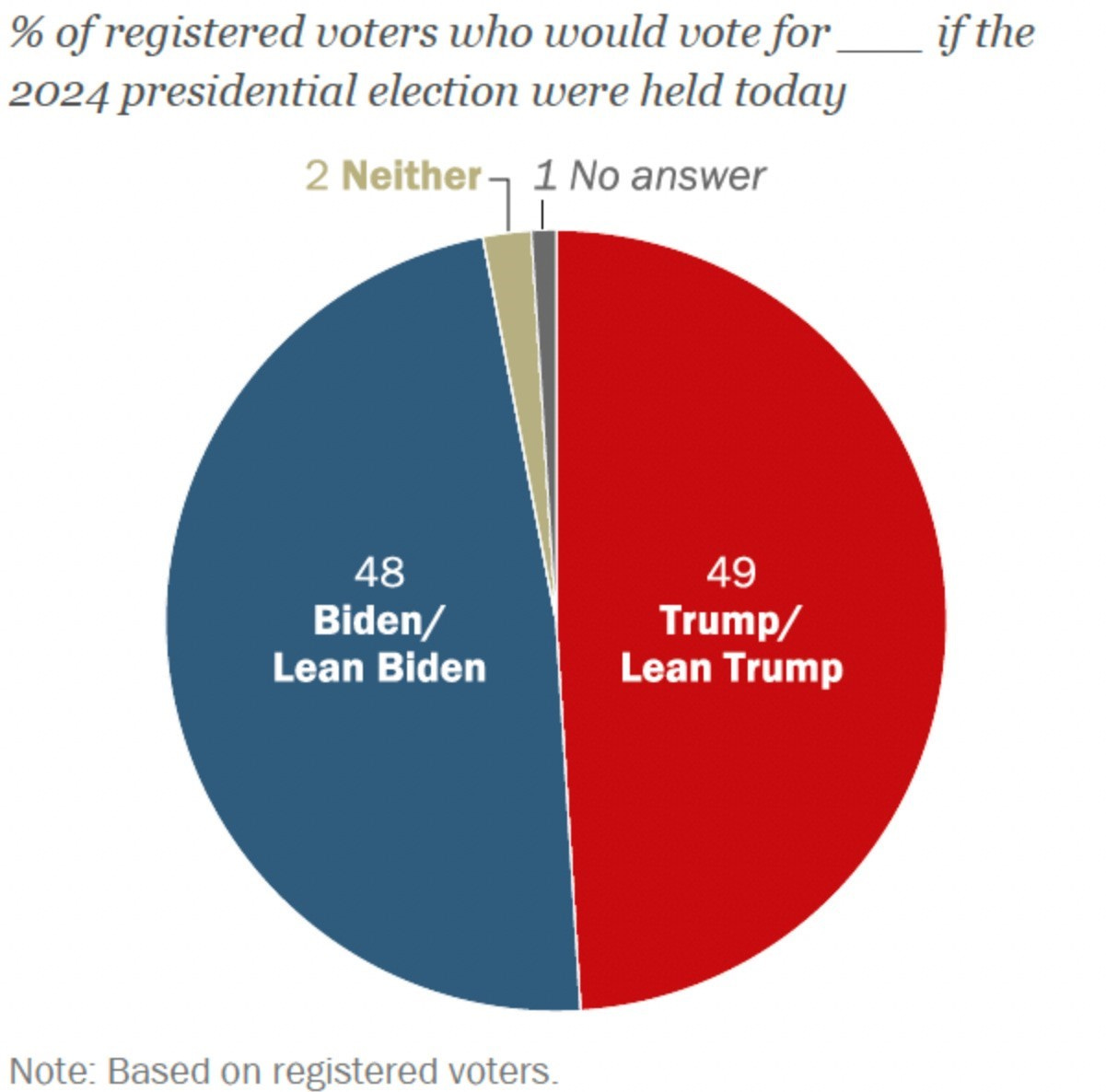

Figure 25. Polls Are Slightly Republican.

Figure 26. Trump's Reelection Betting Odds Are 50%, President Biden's Reelection Betting Odds Are 35%.

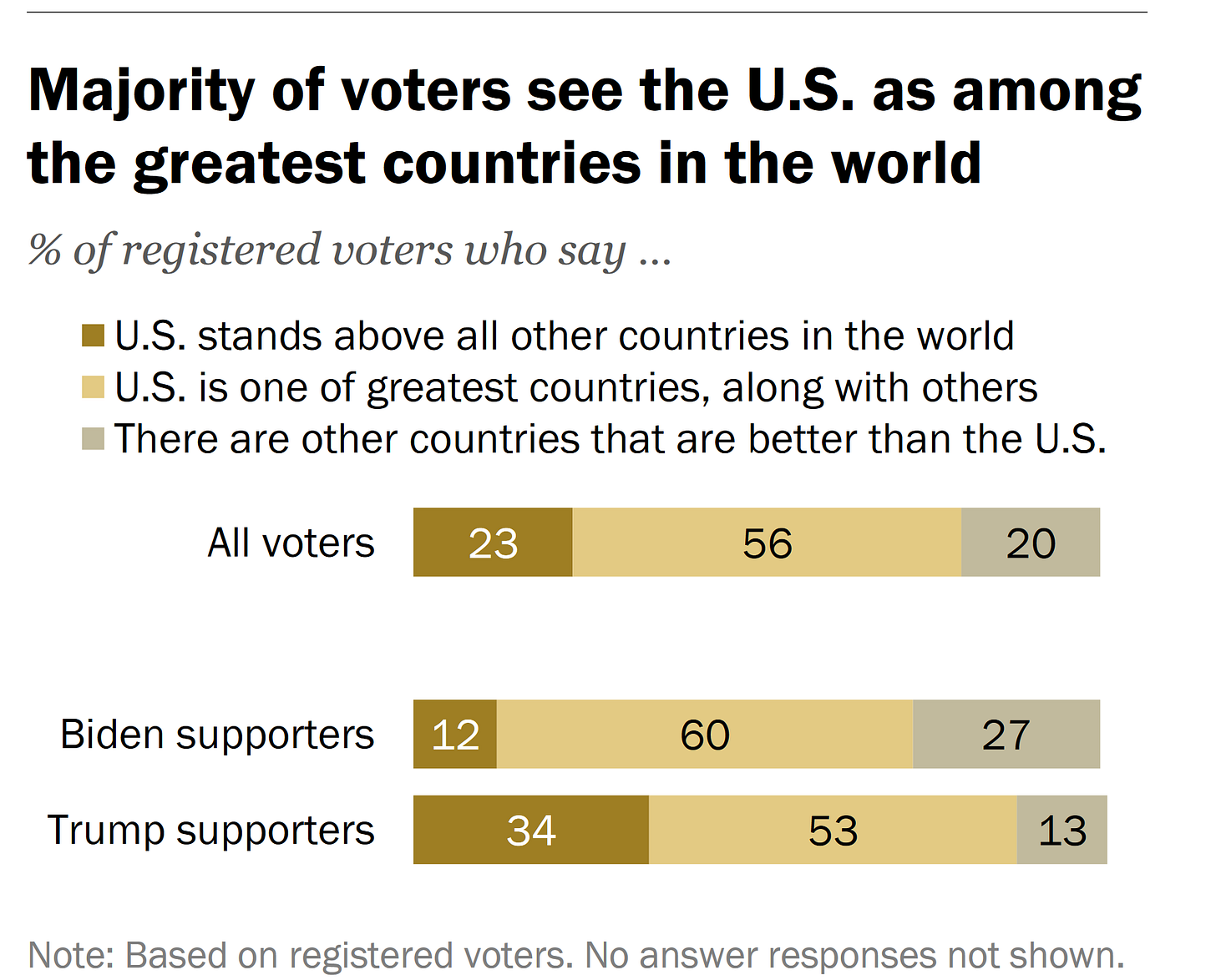

Figure 27. Compared To Democratic Voters, A Larger Percentage Of Republican Voters Think That The United States Leads Other Nations In The World.

These statistics suggest a quite tied election if Trump isn't out of the ballot; if Trump is out of the ballot, it's more than likely that President Biden will be reelected.

Figure 28. Quite Tied Election If Trump Isn't Out Of The Ballot.

To conclude, upcoming inflation rate data will likely skew the forward monetary policy stance, as monetary policy is data-dependent. I expect a hawkish hold in the forthcoming FOMC rate decision; markets should be attentive to Jerome Powell's press conference after the rate decision as it will likely signal the forward rate stance. If forward inflation data releases are more elevated than expectations, yields and the dollar should rise, and markets should lower on a hawkish rally; if inflation data releases show deflation, yields and the dollar should lower, and markets should rise on a dovish rally.

Canada:

The latest statistics show a drastic slowdown in the Canadian economy, with a stagnating Gross Domestic Product (GDP) growth and a sharp increase in unemployment rate. These factors may be the reason why the BoC has cut rates; the achievement of price stability in Canada has allowed the BoC to cut rates and focus on the economic stability of the nation.

Figure 29. BoC Cuts Rates As Canada Stagnates.

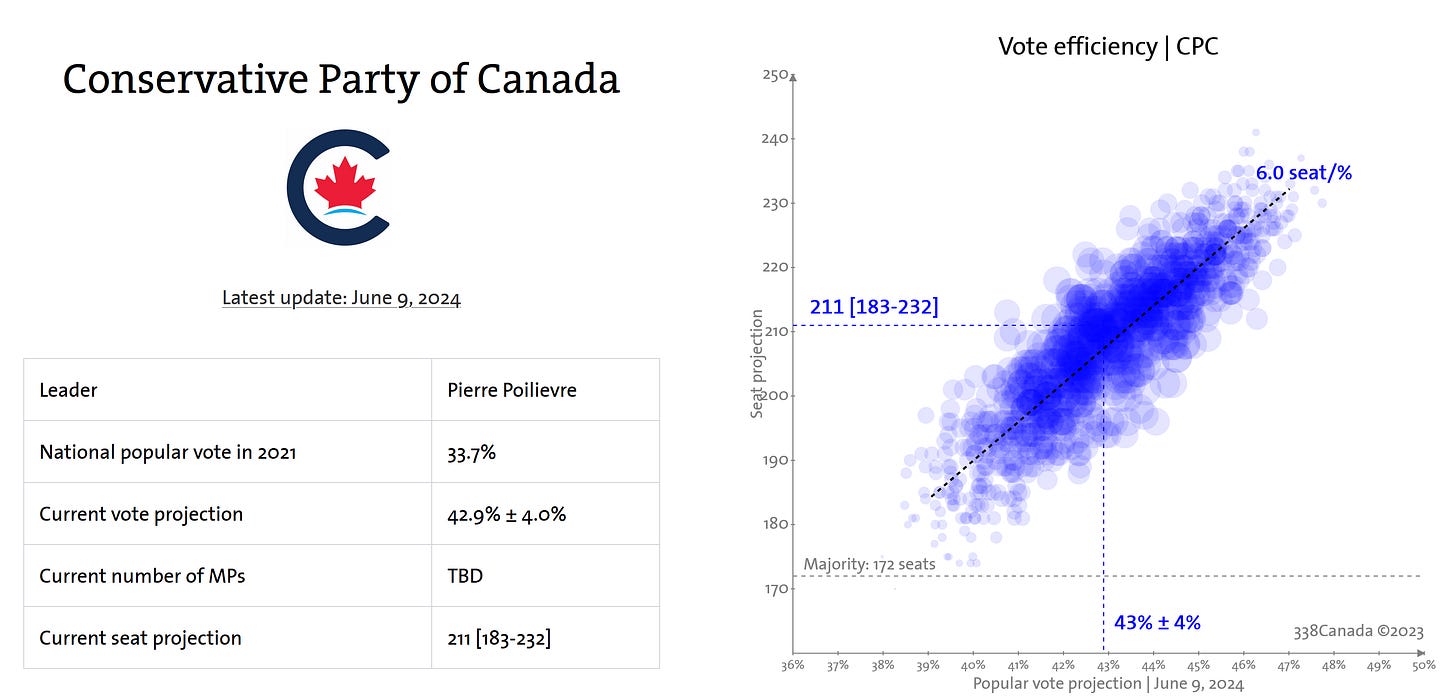

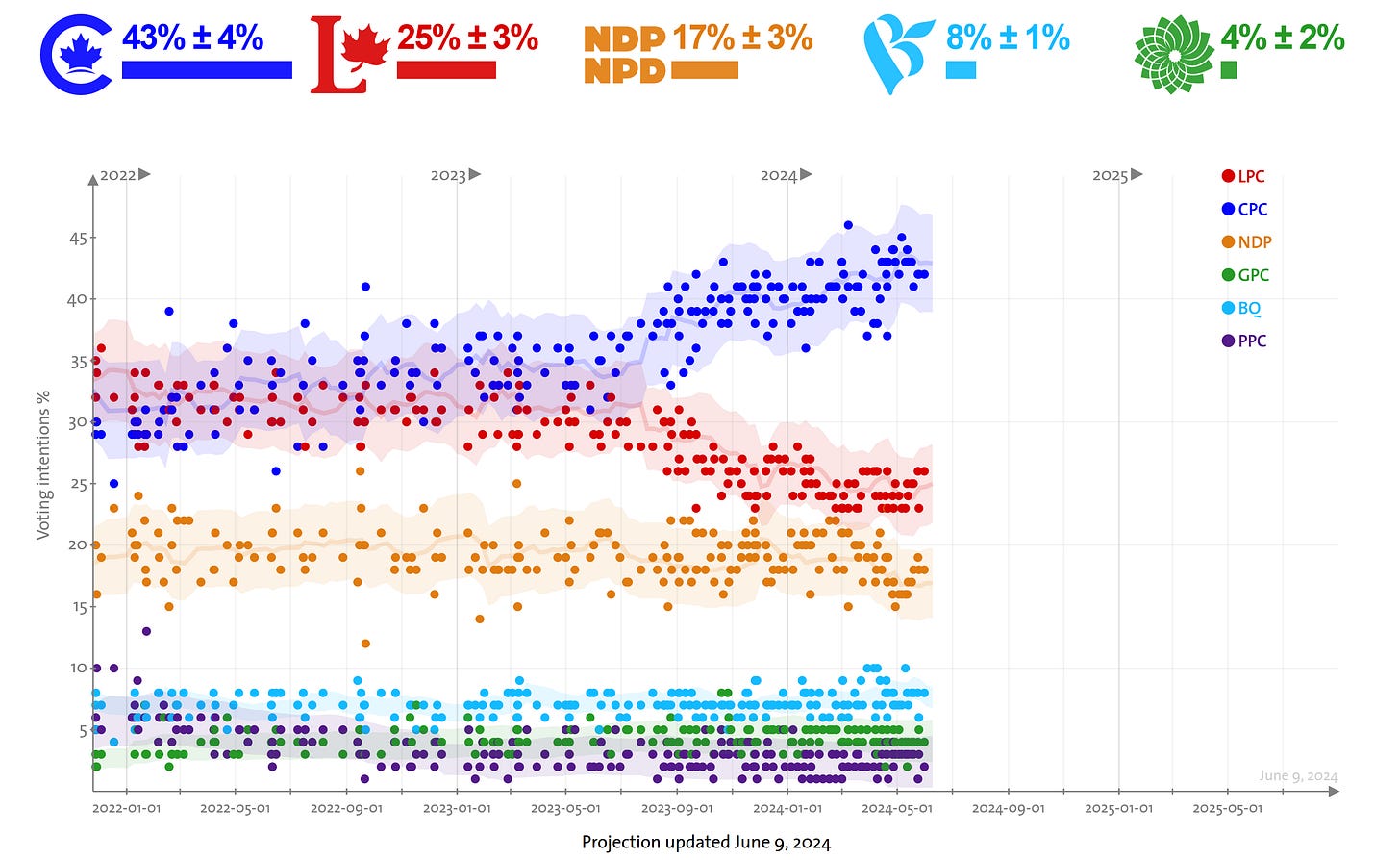

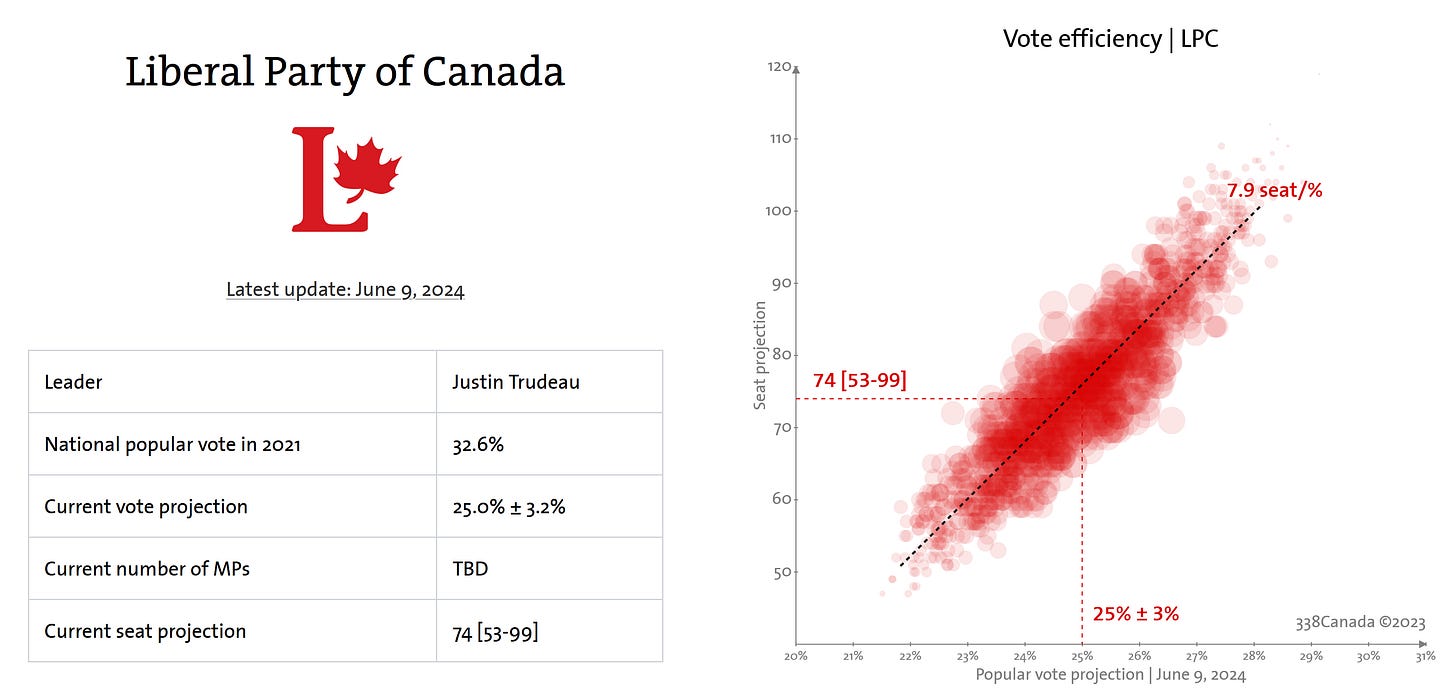

Given these factors, Canadians have drastically shifted their politcal support from Justin Trudeau to Pierre Polievre. Controversial legislative measures are the main vector of Canadians' political affiliation changes.

Figure 30. Vote Efficiency Of The Conservative Party Of Canada ( CPC ).

Figure 31. Canada Polling Statistics.

Figure 32. Vote Efficiency Of THe Liberal Party Of Canada ( LPC ).

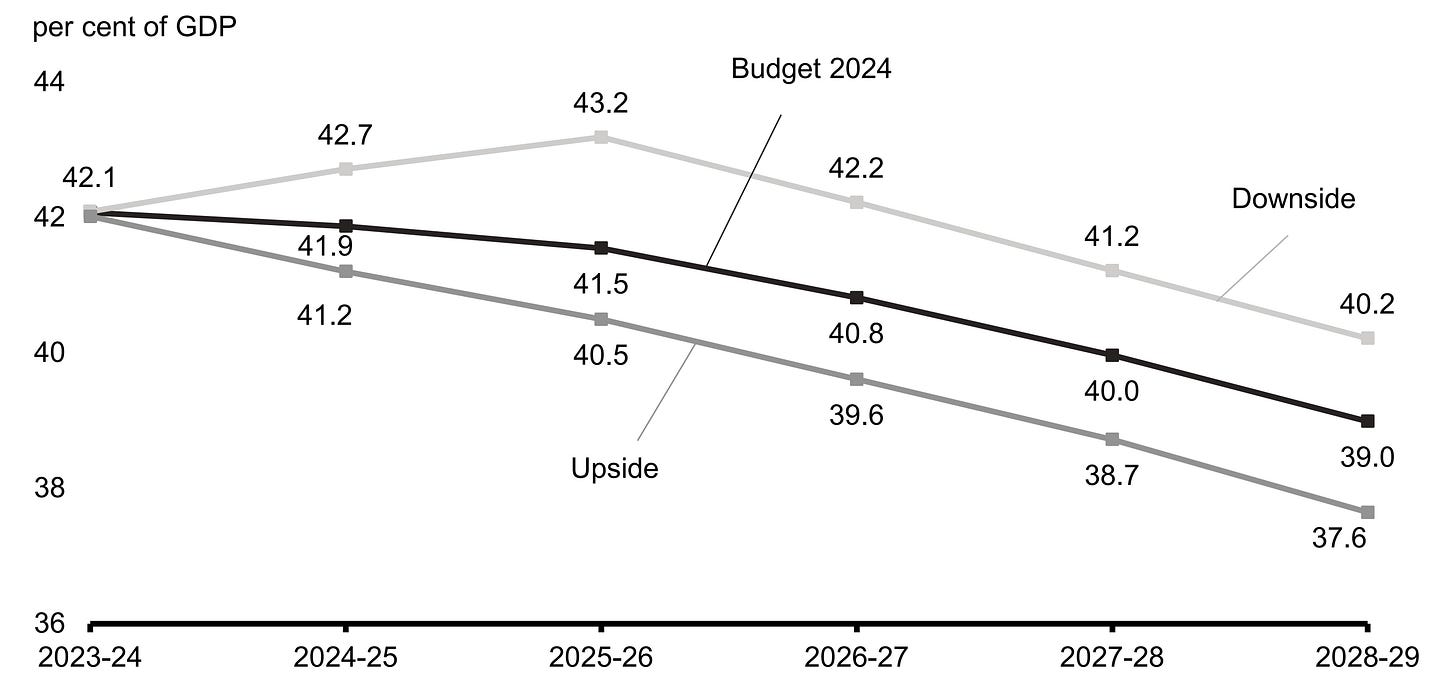

Despite the fact that the Canadian government's legislative policies were focused on ensuring productivity, they haven't delivered; the fact that the government's budget is prudent offsets the fact that they aren't effective.

Figure 33. The Canadian Government's Budget Is Prudent Given The Government Debt To Gross Domestic Product (GDP) Projections Over It.

To conclude, the Canadian government has to modify legislative measures as the Canadian economy stagnates and monetary policy can't do all the work with rate cuts as that measure is inflationary and does more harm than good.

🌍

Europe:

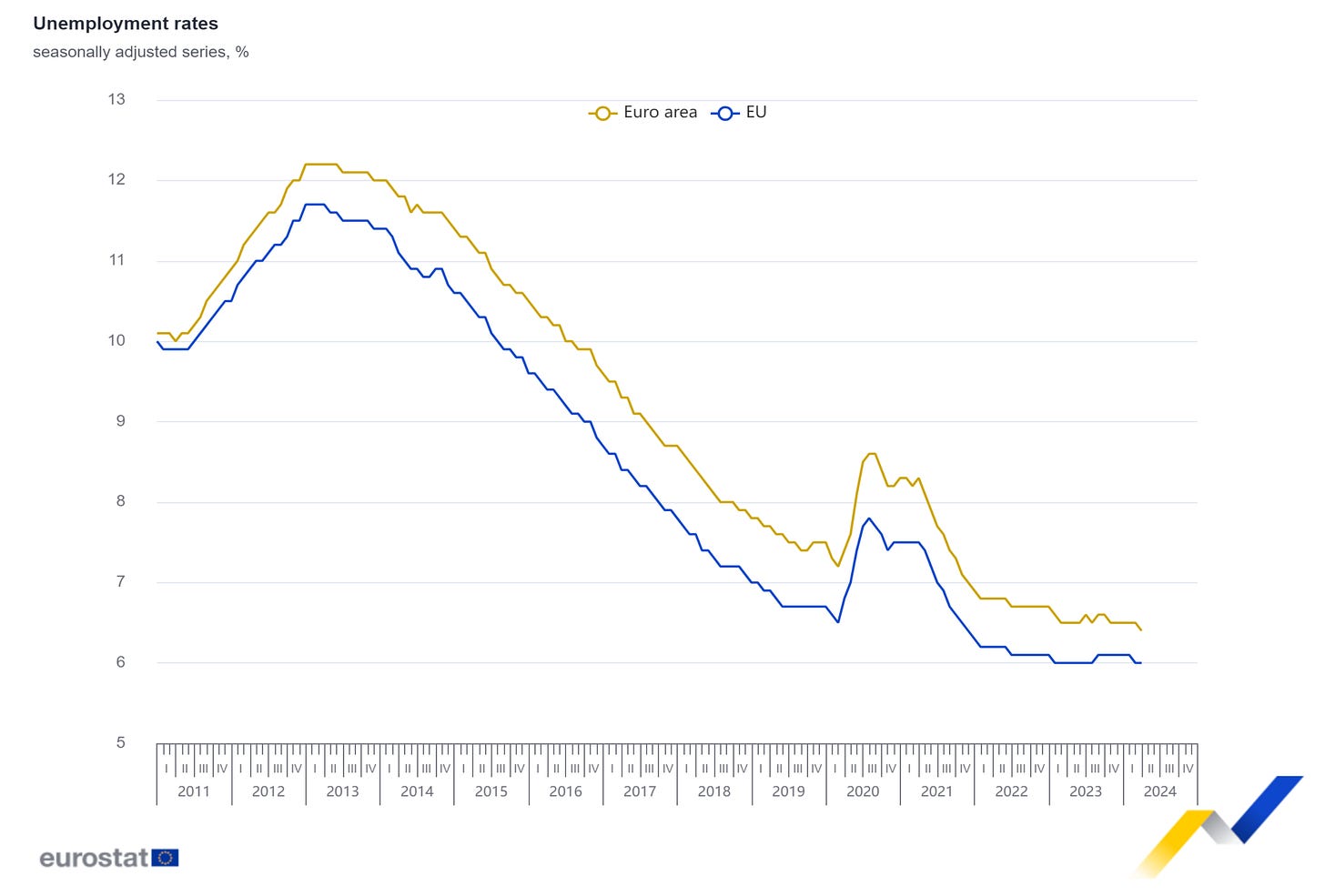

The record low unemployment rate and consistent Gross Domestic Product (GDP) growth suggested no rate cut for the previous European Central Bank (ECB) rate decision, but the European Central Bank (ECB) delivered a rate cut.

Figure 34. Record Low Unemployment Rate In Europe

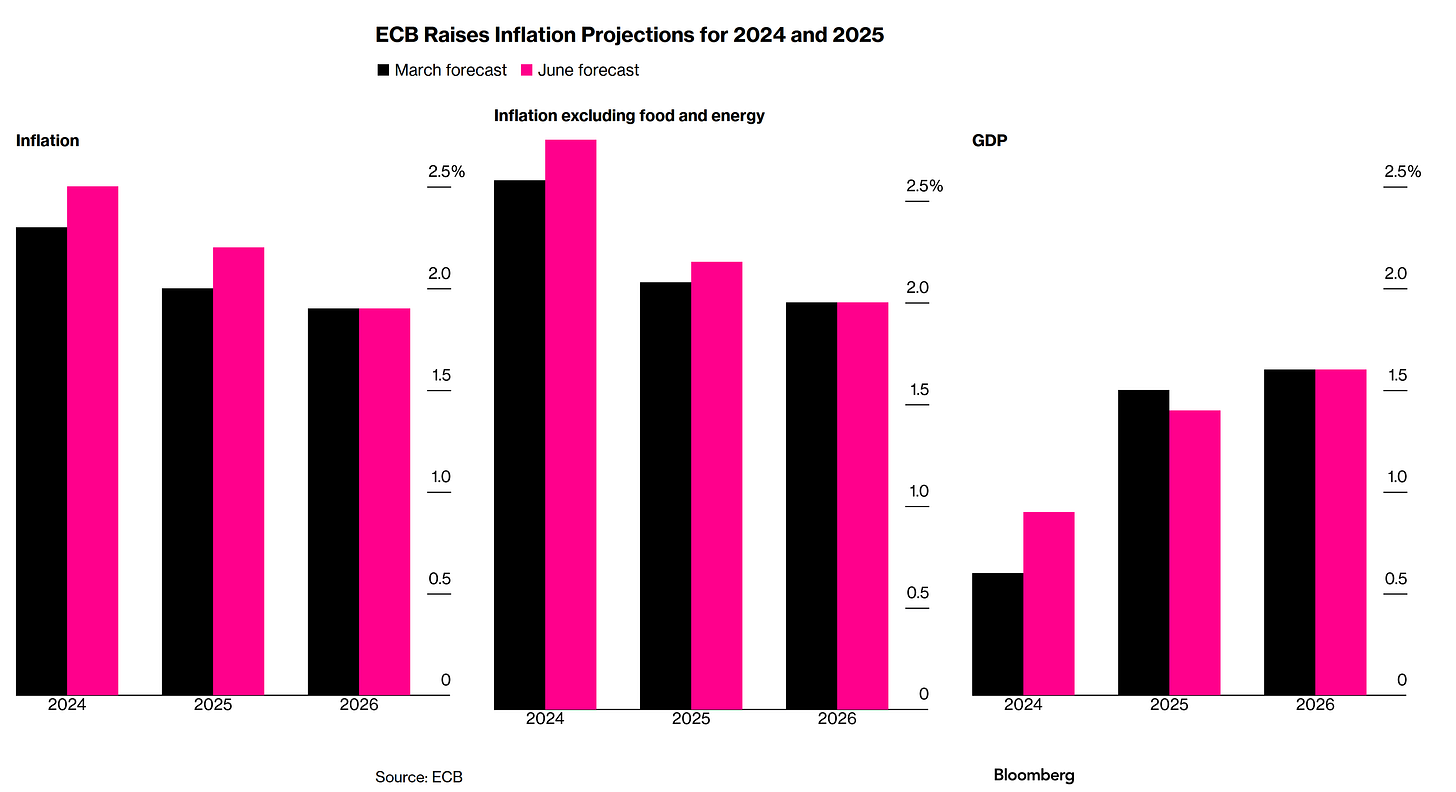

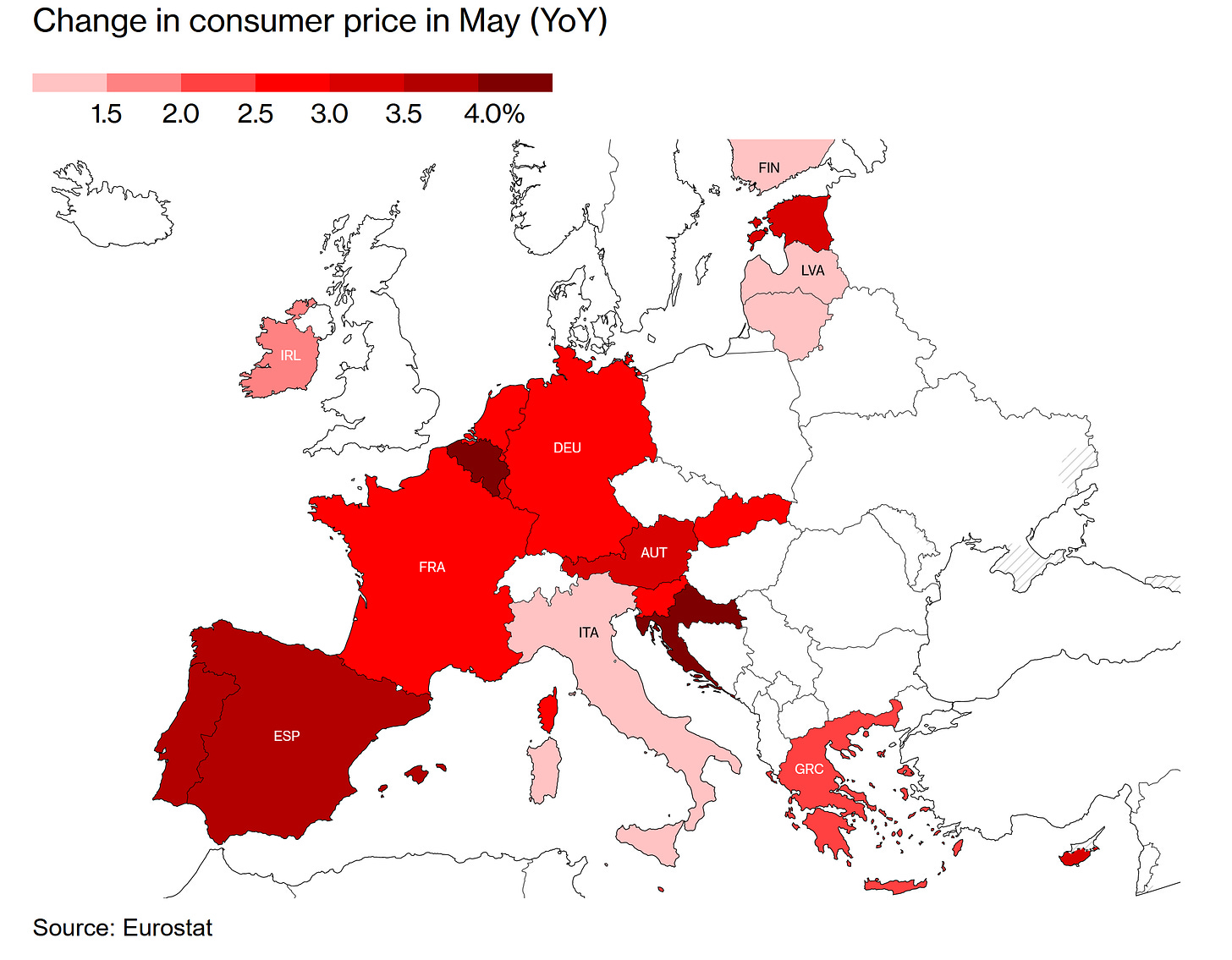

The fact that the European Central Bank (ECB) has cut rates when inflation in many countries of the Euro-Area hasn't reached the European Central Bank's price stability goal with a strong employment market and consistent Gross Domestic Product (GDP) growth suggests that the European Central Bank (ECB) has made a mistake by cutting rates too soon.

Figure 35. Most Euro-Area Countries Have An Inflation Rate Higher Than The European Central Bank's (ECB) Price Stability Goal.

Logically, after the inflationary monetary policy measure of cutting rates, the European Central Bank (ECB) raised the inflation projections for this year and next.

Figure 36. The European Central Bank (ECB) Raises Inflation & Growth Projections.

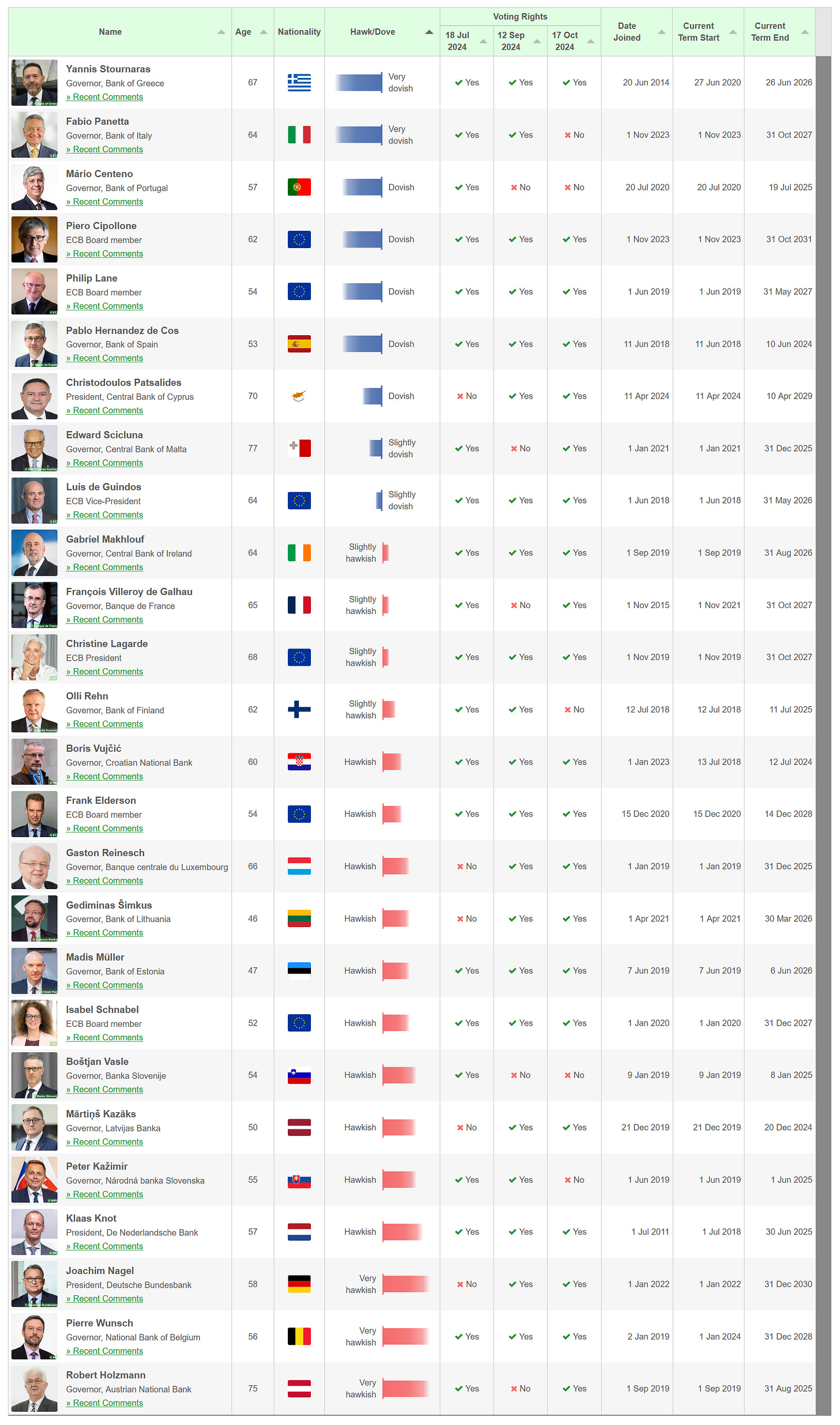

The surprising part is that the dovish rate cut wasn't priced-in markets, and the European Central Bank's (ECB) Governing Council members kept a somewhat neutral-hawkish stance before and after the rate decision.

Figure 37. European Central Bank's (ECB) Governing Council Hawk & Dove Members.

The Euro-zone Phillips curve indicates soft-landing; the non-existent risk adhered to continent-based geopolitical developments ensures soft-landing, given the fact that, as mentioned before, Europe completely phased out Russian natural gas with Norwegian natural gas. Only the Taiwan war would generate a hard-landing for Europe. Political results in recent elections didn't come as surprise; in fact, the recent results should be welcomed, as political results show emerging political parties that are prudent when it comes to economic growth and balanced spending. The socialist economic agenda of debt-based growth in Europe will likely be winded down, which gives upside to the European Government Granted Bond market.

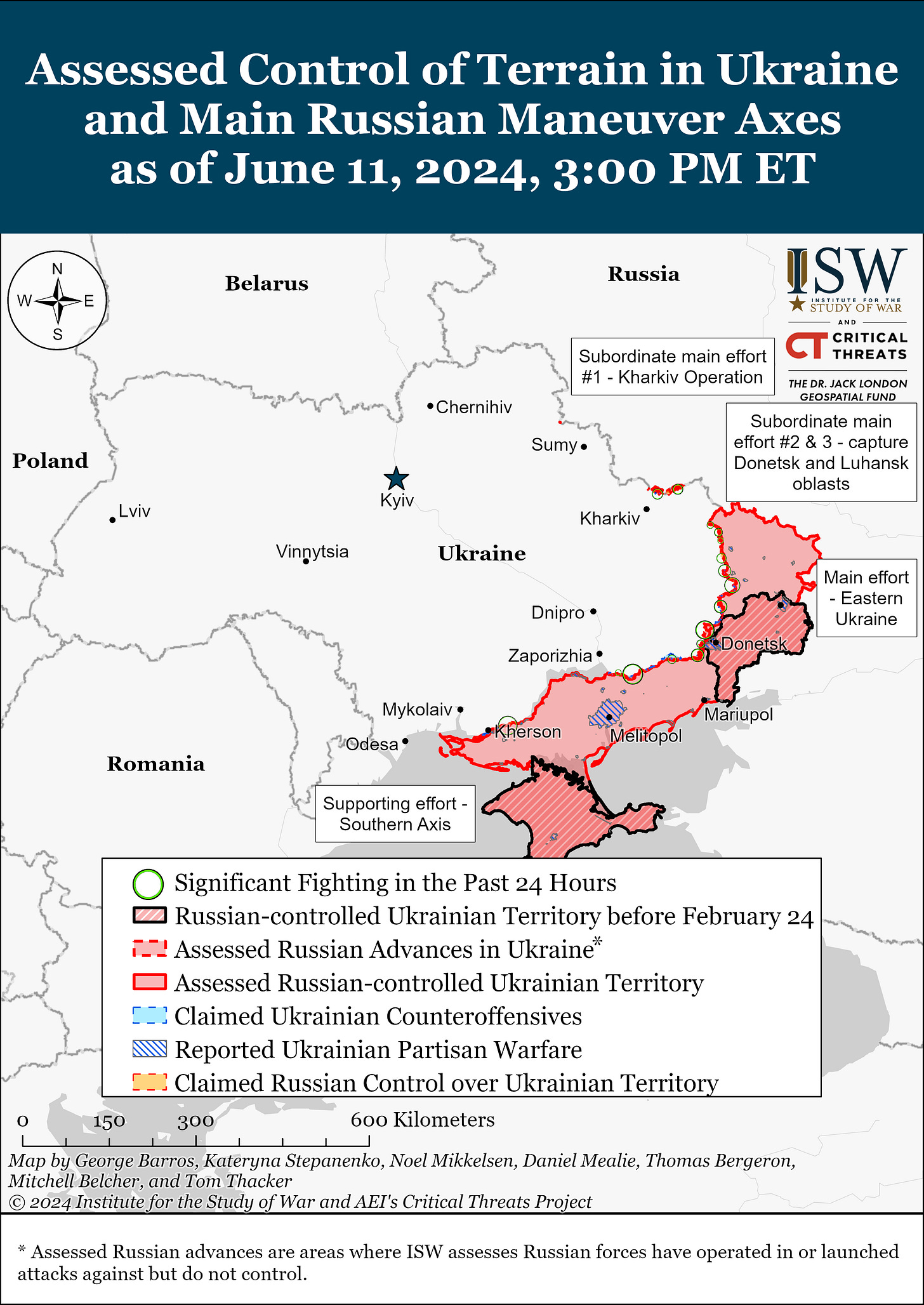

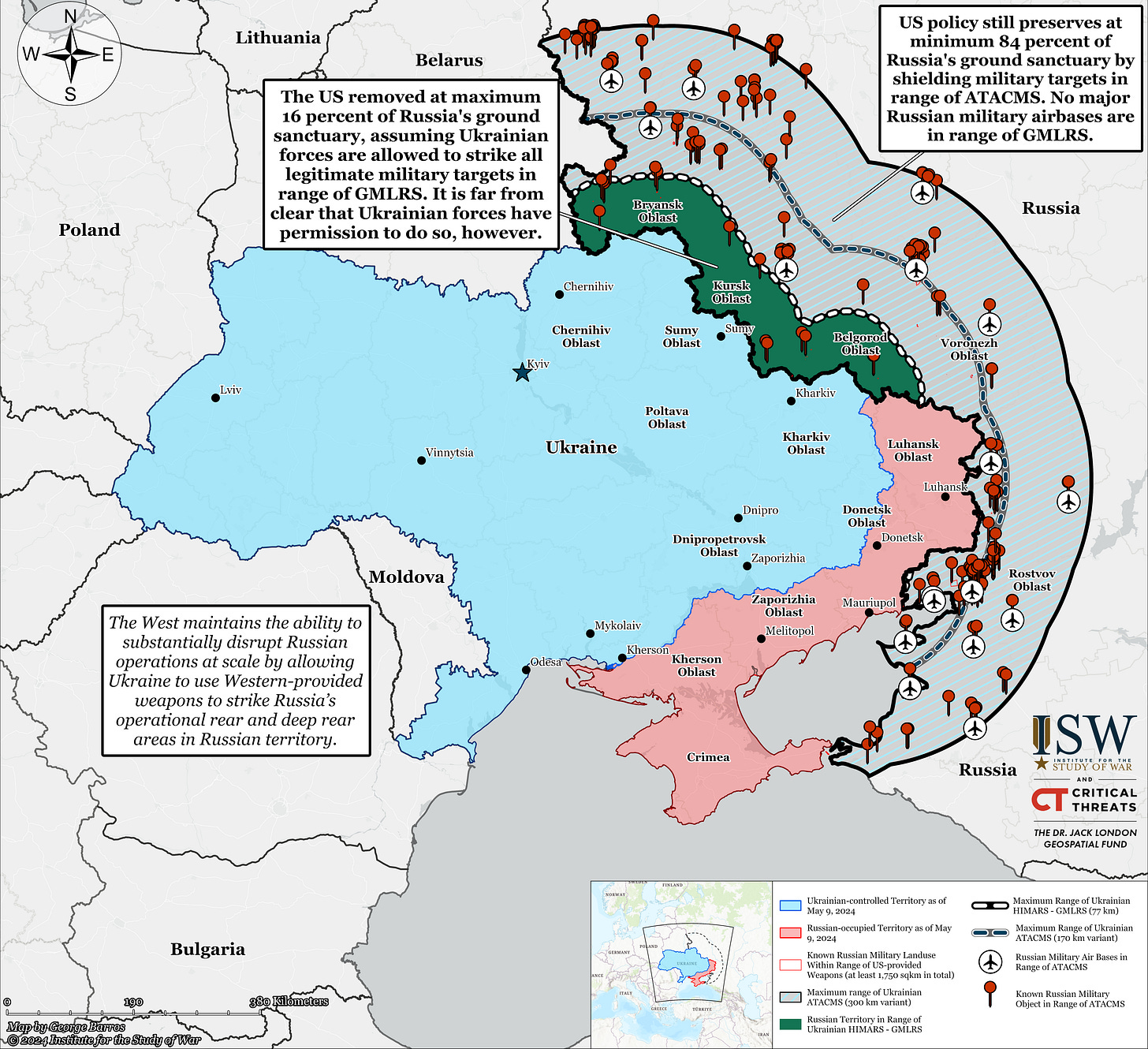

When it comes to geopolitics, the Ukraine war remains concentrated in the same regions; NATO countries have given greenlight to Ukraine for the use of long-range missiles into Russian territory, which has elevated the geopolitical scenario to a new level where Russia bluffs the use of nuclear weapons by doing tactical nuclear drills near the region.

Figure 38. Russo-Ukrainian War Map.

Figure 39. NATO Greenlights Ukraine The Use of ATACMS In The Russian Federation Territory.

To conclude, it'd be a coward move to use nuclear weapons as nobody wins a nuclear war, which is why I highly doubt nuclear weapons will be used. It remains unclear the forward monetary policy path given the monetary policy mistake with strong employment and growth data; I'll be attentive to forward comments by Ms. Lagarde regarding to current and forward monetary policy guidance, for the moment she's reluctant of further rate cuts, which is coherent.

United Kingdom:

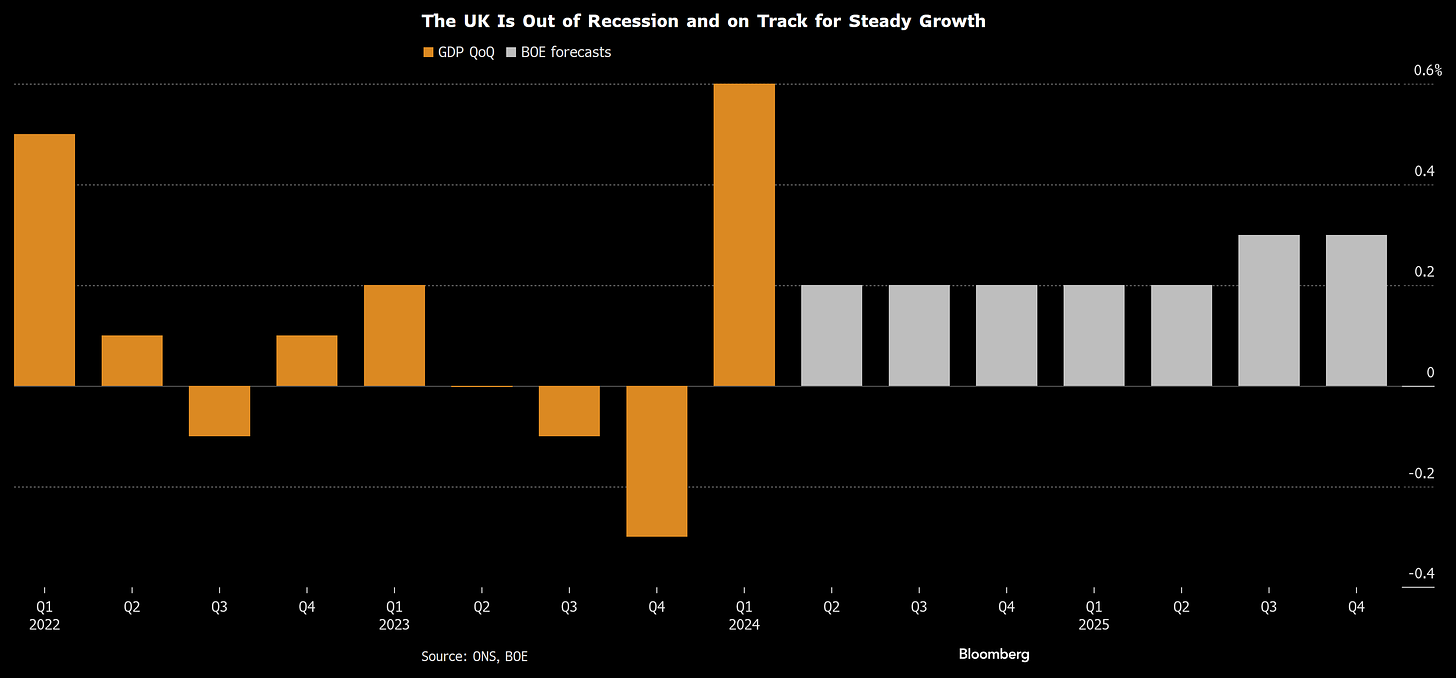

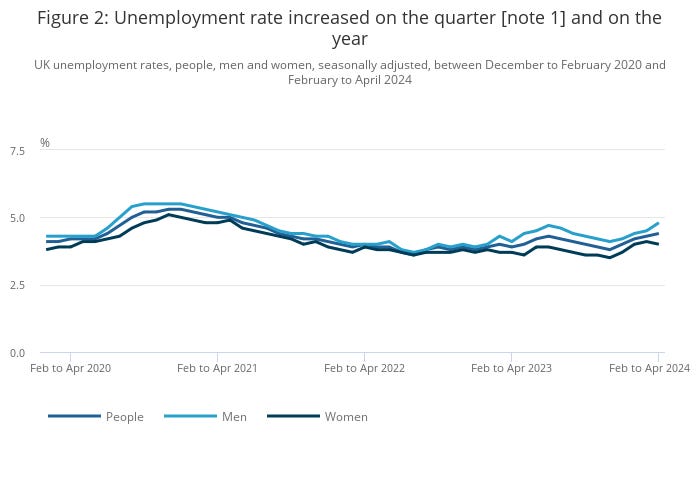

The United Kingdom exited recession with Gross Domestic Product (GDP) growth at levels not seen since late 2021, although the unemployment rate rose to the highest level since 2021.

Figure 40. The United Kingdom Exits Recession.

Figure 41. Highest Unemployment Rate Since 2021.

It's quite clear that the United Kingdom is facing structural issues that monetary policy can't really address without undoing the progress made over price stability.

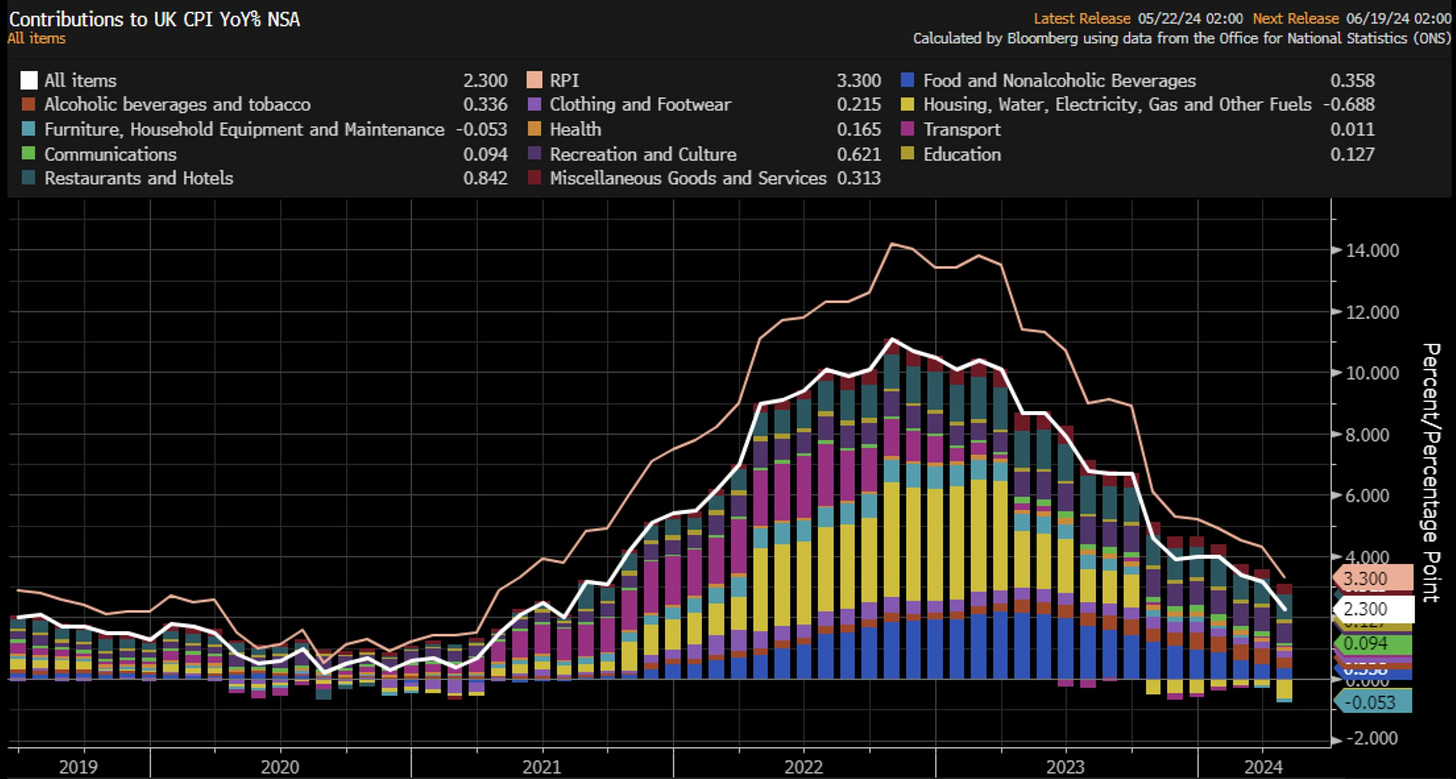

Figure 42. United Kingdom Consumer Price Index (CPI) Not Seasonally Adjusted (NSA).

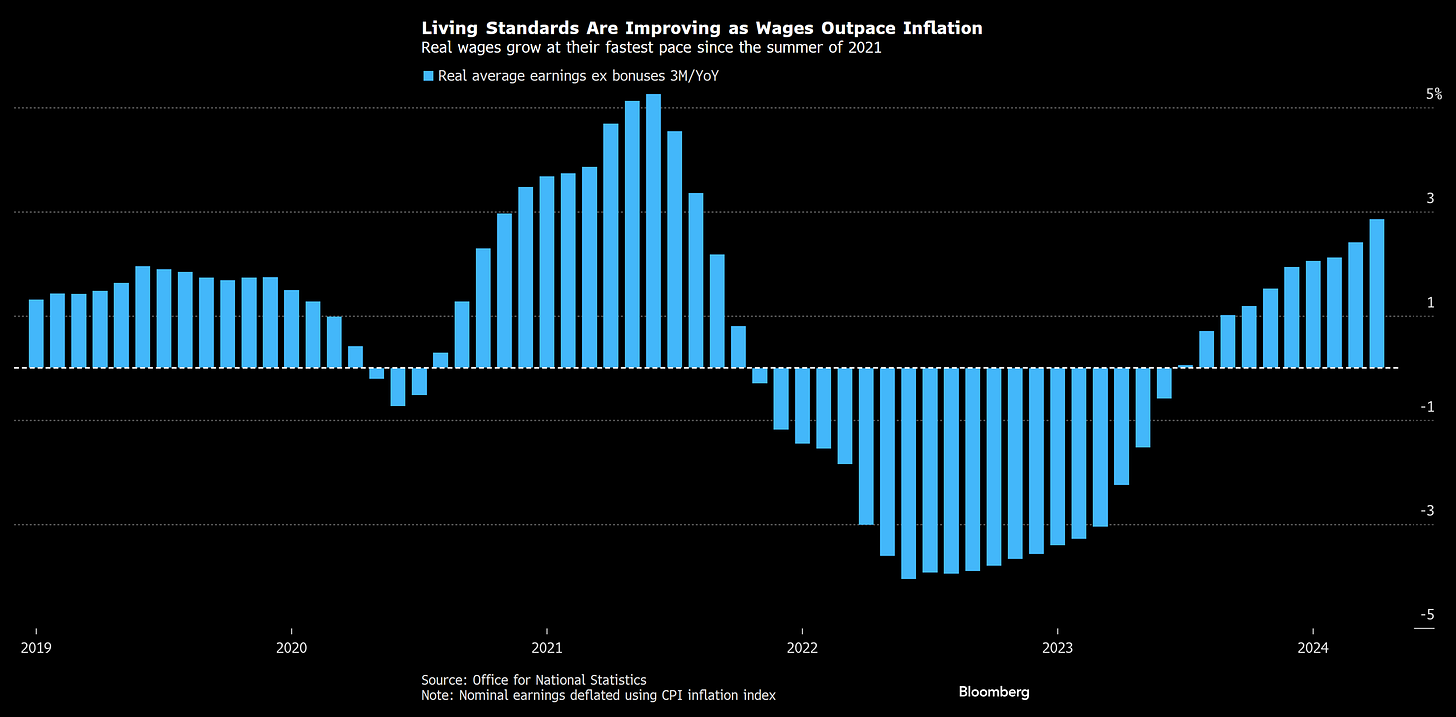

Figure 43. Living Standards Are Improving As Wages Outpace Inflation.

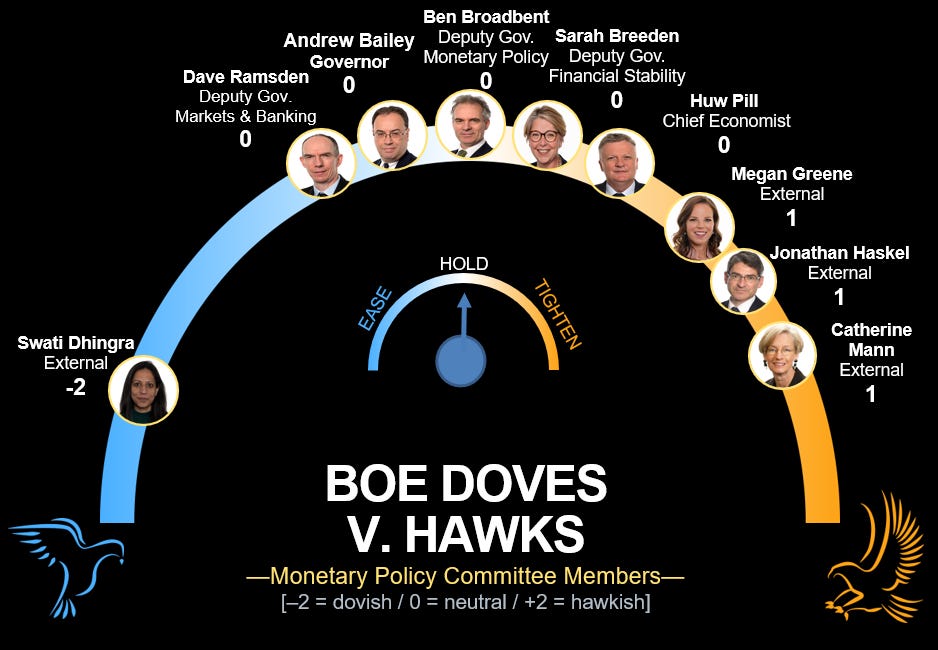

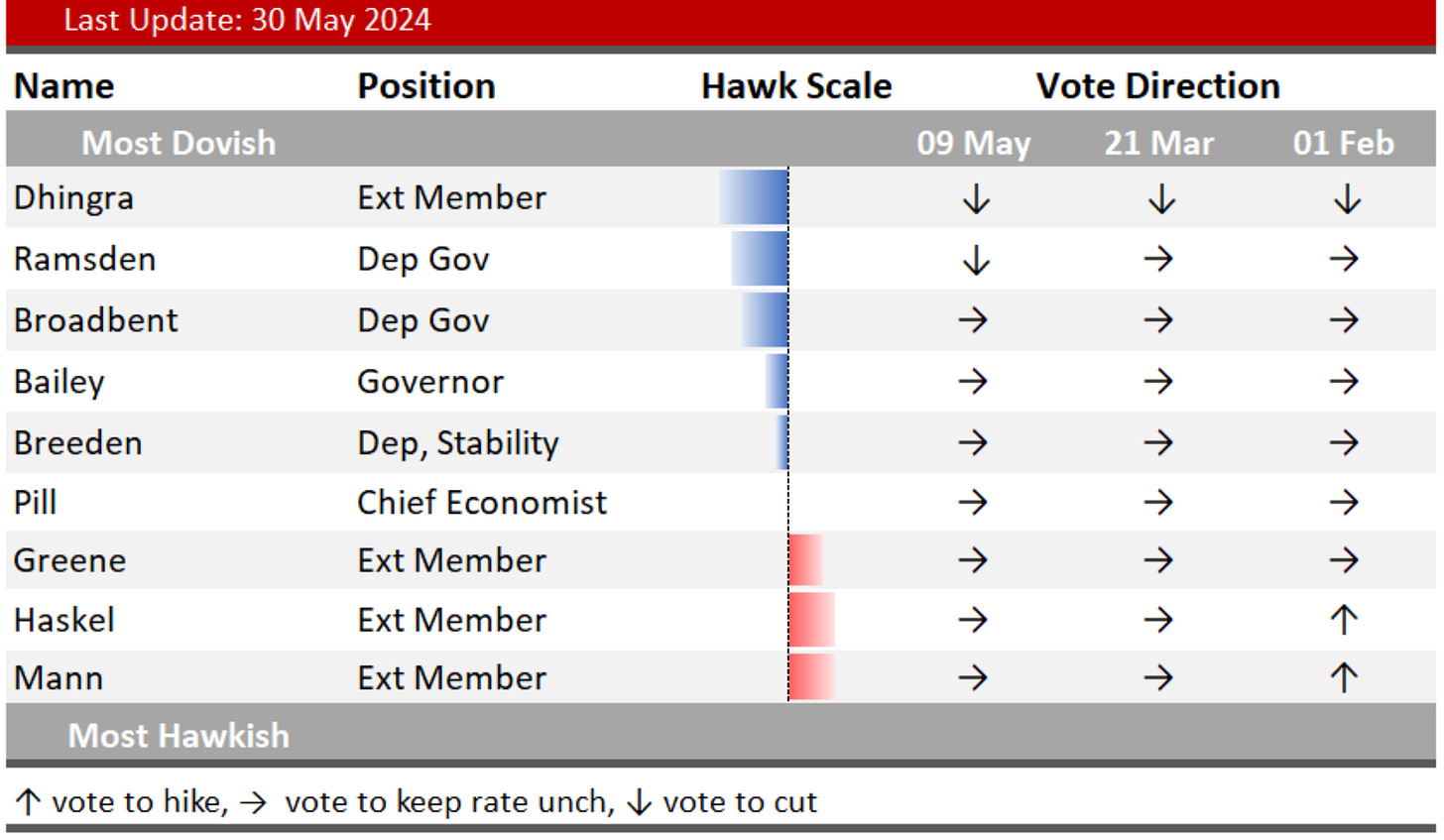

Thus far, the Bank of England's Monetary Policy Committee's stance has been hawkish-nimble, but recent statistics have skewed the stance dovishly.

Figure 44. Bank of England (BoE) Monetary Policy Committee's Hawks & Doves Infograph.

Figure 45. Alternative Data.

Do feel free, as it’s free, to share, leave a comment, and subscribe to Quantuan Research Substack if you want, by using the next buttons.

It's not about the money (the research is free); it's about sending a message (delivering alpha to the reader).

Source of the video: Warner Bros.

Note: If the text in the post is grey (example) it is because the source of data is linked; everything is linked in the text, so it’s not messy to add everything at the end like in some tweets.

Share this post