The current scenario.

Analysis of microeconomic data, macroeconomic data, political data, geo-political data, and monetary policy with commentary on it.

United States:

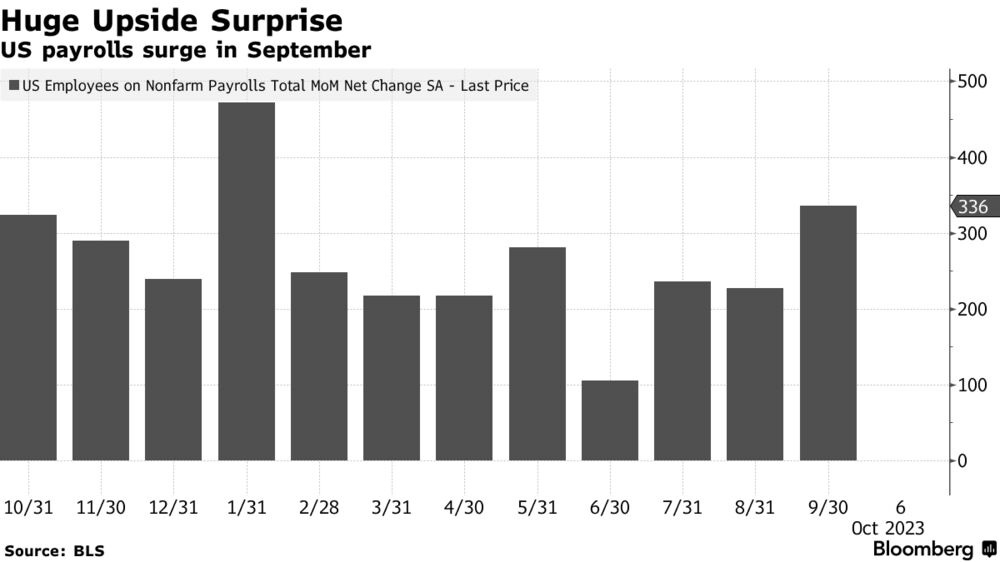

The United States economy remains in line with expectations; the latest Gross Domestic Product data suggests that the economy remains strong, consumer spending statistics remain resilient, and recent statistics confirm previously explained expectations over consumer spending. The Second Government Debt Ceiling Crisis this year shadowed recent strong statistics, but politicians acted quickly towards a resolution, which markets well received. The latest employment statistics showed good surprises, releasing data higher than economists' forecasts. The soft landing path still remains a likely scenario, but the same risks remain.

The current supply-driven inflationary pressures are expected to remain due to the fact that the United States government hasn't taken measures towards addressing these supply-driven inflationary pressures that monetary policy can't address, given the fact that monetary policy can only address demand-driven inflationary pressures. The United States' Department of Energy's Strategic Petroleum Reserve releases won't be in place once it empties, the quantified expected end of these releases is less than 2 weeks.

The United States' Congress did not appropriately support the United States' Department of Energy's operations; hence, the United States' Department of Energy's Strategic Petroleum Reserve can't be refilled. These factors further enhance the thesis over forward supply-driven inflationary pressures; next week's non-core inflation data will more than likely reflect recent months' spike in energy prices, whereas core-inflation data will more than likely reflect monetary policy measures aimed at addressing demand-driven inflationary pressures through the interest rates.

Many folks asked what was behind the recent choppy price action in energy sector commodities; well, the answer is more speculative than rational. A United States Energy Information Administration statistical data release made the whole energy sector have a black swan event; main energy sector commodities demand remain higher than supply; hence, main energy sector commodities prices are at a discount relative to forward and current supply-driven inflationary pressures. Quoting Warren Buffett, "Be Fearful When Others Are Greedy and Greedy When Others Are Fearful"; therefore, folks, it's time to be greedy while others are fearful, given the pressurization by the United States' Department of Energy's Strategic Petroleum Reserve releases and non-rational speculation.

The Organization of the Petroleum Exporting Countries Plus (OPEC+) will more than likely stick to the same stance towards reducing volatility; hence, further oil supply cuts are expected. Therefore, these measures will more than likely further enhance energy sector prices, as supply of these commodities is lower and demand remains constant or high, without mentioning that summertime has concluded and wintertime energy sector commodity demand has not yet been reflected.

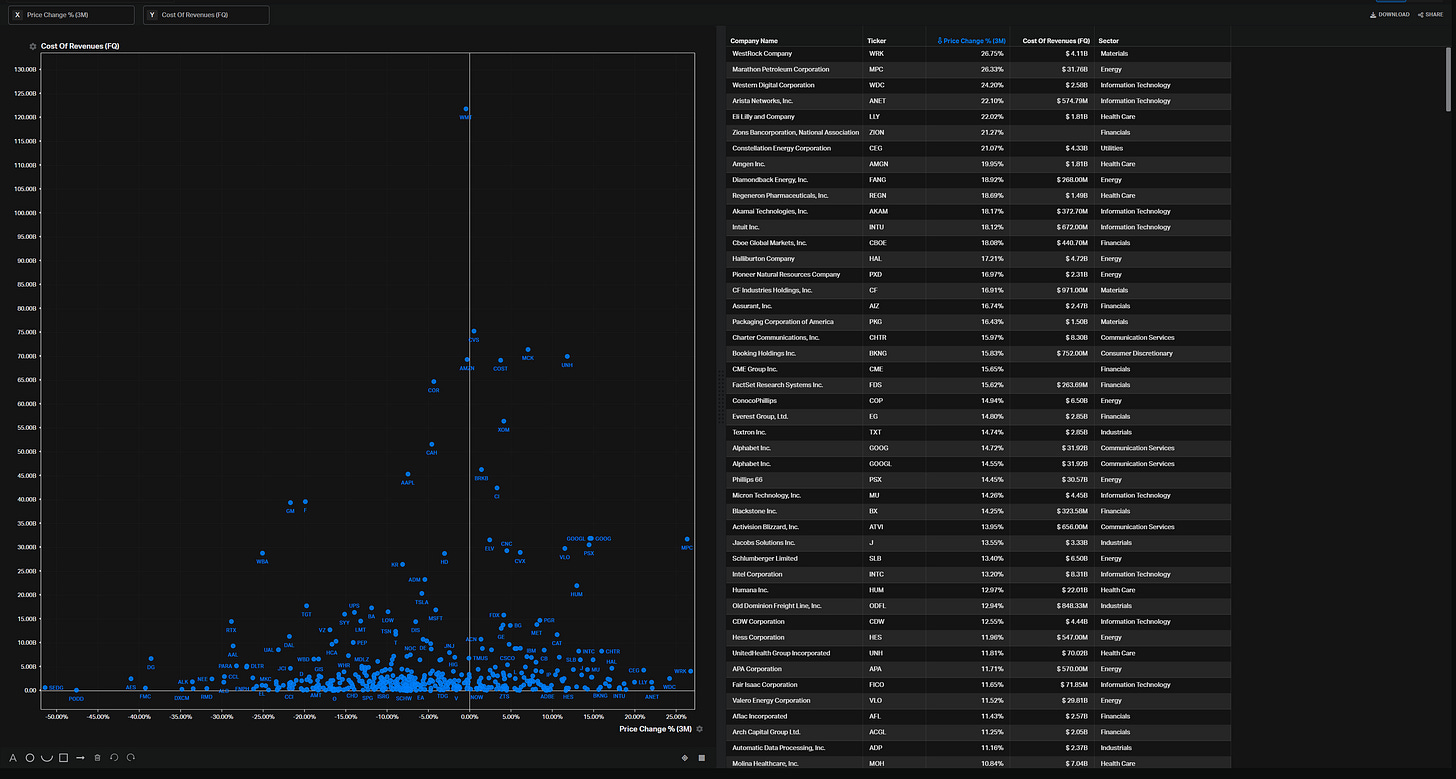

Markets are behaving in the range of expectations, recent months' increases in energy sector prices reduce the upside of some sectors of the market, specially of risk-on sectors such as high beta and discretionary sectors; due to two factors: more than likely consumer spending shifts from discretionary spending to energy, utilities, staples... ( i.e., consumer spending shift from non-essential towards essential spending ) and increased Cost Of Revenues of discretionary sectors given increased/increasing energy prices, the next chart shows the current 3-month performance of the S&P500 companies and their Cost Of Revenues as of their latest quarter release.

Risk-off sectors remain the consumer and producer essential sectors, a thing to remark is that some sectors stocks are over-traded or over-valued relative to their bonds, this peculiar performance is mostly concentrated in technology sector; a simple example is how Apple Inc. bonds are trading at low non-rational levels relative to the stock; recent bond market performance has been mostly concentrated in high-yield sectors; since the Fitch Ratings measure over the United States Government Sovereigns, the United States Government Bonds are considered high-yield; short-term United States Government Treasuries remain a bond bull niche.

The most asked question has been, "What about long-term United States Government Treasury Bonds?"; well, overnight index swaps, as explained before, showed and have been showing a higher peak rate and a higher neutral rate, meaning that the higher for longer monetary policy stance is expected. Jerome Powell's remarks during the last FOMC press conference indicated that data releases were stronger than expectations, requiring a more hawkish stance; data releases have been strong since then and before that statement too; therefore, the November FOMC rate decision is expected to be hawkish but nimble, ensuring price stability through the interest rates; the employment statistics remain strong, allowing the FOMC members' dual mandate to be focused on price stability until after inflation gets to the 2% inflation target. Given the previously mentioned expectations over monetary policy, the only long-term risk-off in government bonds are United States Government EE Bonds which the government ensures that the bond doubles its value after 20 years of holding it; hence, the only factor that couldn't ensure it would be a government shutdown, which the government prevents through Congress' measures every few years and recently every few months.

When it comes to geopolitics, the proxy war by NATO in Ukraine is reducing the United States government's ability to enhance fiscal policy measures in the United States to the point that it has been one of the main factors that has almost caused a government shutdown and has caused the Second Government Debt Ceiling Crisis so far this year. Recent measures by Russia over one of the most important nuclear treaties indicated that the conflict may escalate to another level at which Tactical Nuclear Weapons could be used, which would activate NATO Article 5, meaning world war. Recent events in the Middle East could mean another Gulf War, which the United States can't really afford. Strategically speaking, China has never had a better opportunity to move forward over the Taiwan dilemma. Reminding once again that the United States' Department of Energy's Strategic Petroleum Reserve is almost empty facing world war and the United States’ Department of Energy can’t refill it; folks, this is quite a nightmare for anyone that has to actually defend freedom in the world.

(…)"To be prepared for war is one of the most effectual means of preserving peace."(…) - George Washington

To conclude, the outlook over the United Kingdom, Europe, China, and Japan remains the same; hence, it seemed unnecessary to update it in this post that is focused on the United States. Although next week there will be another post over forward monetary policy expectations over the Bank of England, European Central Bank, People's Bank of China, and Bank of Japan, along with as always analysis over their economies performance, with commentary in it. Enjoy the 3-day weekend folks.

Do feel free, as it’s free, to share, leave a comment, and subscribe to Quantuan Research Substack if you want, by using the next buttons.

It's not about the money (the research is free); it's about sending a message (delivering alpha to the reader).