Monetary Policy Pivot In A Complicated Scenario.

Analysis of microeconomic data, macroeconomic data, political data, geo-political data, and monetary policy with commentary on it.

United States:

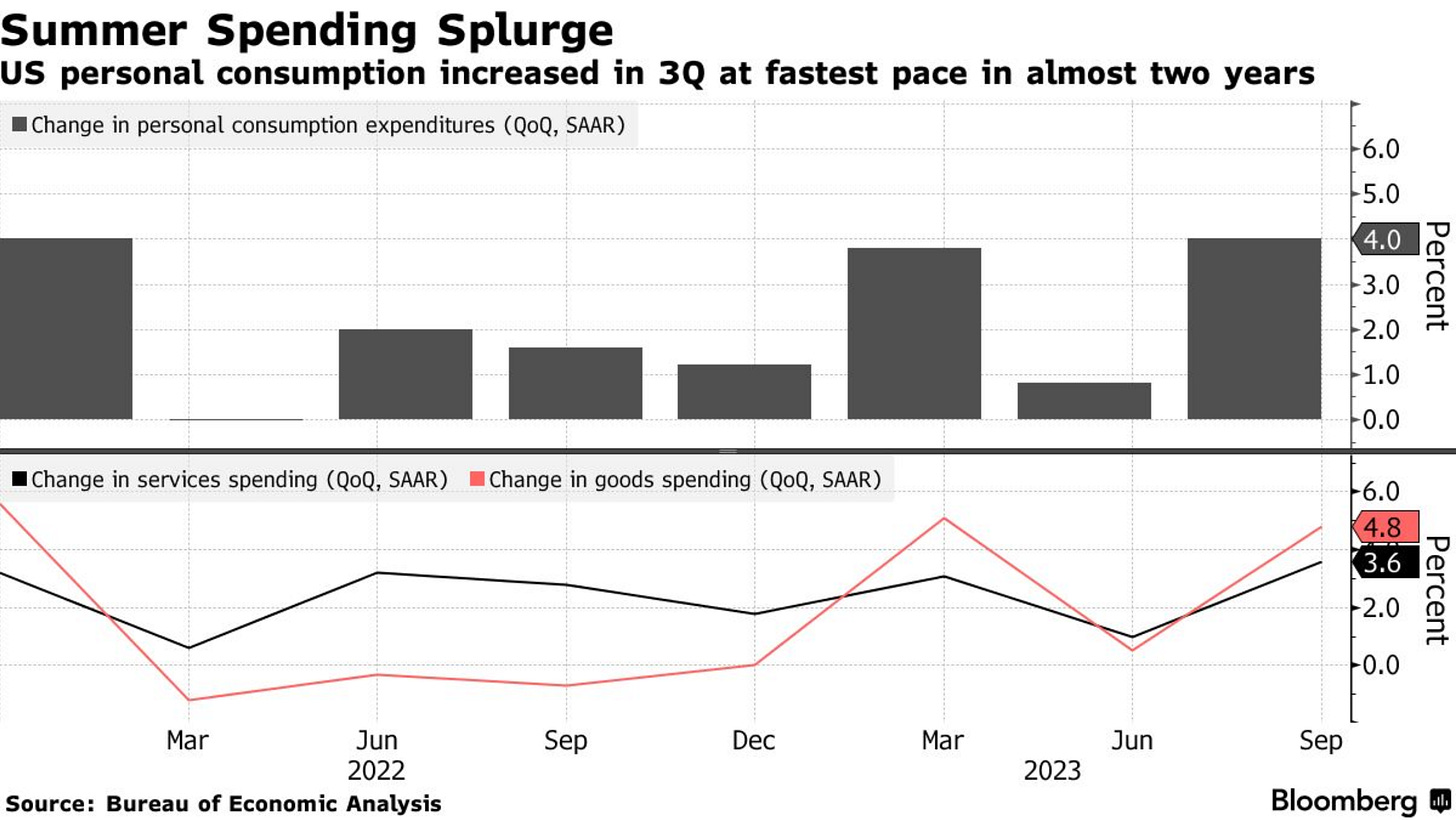

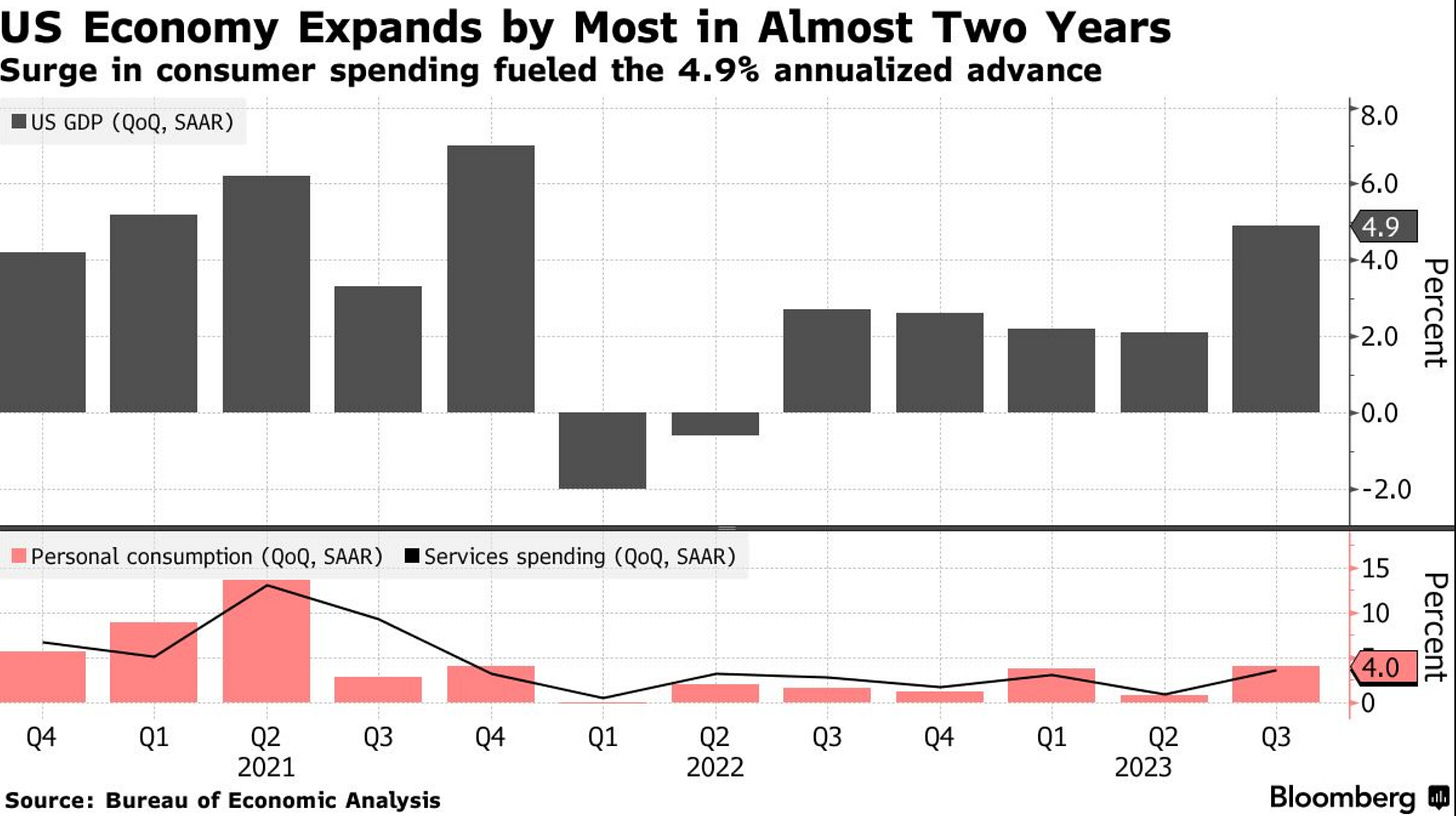

The United States economy is performing within the range of expectations; recent statistics proved to show Americans' resilience, with consumer spending increasing to its fastest pace in almost two years, as can be seen in the next chart.

Figure 1. Americans’ Spending Increases At The Fastest Pace In Almost Two Years.

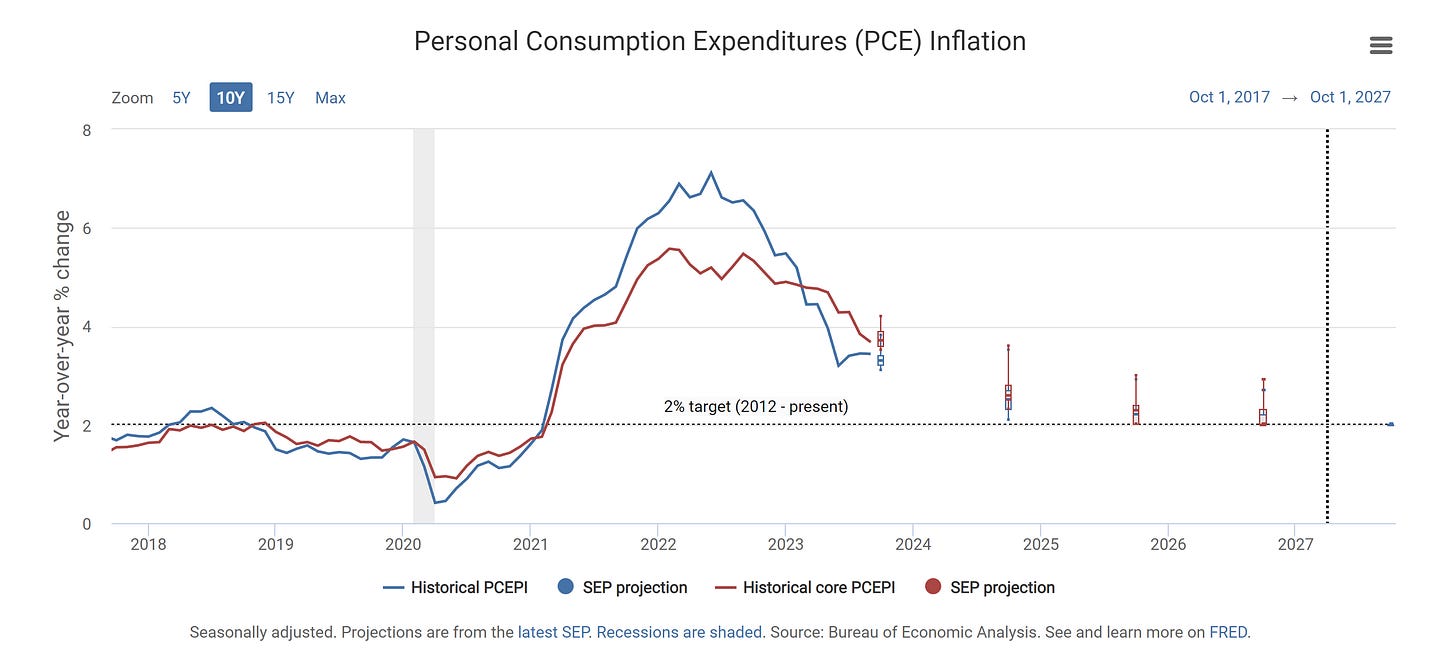

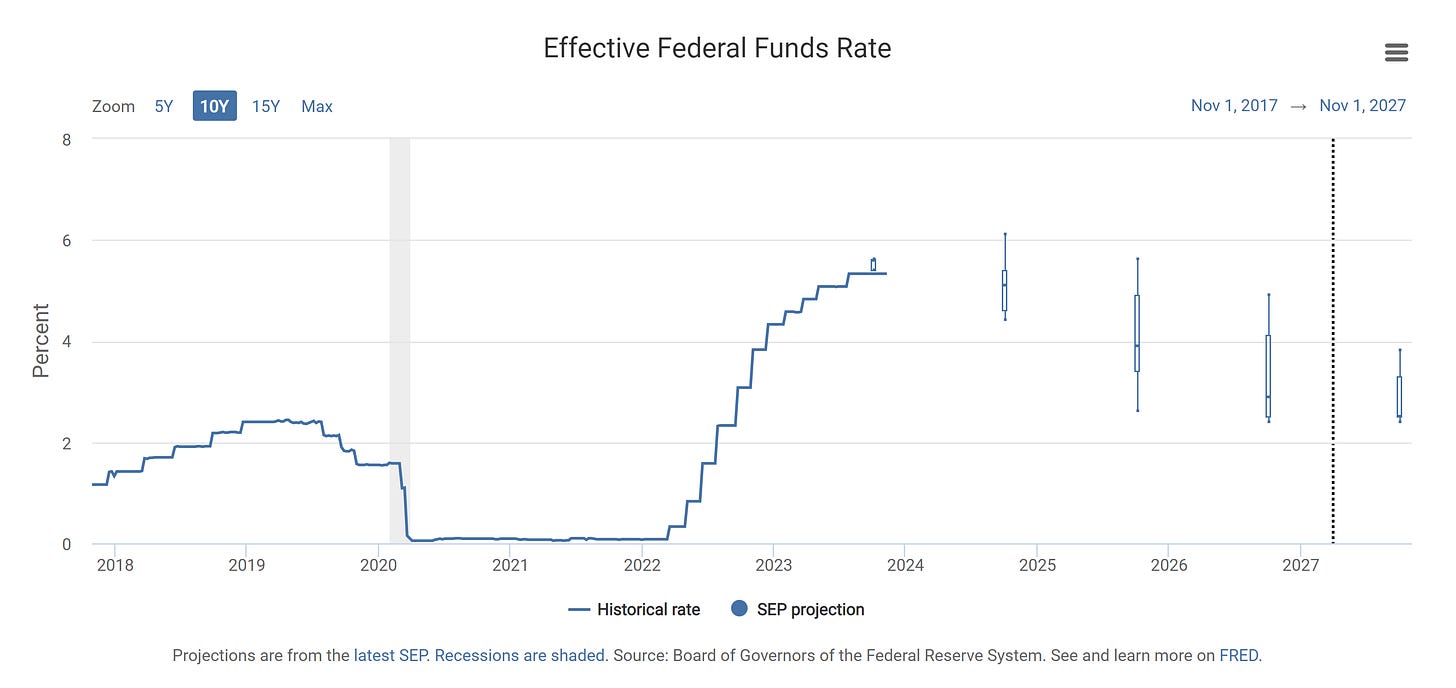

Inflation continues its expected trend; monetary policy shift indicated in recent statements by FOMC officials shows a dovish but nimble approach to forward developments, indicating a nimble-hawkish approach if necessary. The next two charts show FOMC officials’ projections over inflation and interest rates with data as of the latest Summary of Economic Projections (SEP).

Figure 2. FOMC officials’ PCE Inflation projections.

Figure 3. Effective Federal Funds Rate (Interest Rates) Projections by the FOMC.

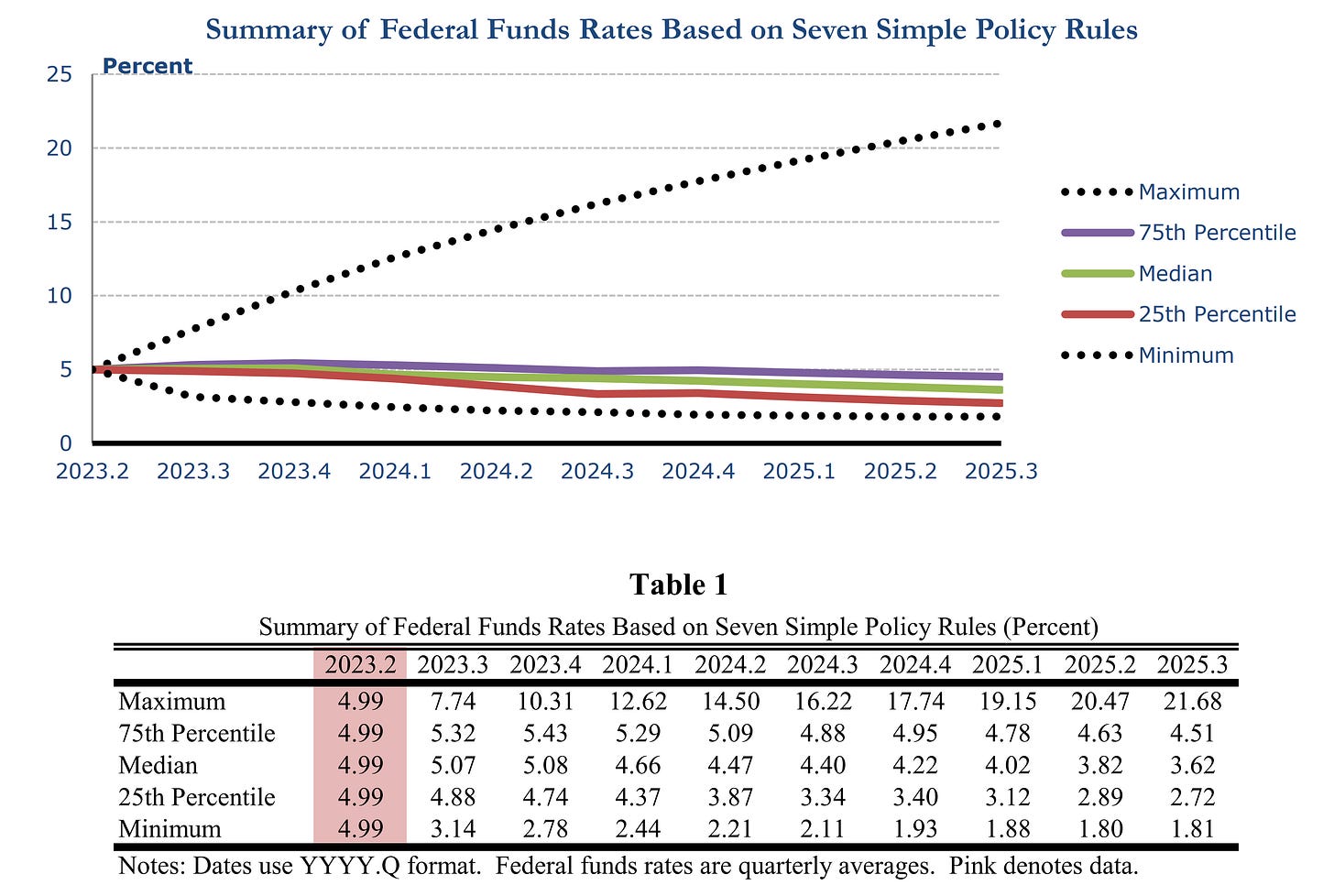

As shown before, interest rate forecasting models indicated that rates were nearing their peak rate. The next chart shows where interest rates should be using the Seven Simple Policy Rules.

Figure 4. Summary of Federal Funds Rates Based on Seven Simple Policy Rules.

Forecasts are in the range of FOMC officials' projections seen in the third figure. Although markets priced in drastic rate cuts into next year, unloading previously frontloaded monetary policy stances. This shift in and by markets is mostly driven by recession fears, although some top government officials remarked that most economists have phased out recession forecasts.

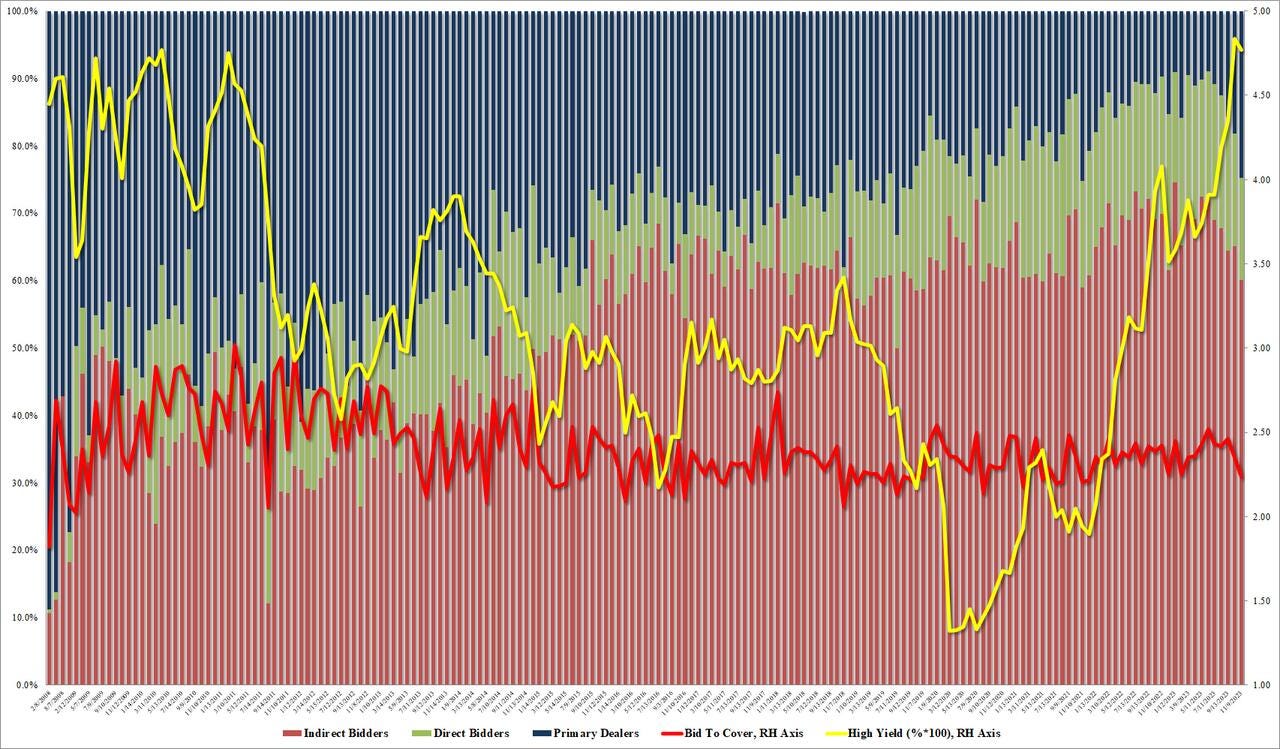

Recession fears vectored by the United States Treasury bonds (USTs) market turmoil are emerging. Recent months turmoil in the United States Treasury bond (USTs) market has proved to be intermittent rather than temporary, with recent statistics showing lower foreign demand and increased dealer award which isn't something good.

Figure 5. Big Warning Flag In The Latest 30Y Bidding Statistics.

The constant foreign countries' selling of United States Treasury bonds (USTs) proves to differ forward expectations over the United States Treasury bond (USTs) market, whose performance after a monetary policy pivot is always to the upside. Recent comments by Janet Yellen after her meeting with China's 何立峰 momentarily made the United States Treasury bond (USTs) market rally, but statistics proved to show the continued selling trend by China; consequently, the market reaction was volatile.

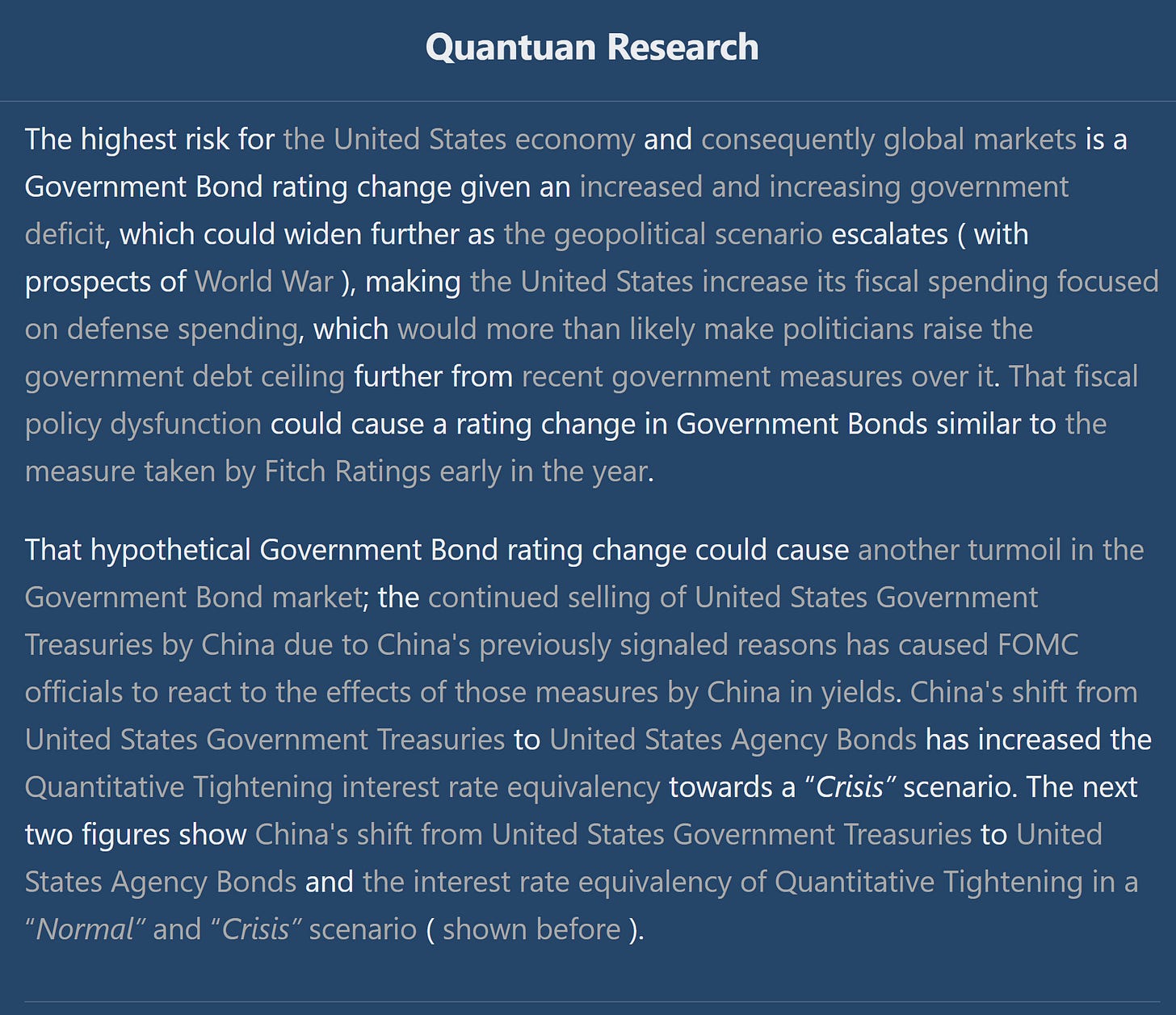

One of the highest risks mentioned in the last post has materialized; the United States government has been downgraded for the second time this year, this time by Moody’s, previous government downgrade was made by Fitch Ratings, which increases volatility in the United States Treasury bond (USTs) market.

Figure 6. Government Downgrade Risk Has Materialized.

The good thing is that after that government downgrade, there is one black swan less to worry about, but the bad thing is that the rest of the black swans on the lists are government shutdown and consequently recession. Although recent data suggested that government shutdown risks remain contained by yet another temporary government measure.

Exponential government spending with a widened deficit has made the government's interest payments relative to the Gross Domestic Product at levels not seen since the late 1980s. Although the Gross Domestic Product keeps increasing, as can be seen in the next chart, those increases are debt-fueled, which shadows that economic growth.

Figure 7. The United States Economy Grew At The Fastest Pace In Nearly Two Years.

The geopolitical scenario remains the same, and so do forward expectations; market spillovers from geopolitics remain contained, although United States Treasury bond (USTs) market turmoil risks remain something that could cause more volatility in markets than geopolitics. Folks, not much has changed since the last post; therefore, expectations remain the same, and so does how to hedge the current scenario.

Europe:

The Euro Area is performing within the range of expectations. Inflation statistics in Europe are trending in the expected range, showing deflation at a fast pace, which proves that the European Central Bank's monetary policy measures have worked.

Forward monetary policy expectations remain the same as Euro Area macroeconomic data performs as expected. Some European countries should enhance fiscal policy guidance towards ensuring that they don't enter into a recession.

Consumer inflation expectations have risen, which is something that the European Central Bank should address. Some European Central Bank officials have suggested that there may be more rate hikes, but this remains unclear as European inflation nears the European Central Bank's 2% target.

European countries measures towards ensuring key commodity supply from Norway have and keep ensuring stability in the Euro Area; that key supply of energy sector commodities to the Euro Area has reduced supply and demand-driven price pressures, which have helped the European Central Bank address inflationary pressures more accurately.

With Euro Area unemployment rates at record lows and inflation nearing the European Central Bank's 2% target, Europe is strong; hence, the Euro should get to the 1.1 level by the end of Q2 of next year. Euro Area Government Granted Bonds have upside, but high uncertainty over European governments' fiscal policy guidance fogs expectations, but deflation offsets uncertainty given the consequent currency valuation enhancement.

United Kingdom:

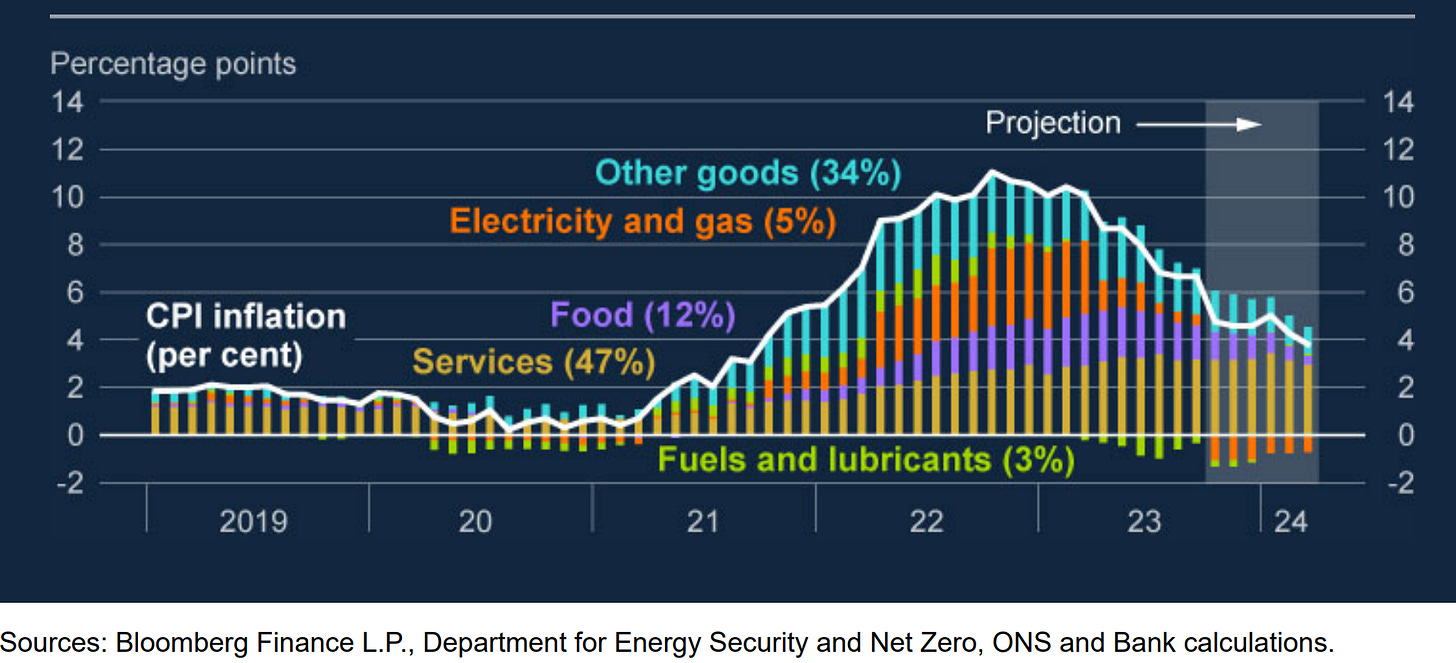

The United Kingdom's economy is performing within the range of expectations, but Brexit is still generating problems for the United Kingdom's economy, although lower inflationary pressures have helped to offset recent statistics.

Figure 8. Bank of England’s Consumer Price Inflation Projections.

Recession risks in the United Kingdom remain contained by Prime Minister Rishi Sunak's fiscal and legislative policy measures that ensure that the United Kingdom's economy doesn't enter into a recession. Spillovers from the United States Treasury bond (USTs) market turmoil are something to which the Bank of England should be attentive in the United Kingdom's Gilt market.

The Bank of England's monetary policy measures have ensured and will continue to ensure price stability in the United Kingdom. Recent inflation statistics show inflation trending better than Prime Minister Rishi Sunak's year-end target, but inflation remains higher than the Bank of England's 2% target; therefore, expectations remain the same.

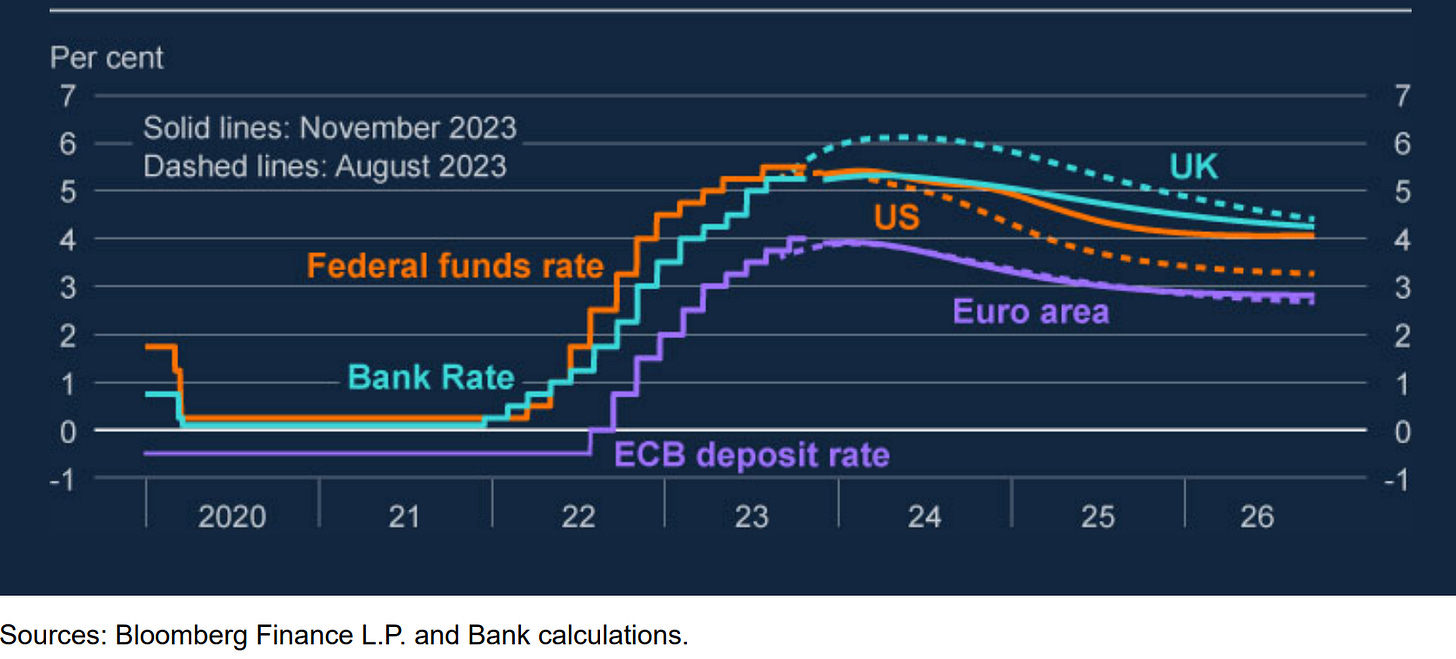

Figure 9. Bank of England’s Monetary Policy Rate Projections.

Recent comments by some of the Bank of England's Monetary Policy Committee suggest that monetary policy may have shifted but hasn't signaled a forward rate path. How to hedge the current scenario remains the same, although Gilt market sentiment is more bullish given recent statistics showing the United Kingdom's inflation trending better than Prime Minister Rishi Sunak's year-end target.

Asia:

China:

China's economy is performing within the range of expectations. 习近平's government’s fiscal policy and legislative measures are ensuring that China doesn't enter into a recession. Which has made the International Monetary Fund increase China's growth forecast.

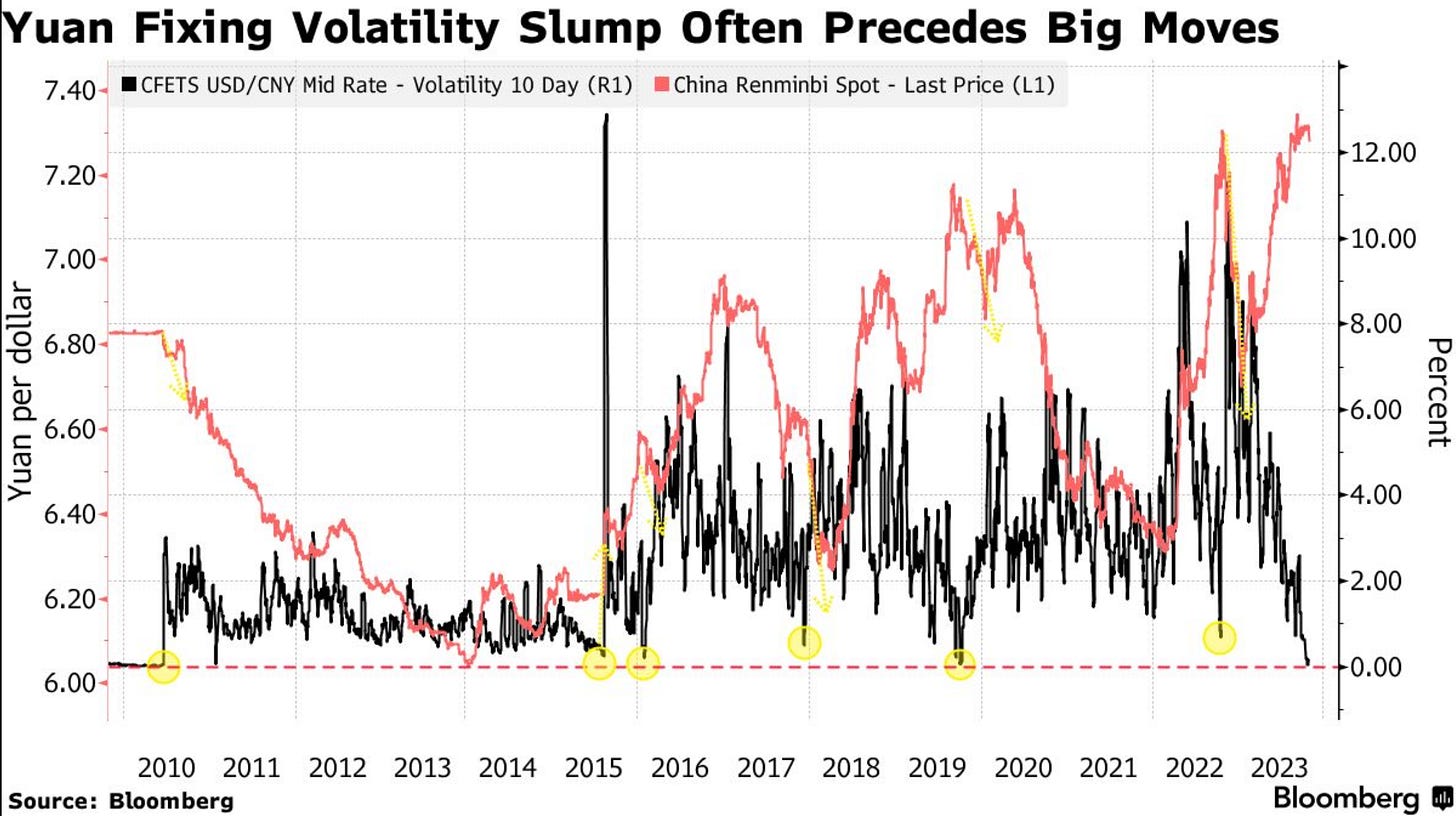

The People's Bank of China's monetary policy measures, led by governor 潘功胜 keep the government's measures stable through open market measures while ensuring stability in the Chinese Yuan. Something to point out is that Yuan fixing volatility has reached levels not seen since 2010, which often precedes big movements in markets, as can be seen in the next chart.

Figure 10. Chinese Yuan Fixing Volatility Has Reached Levels Not Seen Since 2010.

Given the forward expectations based on previously seen movements in the Chinese Yuan when fixing volatility reaches levels similar to current ones, it's appropriate to lean towards bullish positioning in the Chinese Yuan.

Japan:

The Japanese economy is performing within the range of expectations, and Prime Minister Fumio's fiscal policy measures will more than likely increase inflationary pressures in the Japanese economy, setting long-term risks for Japanese economic growth and stability.

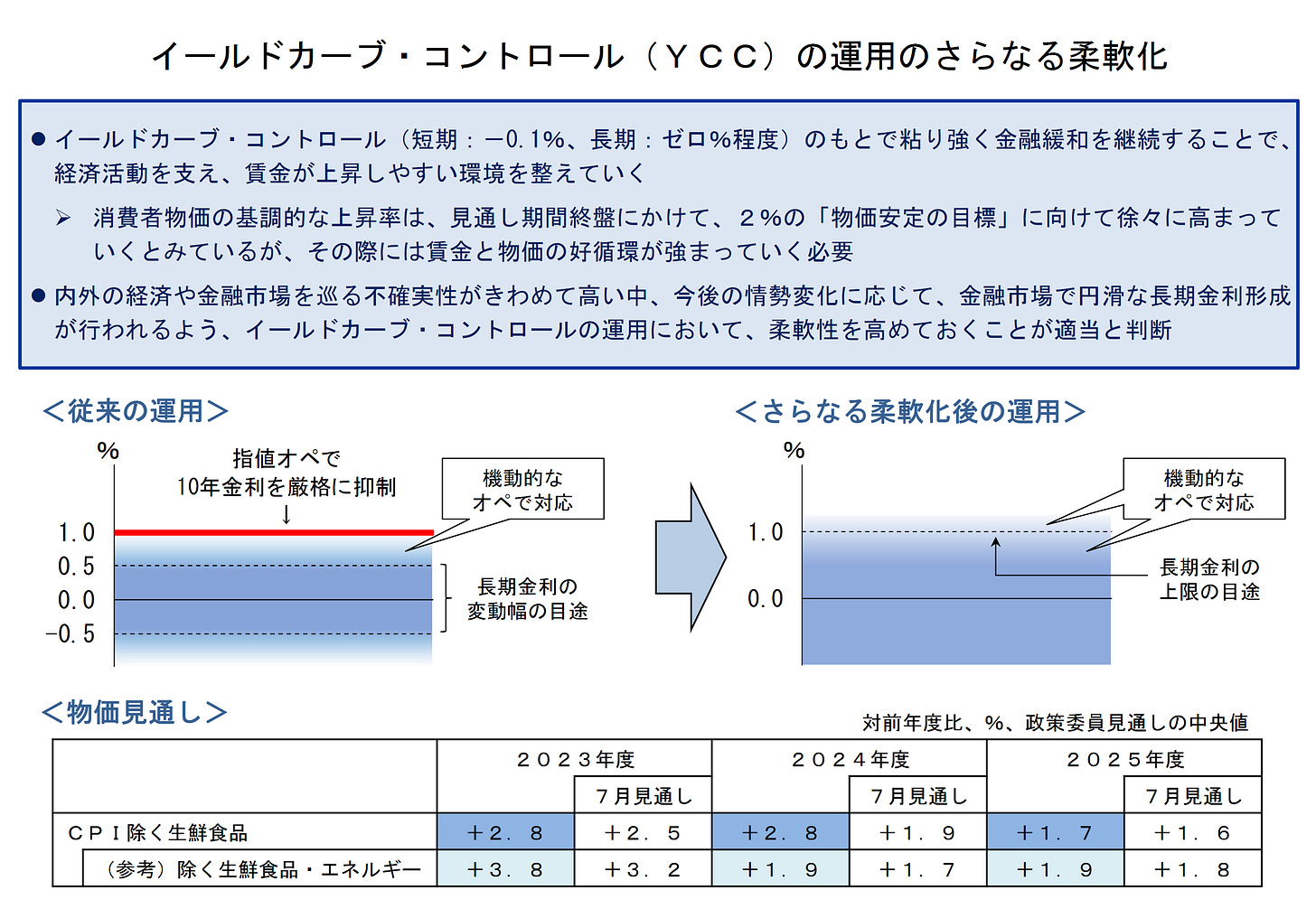

Recent comments by Bank of Japan governors indicated that the Bank of Japan may be existing the negative rate environment. Which is unlikely given the government's fiscal policy measures that prevent monetary policy from changing its stance.

Inflation in Japan is keeping its trend showing deflation, although forward expectations are towards reflation given government measures. In dollar terms, the Japanese Yen devaluation makes Japanese inflation higher, as consumers' spending in dollar terms is affected to the point that some goods prices in global trade increase by five to six percent in Yen terms.

Recent changes by the Bank of Japan set further pressure on the Japanese Yen and Japanese Government Bond market.

Figure 11. Bank of Japan Changes The Yield Curve Control Upper Band.

Even though the Japanese Yen has devalued toward the intervention zone, which is above 150 yen per dollar, Japanese markets remain cheap in dollar terms.

Do feel free, as it’s free, to share, leave a comment, and subscribe to Quantuan Research Substack if you want, by using the next buttons.

It's not about the money (the research is free); it's about sending a message (delivering alpha to the reader).