Interesting year-end.

Analysis of microeconomic data, macroeconomic data, political data, geopolitical data, and monetary policy with commentary on it.

United States:

The United States economy is performing within the range of expectations; recent statistics show a weakening in the strong trend in statistics over employment ( Note: That change in employment statistics is temporary as it was given by events that have concluded. ), although employment statistics remain strong, as supply and demand of workers return into balance, which is something that Jerome Powell remarked recently, which proves to show that FOMC officials are attentive to change in statistics.

(...) To begin with our maximum employment goal, I am glad to say that, by many measures, conditions in the labor market are very strong. A couple of years ago, as the pandemic receded and the economy reopened, the number of job openings grew to greatly exceed the supply of people available to work, leaving a widespread shortage of workers. Today, labor market conditions remain very strong, and the economy is returning to a better balance between the demand for and supply of workers. (...) - Jerome Powell, Chair of the Board of Governors of the Federal Reserve System.

If you want to read the opening remarks or watch the whole speech, here are the links:

- Document of the opening remarks. (here)

- Video of the whole speech. (here)

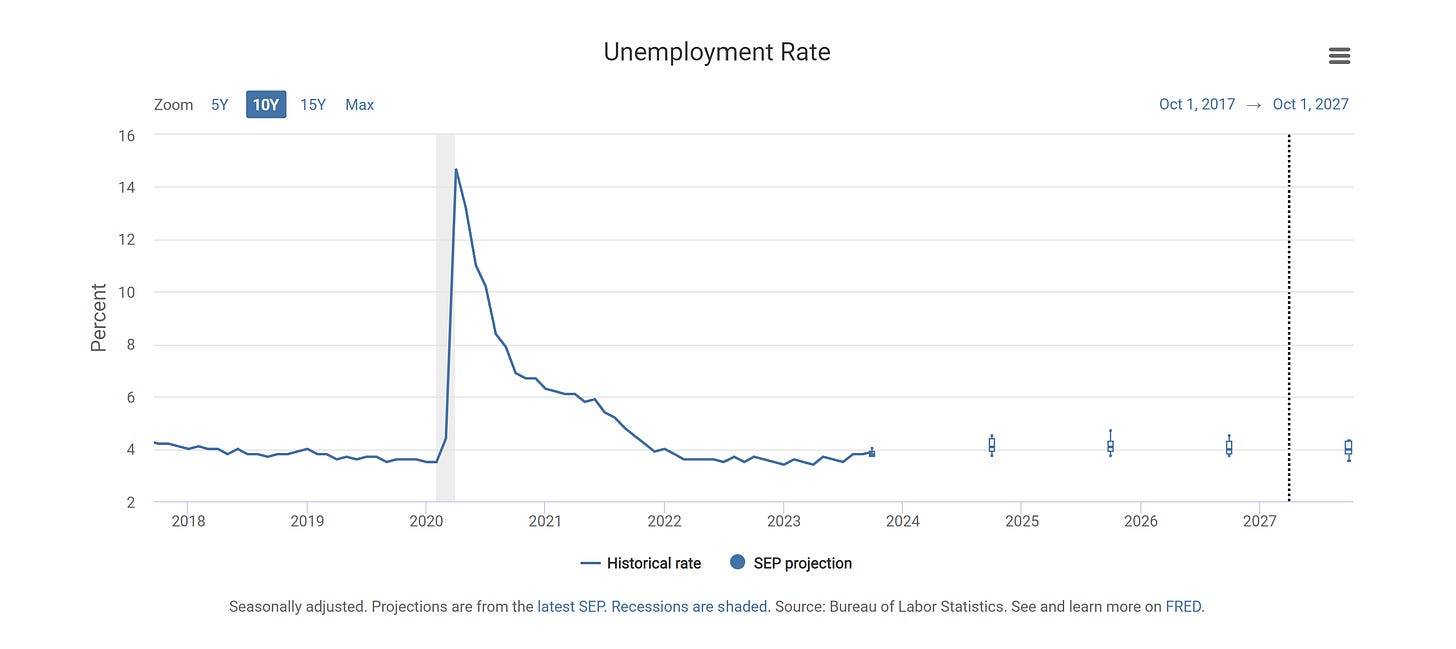

Employment statistics remain in the range of FOMC officials’ projections, as can be seen in the next chart, with statistics from the latest Summary of Economic Projections ( SEP ).

Figure 1. FOMC officials’ Unemployment Rate Projections.

When it comes to inflation statistics, on Year-Over-Year basis, inflation statistic show deflation.

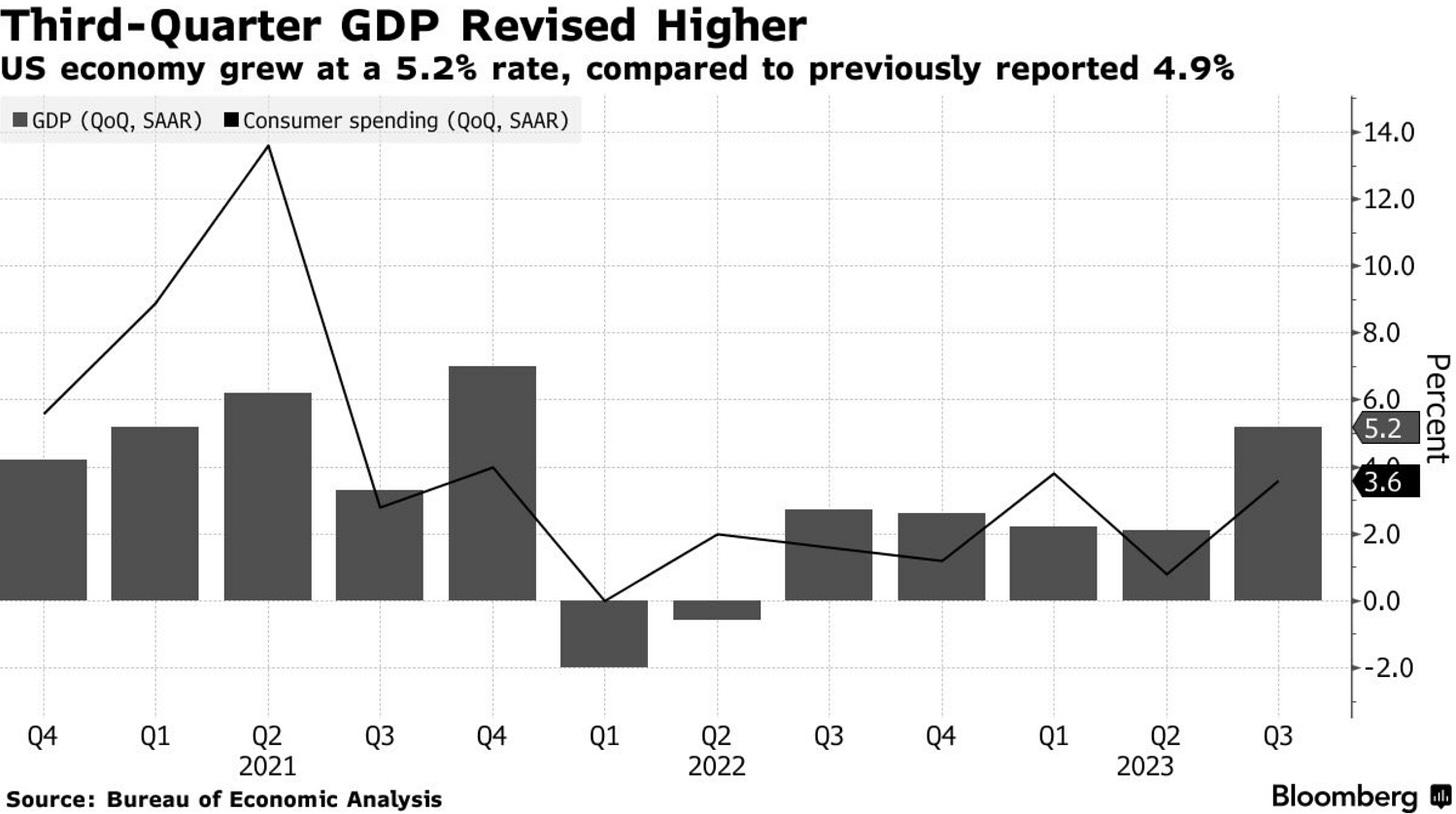

But trailing inflationary statistics show inflation at levels not seen in decades; this is something that the FOMC members of the Federal Reserve should be taking attention to, as these statistics show high inflationary pressures that put at risk the long-term projections for the United States economy, although consumer spending remains strong, which enhances the forward expectations for the economy, which has been performing at 5.2%, a Gross Domestic Product ( GDP ) growth pace not seen since 2021, as can be seen in the next chart.

Figure 2. The United States Growth At Levels Not Seen Since 2021.

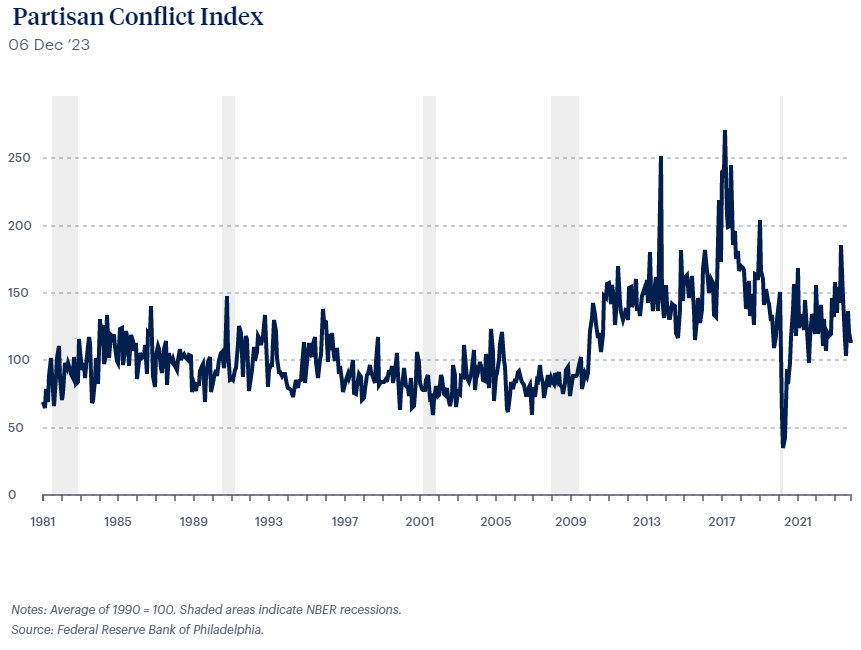

The United States’ consumers remain resilient with a strong job market; the only factor that pressurizes the upside to the economy is the still high inflationary pressures. Although short-term expectations over monetary policy remain dovish, long-term expectations over monetary policy are somewhat hawkish, this is due to the fact that a repetition of similar implementations of monetary policy measures in 2020 & 2021 would cause a reflation similar to then in the long-run; therefore, it is coherent to stay positioned for either scenario where those monetary policy measures are and aren’t implemented. The Federal Reserve Bank of Philadelphia's Partisan Conflict Index lowered from May 2023 highs, which indicates that the level of uncertainty is low, which is good news, as can be seen in the next chart.

Figure 3. The Federal Reserve Bank of Philadelphia's Partisan Conflict Index.

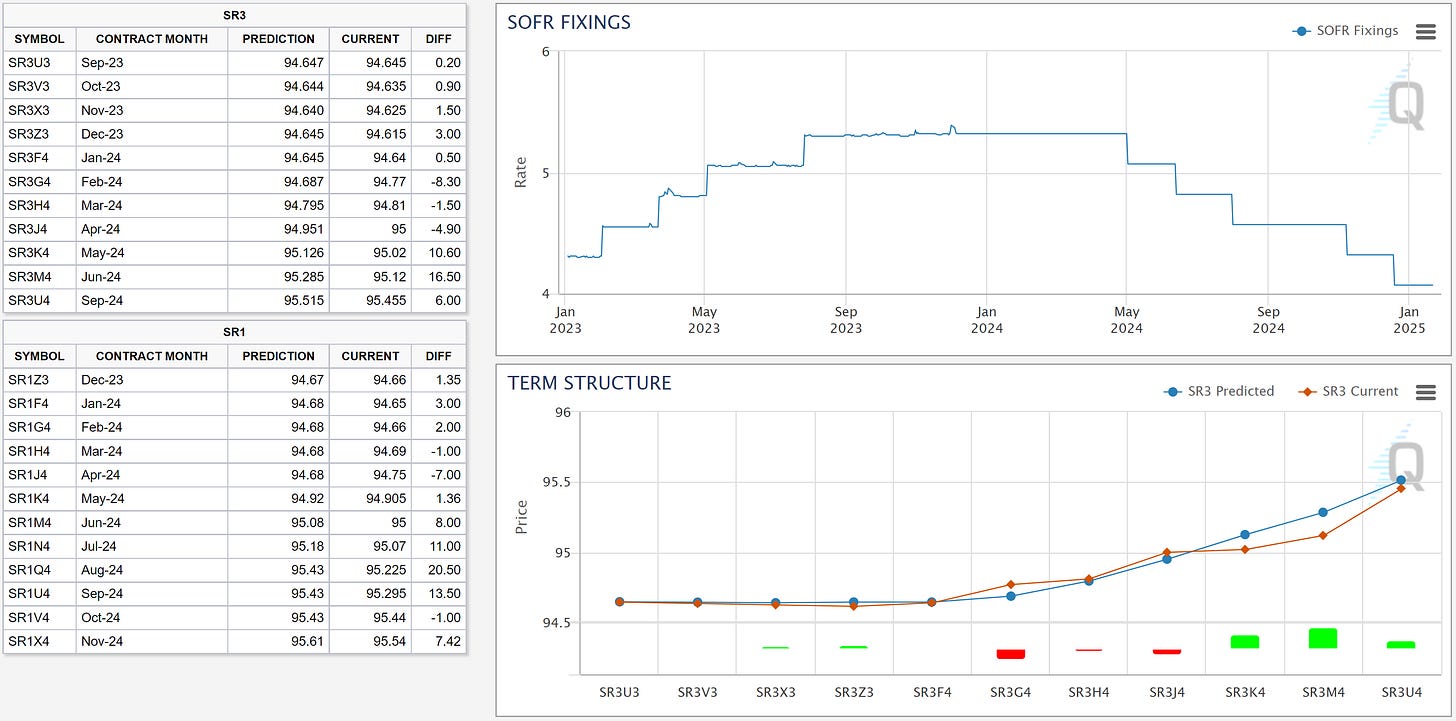

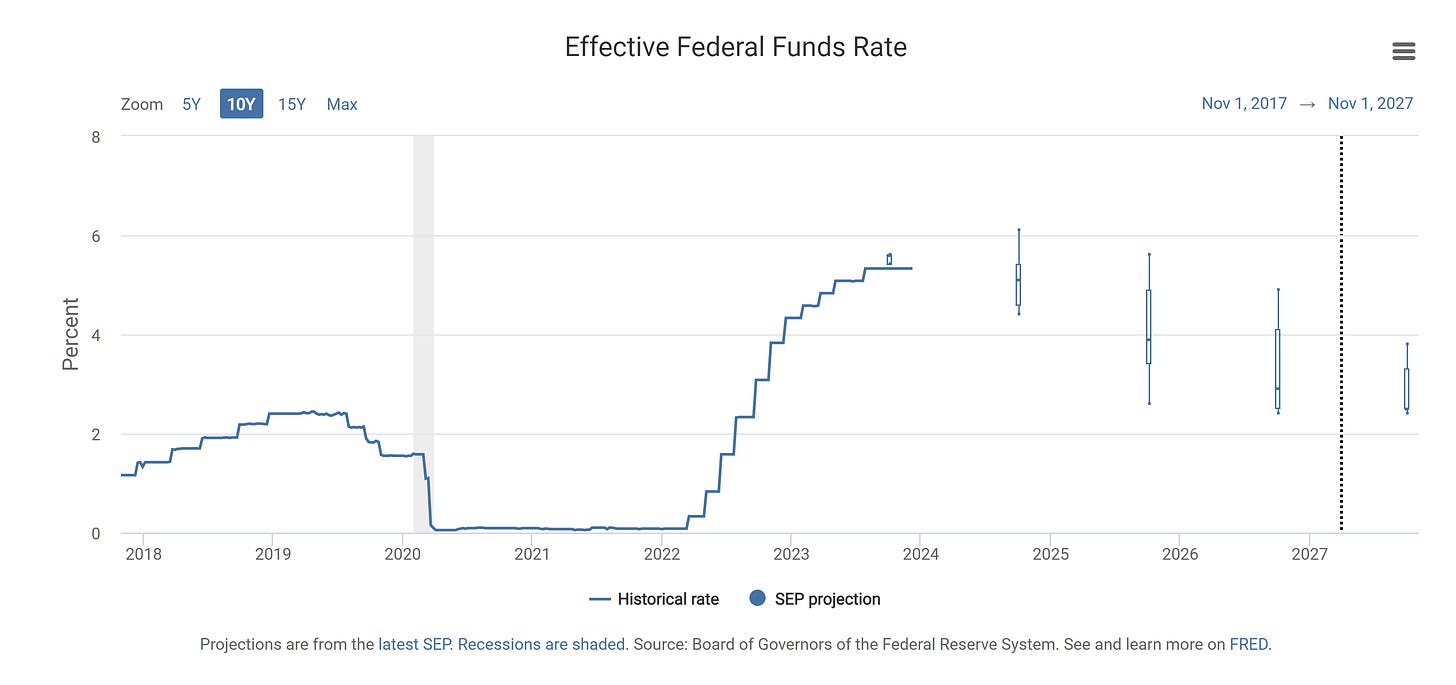

There are discrepancies over FOMC officials statements over monetary policy; hawkishness is something that remains, but monetary policy dovishness, as explained before in October 2023, is surging. FOMC officials’ projections over monetary policy are hawkish; with the median rate for the fourth quarter of 2024 at 5.1%, markets are far more dovish than what FOMC officials project. The next two charts show the currently priced-in forward rate path in SOFR data and the FOMC officials’ rate projections.

Figure 4. Currently Priced-In Forward Rate Path In SOFR Data.

Figure 5. FOMC Officials' Effective Federal Funds Rate (Interest Rates) Projections.

Risks for 2024 are government shutdowns given the widening government deficit and reflation due to the market-priced ultra-dovish rate path, which would cause a hawkish shift in monetary policy, both of which are expected to materialize. Markets seem to ignore next year's government shutdown risk, which would cause spillovers in markets, similar to recent months' turmoil.

The United States is currently in a fire and ice kind of scenario, where the government deficit is a torch or flamethrower, melting a cold but strong economy with strong consumer spending and strong employment statistics. Downplaying near-term and long-term risks vectored by a concerning government deficit would be reckless; this is the main reason why gold spiked to new all-time highs recently.

To conclude, when it comes to geopolitics and politics, the United States is facing a big dilemma as war-related spending is still dificulting the United States ability to focus on domestic fiscal spending and even increasing expectations over government shutdowns. The current Second Cold War is still phasing towards a World War scenario; expectations for 2024 over geopolitics remain the same, as direct and indirect enemies of the United States will join the BRICS alliance next year, some of whom are currently in direct conflict with a United States' ally, which consequently results in an indirect escalation of the conflict once they join the BRICS alliance.

Europe:

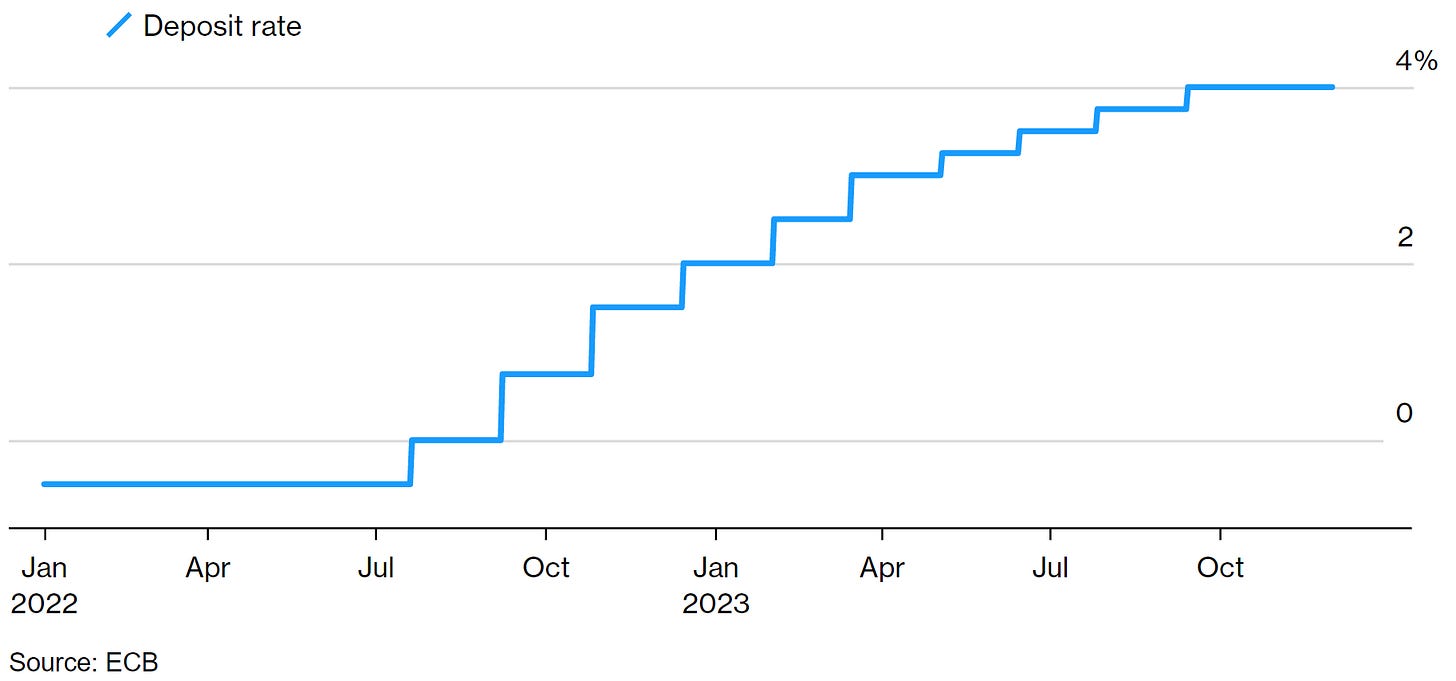

The Euro Area economy is performing as expected, European governments' fiscal and legislative policy measures are ensuring safe and stable growth in the long-run. Inflation statistics prove to show that the European Central Bank's ( ECB ) monetary policy measures have and are ensuring price stability in the Euro-zone.

Figure 6. The European Central Bank ( ECB ) Stops Hiking As Inflation Approaches 2%.

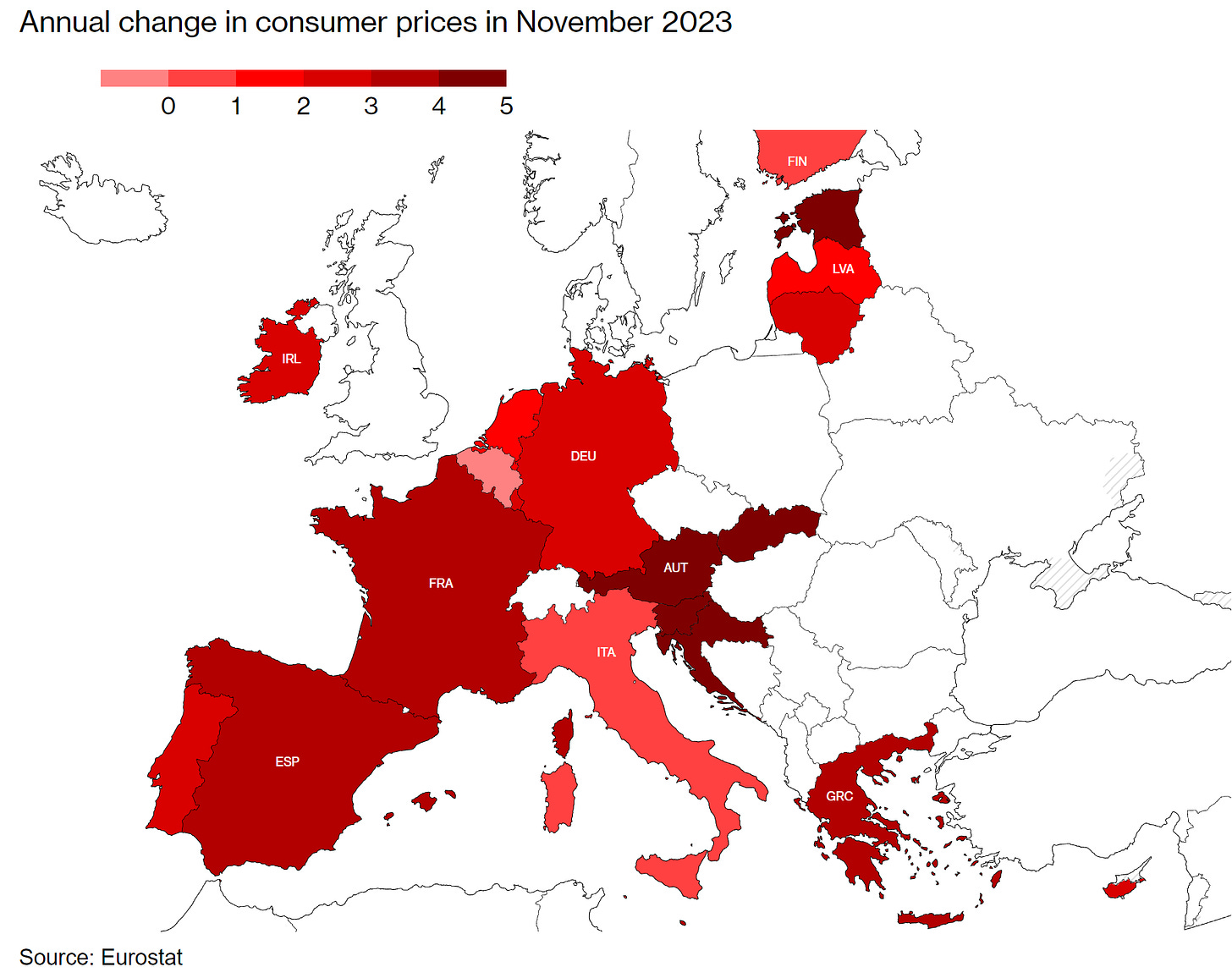

Euro-zone inflation statistics show deflation, although most countries in the Euro-zone have an inflation statistic higher than the European Central Bank's ( ECB ) 2% target, as can be seen in the next chart.

Figure 7. Inflation Rates Across Europe Remain Higher Than The European Central Bank's ( ECB ) 2% Target.

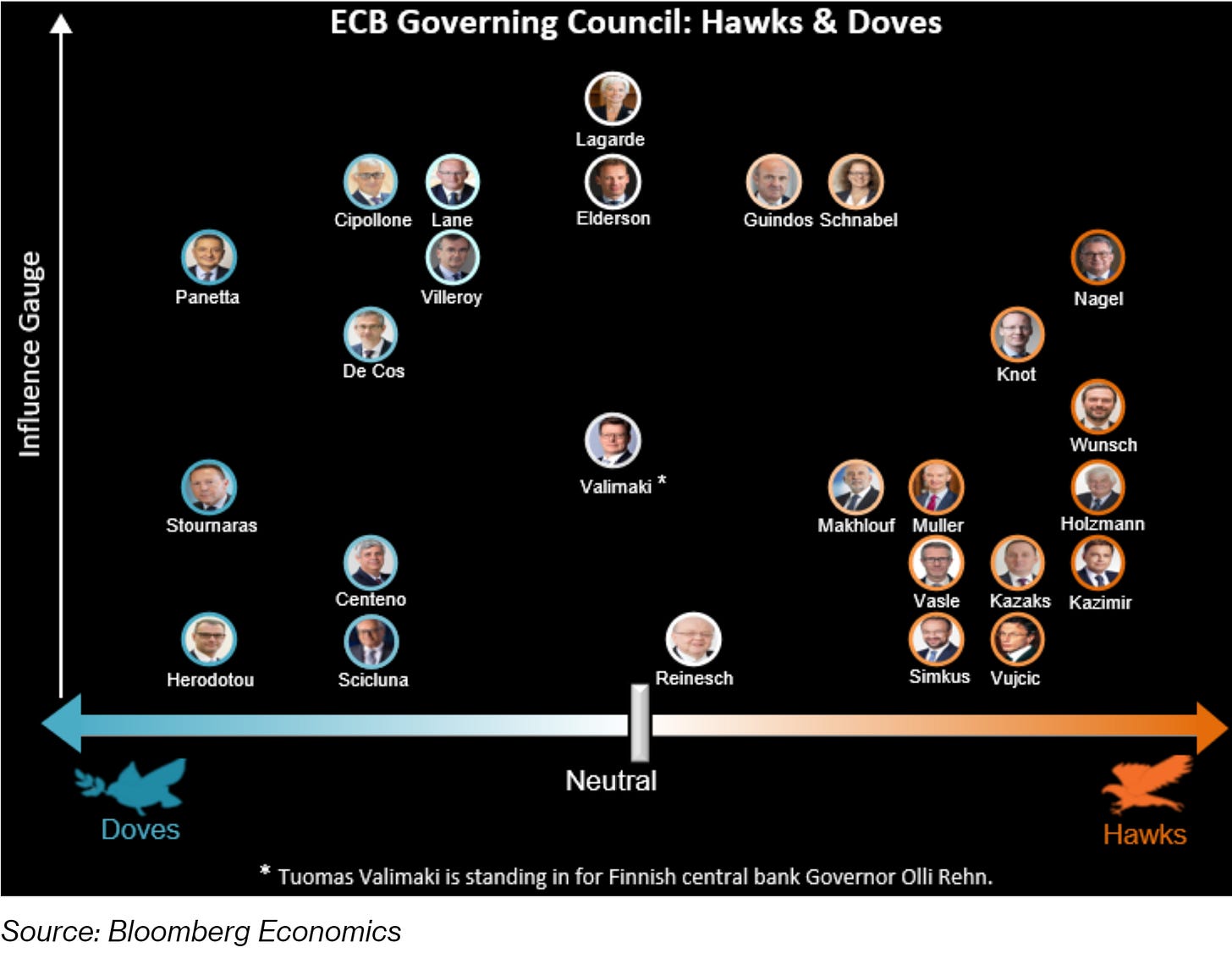

These statistics are something that the European Central Bank's ( ECB ) Governing Council members should be attentive to. The European Central Bank's ( ECB ) Governing Council members monetary policy stance is neutral, not too hawkish nor too dovish, as can be seen in the next chart.

Figure 8. European Central Bank ( ECB ) Governing Council Monetary Policy Hawks & Doves.

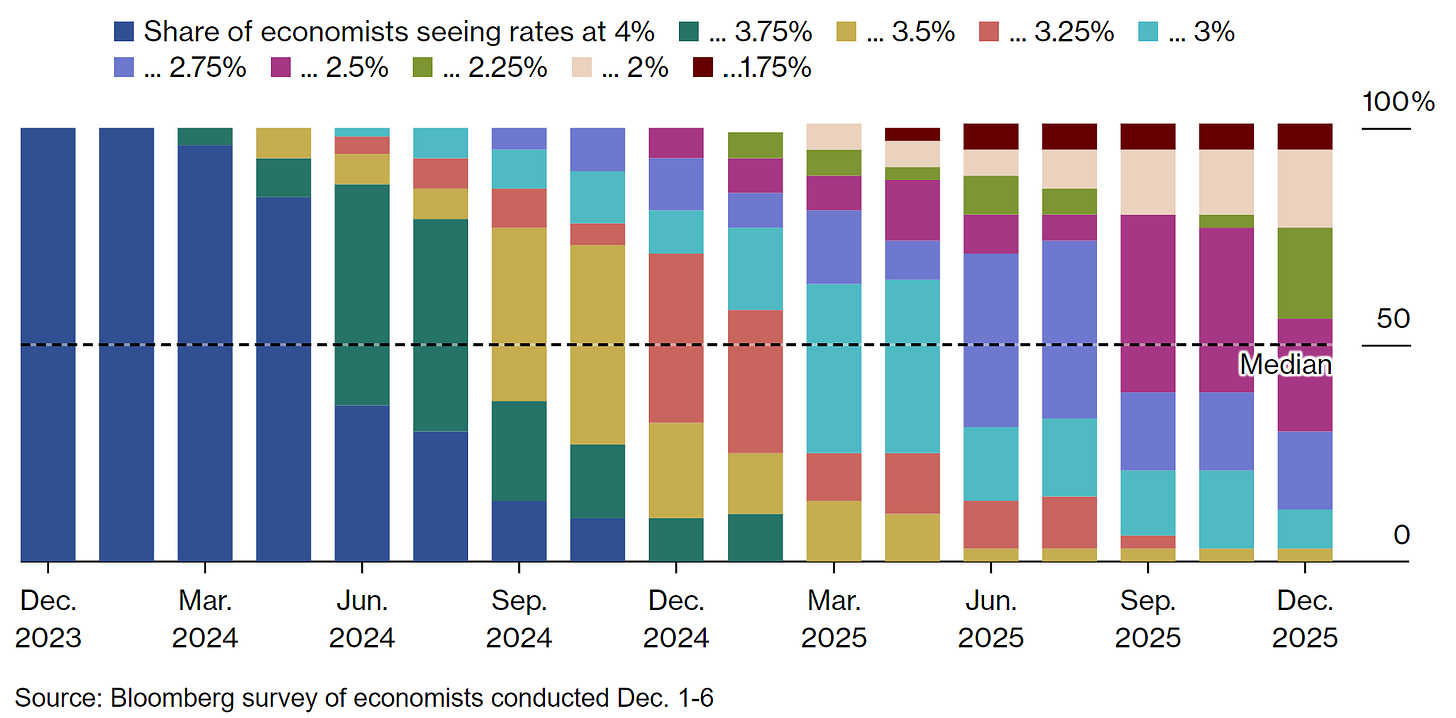

Although markets are pricing a quite dovish rate path in the €STR, which is the Euro equivalent of SOFR. Economists' expectations over the forward rate path are dovish, with both traders and economists agreeing on the forward rate path with 150 basis points of rate cuts next year, but there are diverse projections, as can be seen in the next chart.

Figure 9. Economists' Expectations Over The European Central Bank's ( ECB ) Monetary Policy Rate.

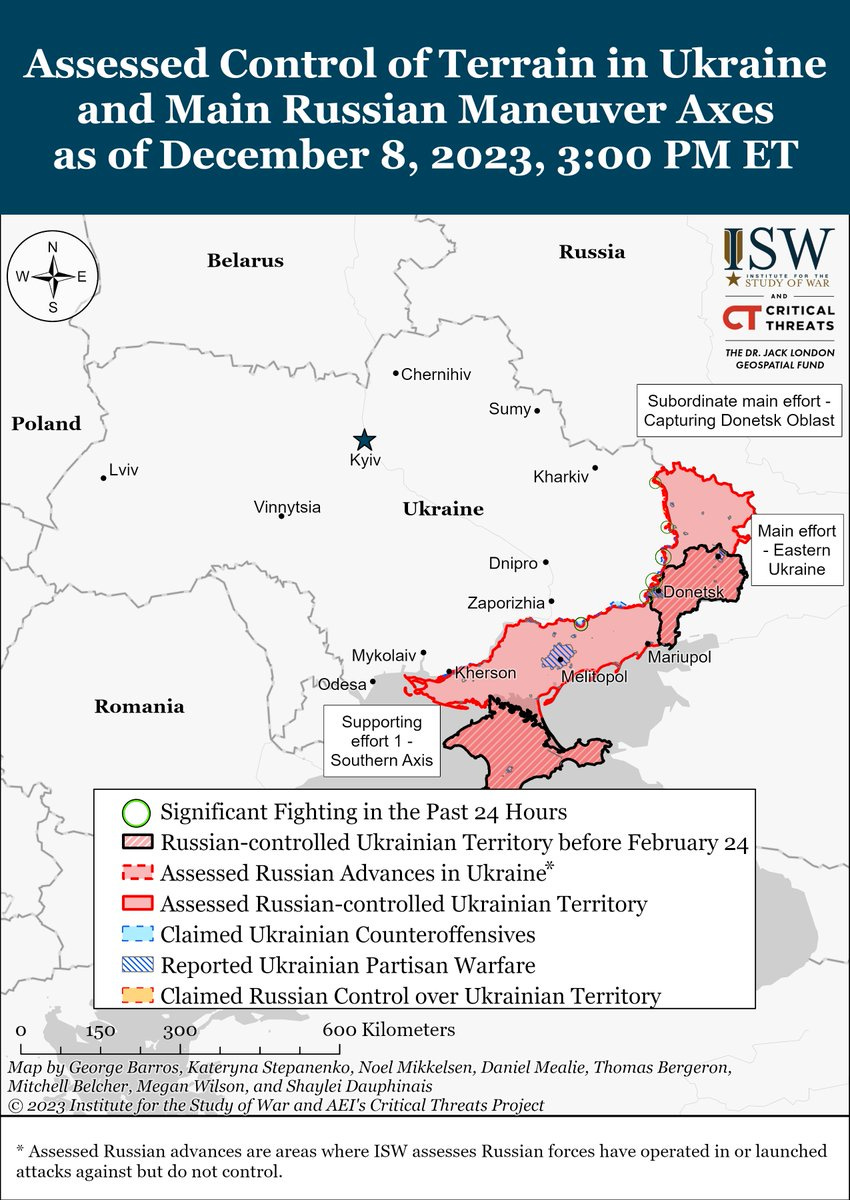

When it comes to geopolitics, the European admission of Ukraine to the European Union would escalate the conflict to another level at which NATO would get involved as UN Article 51 / EU Mutual Defense Clause and NATO Article 5 would get inwoken, and so Russia would directly fight a group of nations not in a proxy war but in a continental war, which may be something that European countries may be willing to risk as they ramp up defense spending. Ukraine's NATO admission is unlikely, although NATO's proxy war prolongation is expected to continue as Russia's Vladimir Putin doesn't desist in Ukraine, and isn’t expected to desist given recent statements.

The Ukraine war has been an attrition war since it started, NATO members may or may not have realized about the fact that NATO is focusing on arming Ukraine with their own defenses and not caring about their own defenses, which will more than probably be needed if and when the conflict escalates.

Figure 10. Russo-Ukrainian War Situation Map.

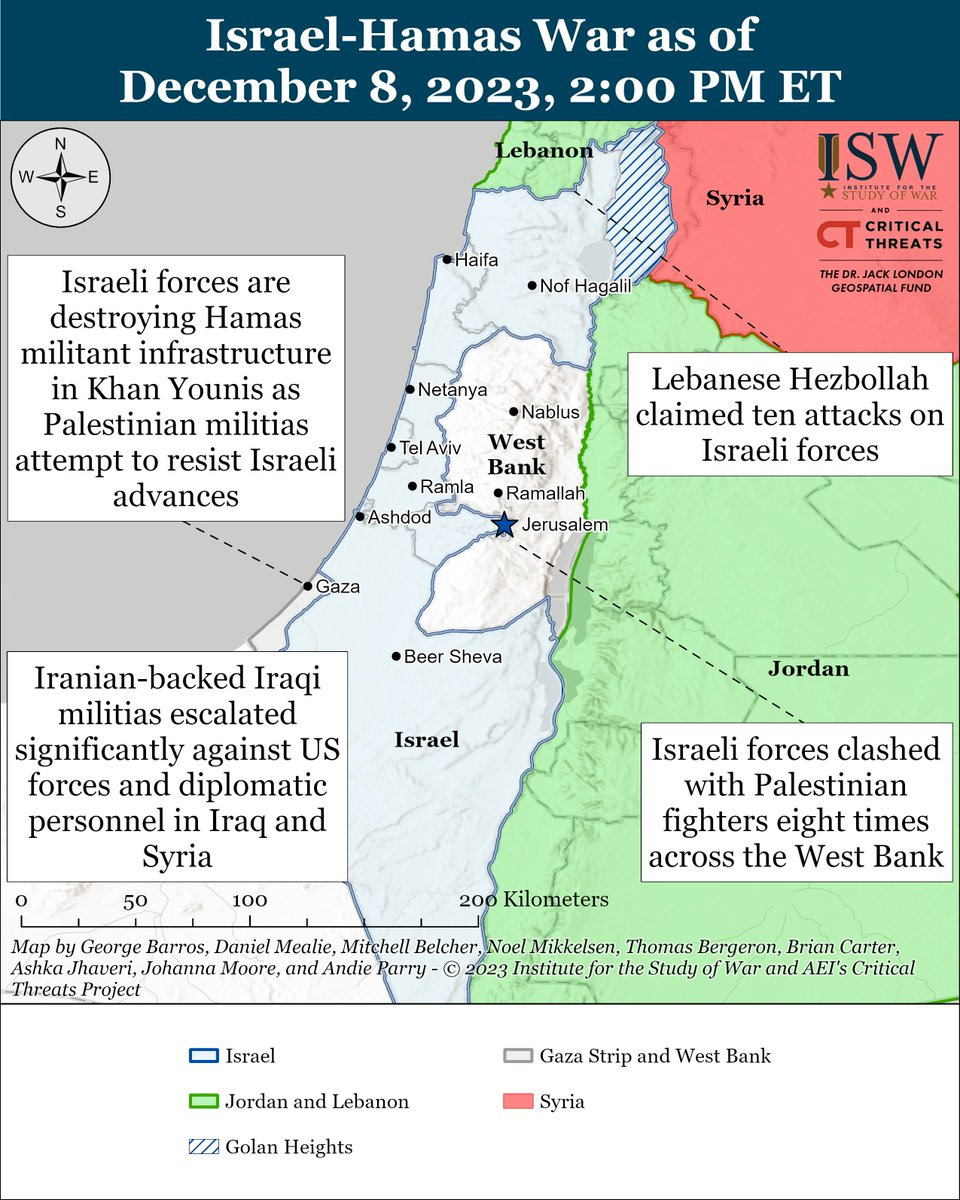

The Hamas-Israel war is also an attrition war, which will weaken the countries that do the same as with Ukraine. The incentivation of proxy wars to weaken defenses and to weaken economically the countries that support those proxy wars is more than probably what the enemies of NATO and the West in general keep incentivating, in order to weaken their enemies for and when World War occurs; the Hamas-Israel war is expected to escalate due to the fact that direct and indirect enemies of NATO allies will join the BRICS alliance next year, which may indirectly imply conflict between alliances once they join the BRICS alliance and consequently World War between alliances, as explained earlier.

Figure 11. Israel-Hamas War Situation Map.

To conclude, Euro-zone statistics are strong, employment data shows a strong Europe fully recovered from the pandemic shock, inflation statistics show a Europe nearing price stability given measures taken by the European Central Bank ( ECB ), Ms. Lagarde comments and decisions keep being macro-prudential, something that economists have welcomed along with the statistics, reflected in markets performance.

United Kingdom:

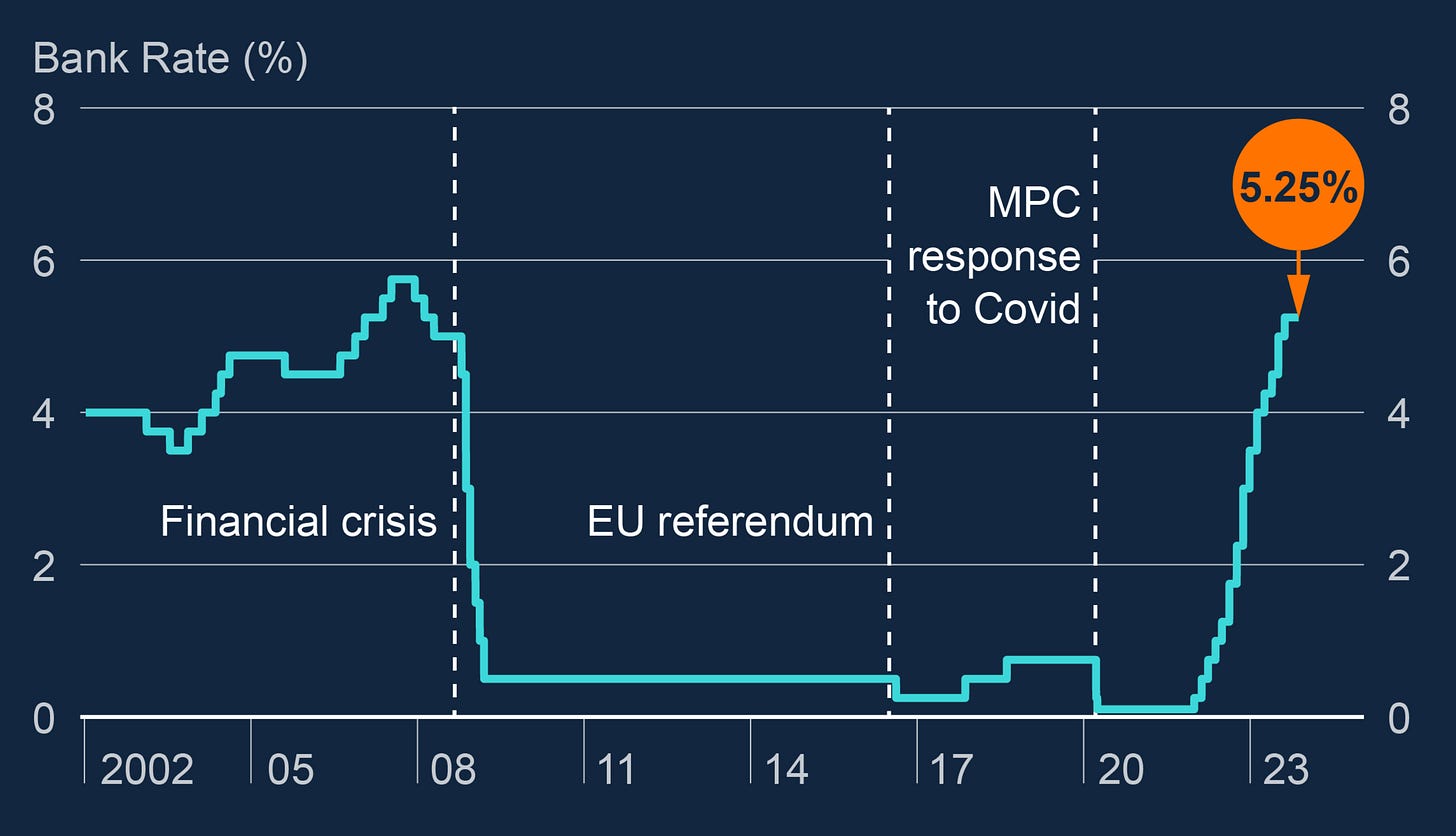

The United Kingdom's economy is performing as expected; fiscal and legislative policy measures taken by Prime Minister Rishi Sunak have and are ensuring stable growth in the United Kingdom; inflation statistics are trending better than Prime Minister Rishi Sunak's year-end expectations, which is good news. The Bank of England monetary policy measures are still ensuring that the price stability goals are achieved.

Figure 12. The Bank of England's Monetary Policy Committee ( MPC ) Pauses.

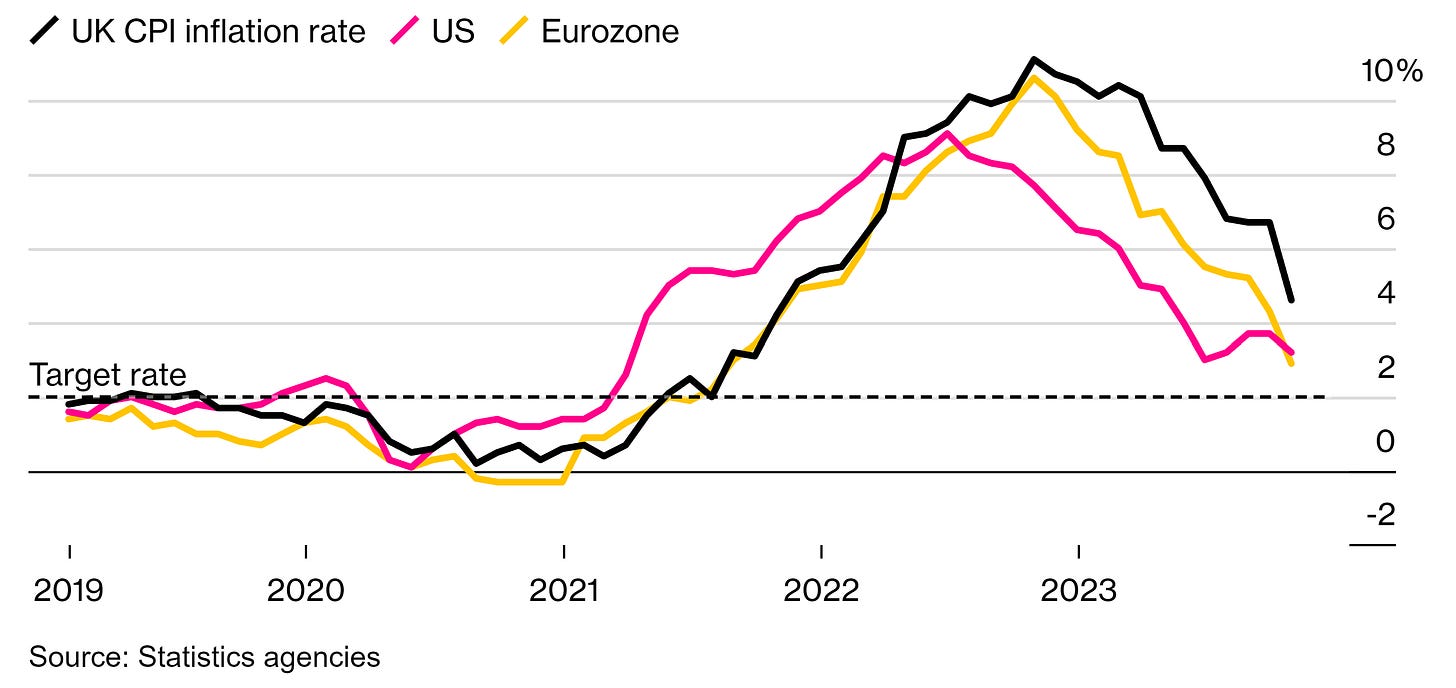

The United Kingdom's inflation is lagged compared to the United States and Europe; this can be seen in the next chart.

Figure 13. Consumer Price Inflation ( CPI ) In The United Kingdom Is Lagged Compared To Other Major Economies.

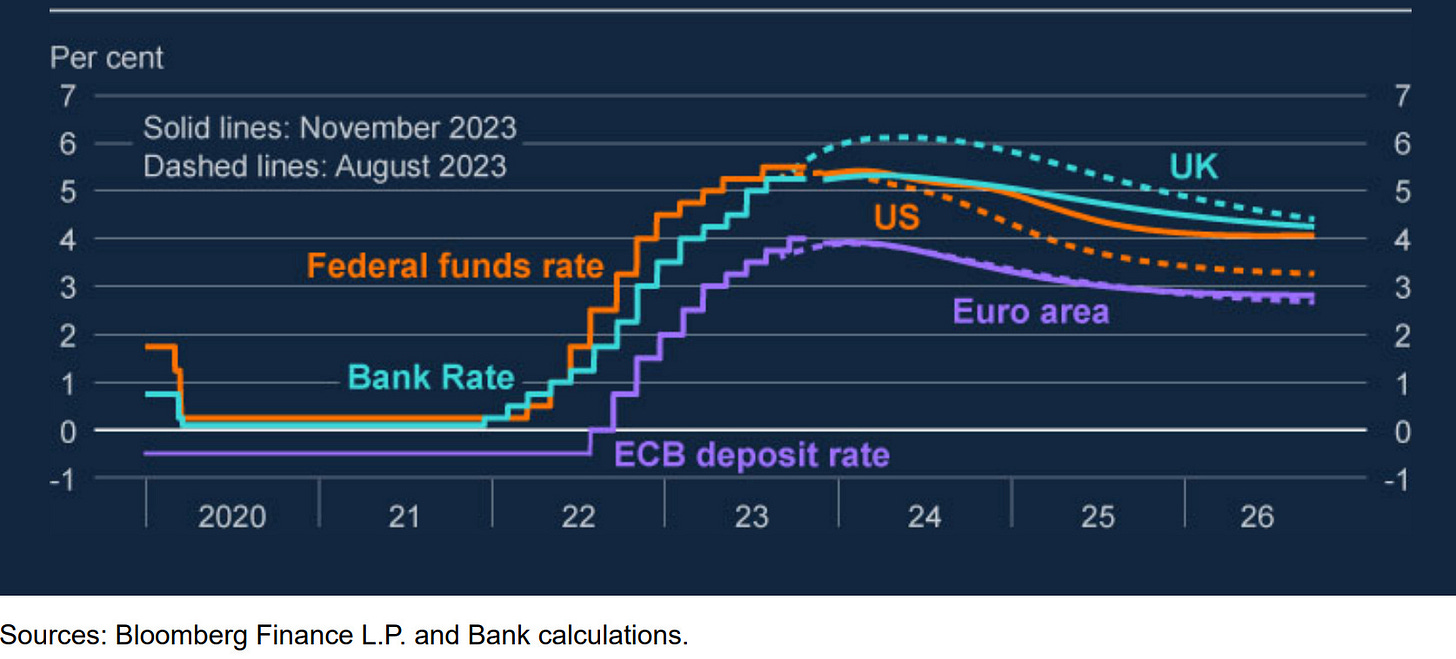

Deflationary pressures in the United Kingdom are at levels not seen in three decades, which is good news; there's still a long path until the Bank of England's monetary policy goals are achieved, but expectations are optimistic. The next chart shows what the Bank of England's Monetary Policy Committee members project over the rates.

Figure 14. Bank of England’s Monetary Policy Rate Projections.

To conclude, markets in the United Kingdom are far less dovish than in the Euro-zone and far less dovish than in the United States, markets seem to be betting on what the Bank of England's Monetary Policy Committee states in their press conferences; SONIA which is the United Kingdom's equivalent of SOFR is pricing rate cuts starting in April of next year, previously expected in June of next year; until then, rates are expected to be held at current levels.

Asia:

China:

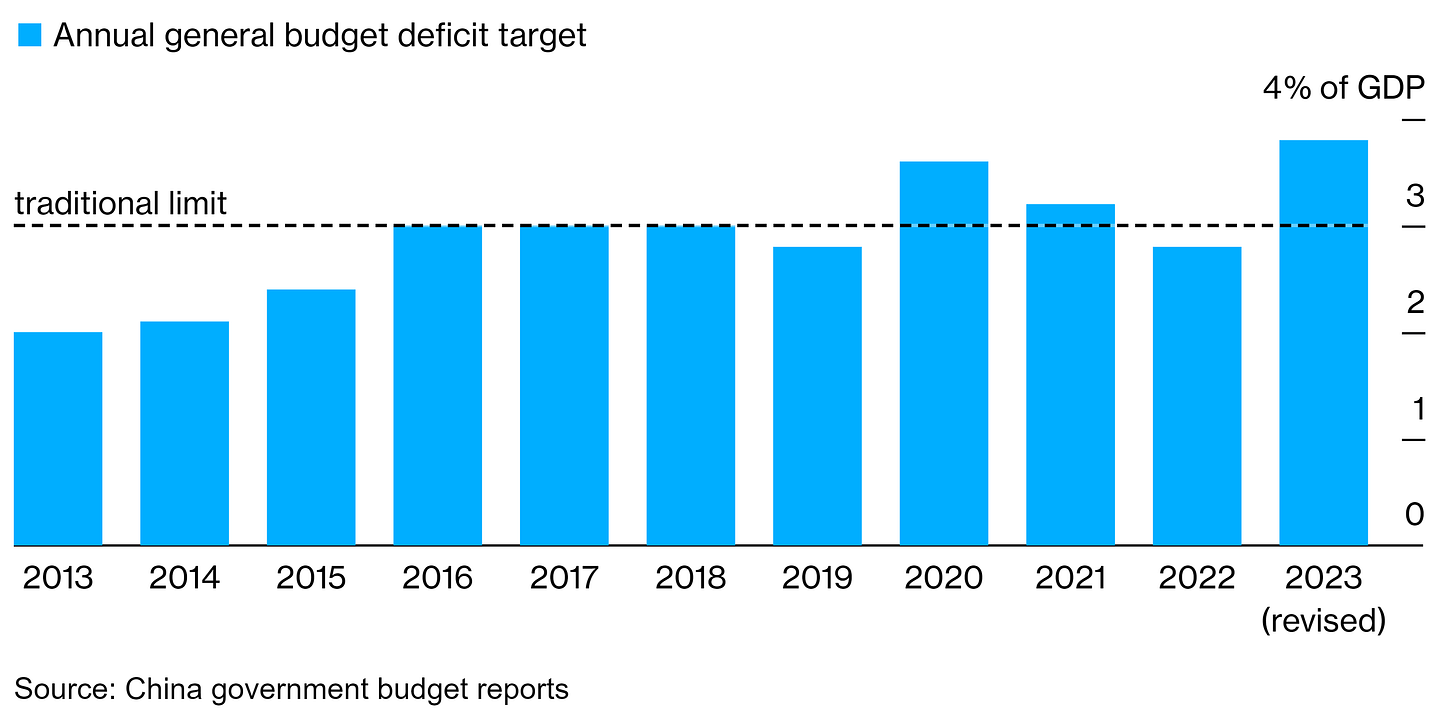

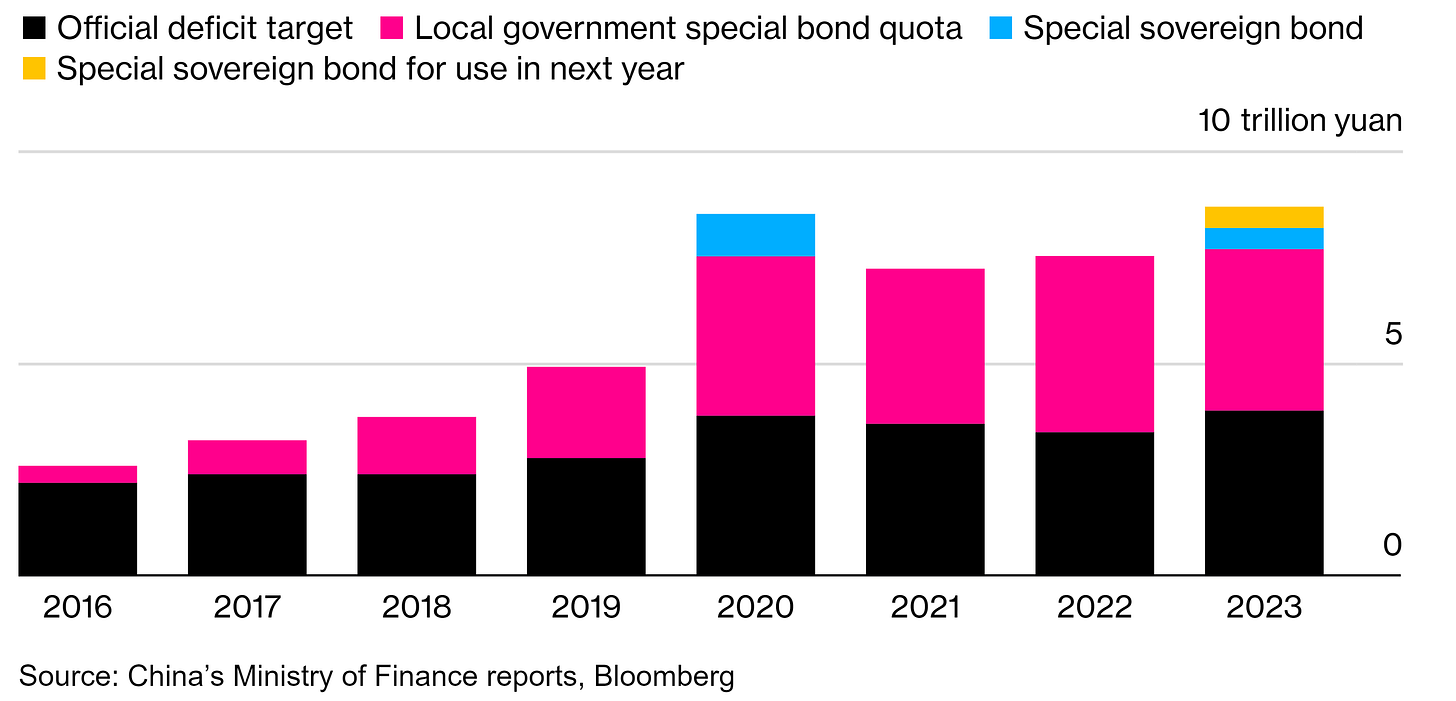

China's economy is performing within the range of expectations; fiscal and legislative policies taken by the government of the People's Republic of China are ensuring a strong and stable economy; the Chinese government exceeded the traditional annual general budget deficit target as of the percentage of the Gross Domestic Product ( GDP ), which is quite rare; the People's Republic of China's government bond issuance has reached levels not seen since 2020; the next two charts show the previously mentioned statistics ( the previously mentioned statistics: 1 , 2 ).

Figure 15. The Chinese Government Has Exceeded The 3% Traditional Annual General Budget Deficit Target.

Figure 16. The Chinese Government Bond Issuance Has Reached Levels Not Seen Since 2020.

The People's Bank of China's monetary policy measures are ensuring stability in the Chinese economy. Recent comments by the People's Bank of China's governor 潘功胜 suggested that the People's Bank of China will continue to support the Chinese economy with high confidence in “healthy and sustainable growth“.

China's youth employment rate is quite worrisome, which the Chinese government is trying to quantify as the situation is quite uncertain due to the fact that China stopped publishing statistics over it, 习近平's efforts towards promoting stability are quite remarkable, recent changes in China's growth ambitions shadowed the previously mentioned worrisome statistics over youth employment.

When it comes to geopolitics, expectations remain the same, it's quite remarkable that China has not yet liberated Taiwan from separatists, as it's theirs as recognized in the One China principle, although China has been having some conflicts with other countries in the Indo-Pacific waters.

Figure 17. China-Taiwan Political-Military Events Map.

To conclude, the recent United States §2670 bill ( Here you have the document if you want to read it ), will more than likely increase geopolitical tensions as it will increase military activity in the Indo-Pacific region.

Japan:

The Japanese economy may be facing recession if the Japanese government doesn't act appropriately, recent statistics show a weakening Japanese economy, with the Japanese Gross Domestic Product ( GDP ) contracting at the sharpest pace since the pandemic, although markets are betting on a hawkish monetary policy stance, which is contradictory.

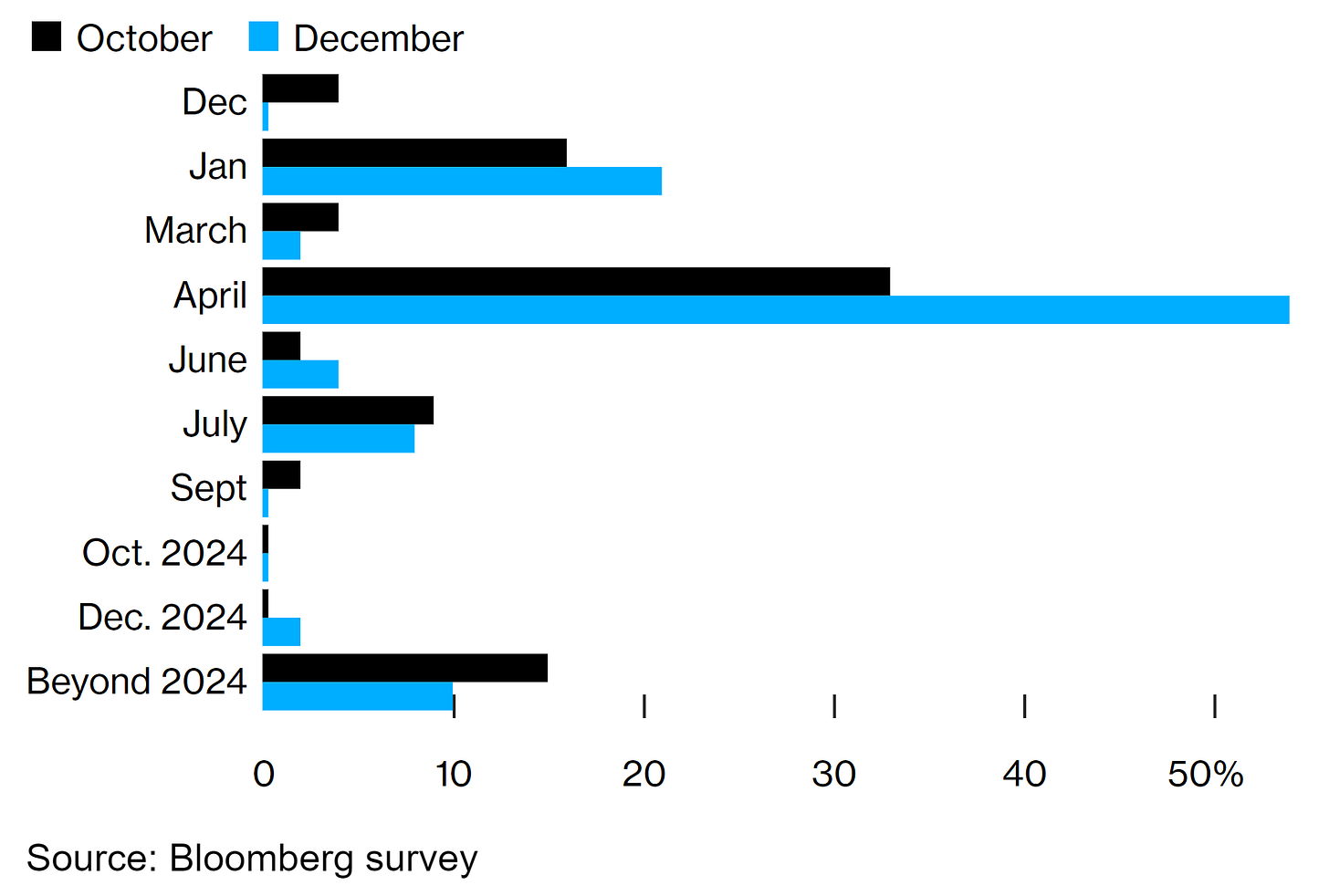

Figure 18. Market Expectations Over Bank of Japan Rate Hike In April Of 2024 Are Higher In December Than In October.

To conclude, markets are bearishly positioned on the Japanese Yen, with some market speculators boosting positioning to the most since April 2022. The Bank of Japan's Kazuo Ueda has two options: save the economy from recession or save the Japanese Yen, either decision will determine the forward performance of the Japanese economy, given the fact that statistics prove that Japan's Prime Minister Fumio Kishida's measures haven't had any effect.

Do feel free, as it’s free, to share, leave a comment, and subscribe to Quantuan Research Substack if you want, by using the next buttons.

It's not about the money (the research is free); it's about sending a message (delivering alpha to the reader).

Note: If the text in the post is grey (example) it is because the source of data is linked, everything is linked in the text so it’s not messy to add everything in the end like in some tweets.