The current view.

Analysis and forecast of microeconomic data, macroeconomic data, political data, geo-political data and monetary policy with commentary on it, with the data of how to hedge the current scenario.

United States:

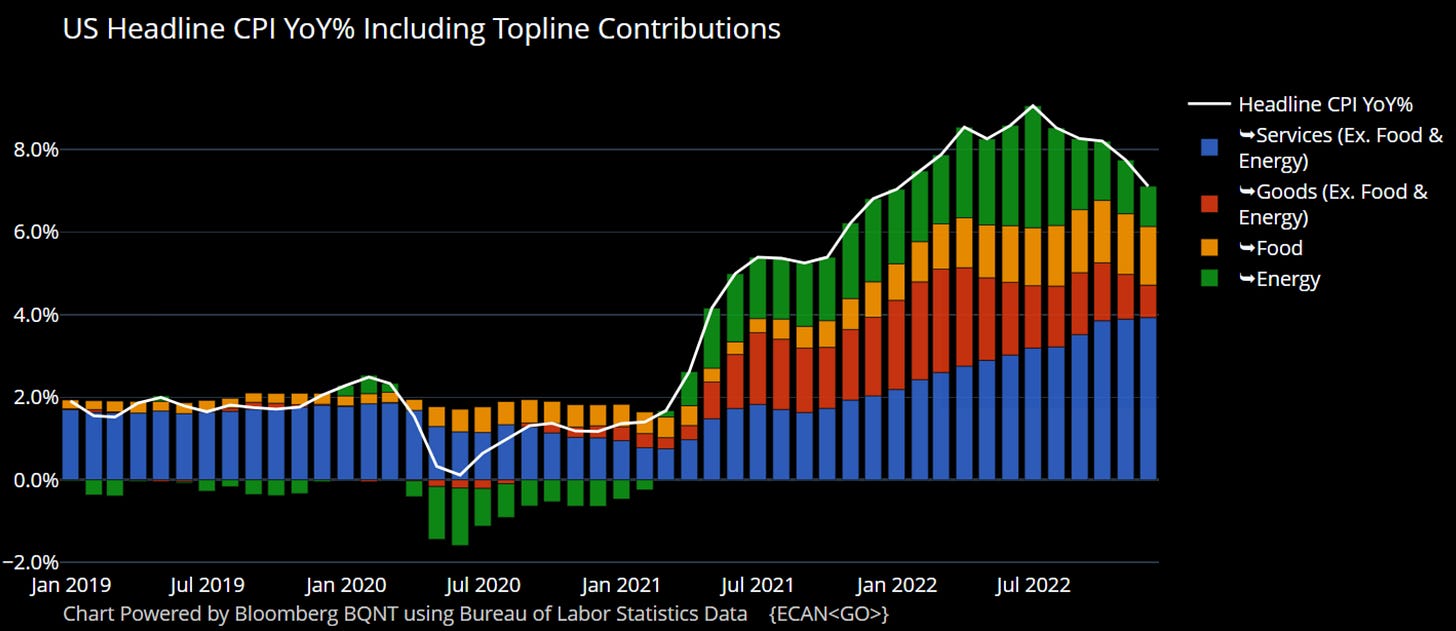

The United States economy is experiencing a disinflationary environment attached to energy prices, which account for a significant portion of inflation measurements either directly or indirectly to consumer and producer inflation indexes. The inflation in food and goods excluding food and energy was slowing in a laggard way given the monetary policy measures which was expected.

Figure 1. United States Consumer Price Index, Year over Year change. Including Topline Contributions.

The Biden Administration has done everything but ensure electric grid security by not temporarily increasing or at least maintaining production of fuels in demand by consumers in the United States until at least the fuels are replaced by sustainable sources. The measures taken by the Biden Administration Department of Energy over fuel prices, do reduce energy prices but in the short term and increases them in the long term, as supply from domestic production is low and government legislative actions reduce production.

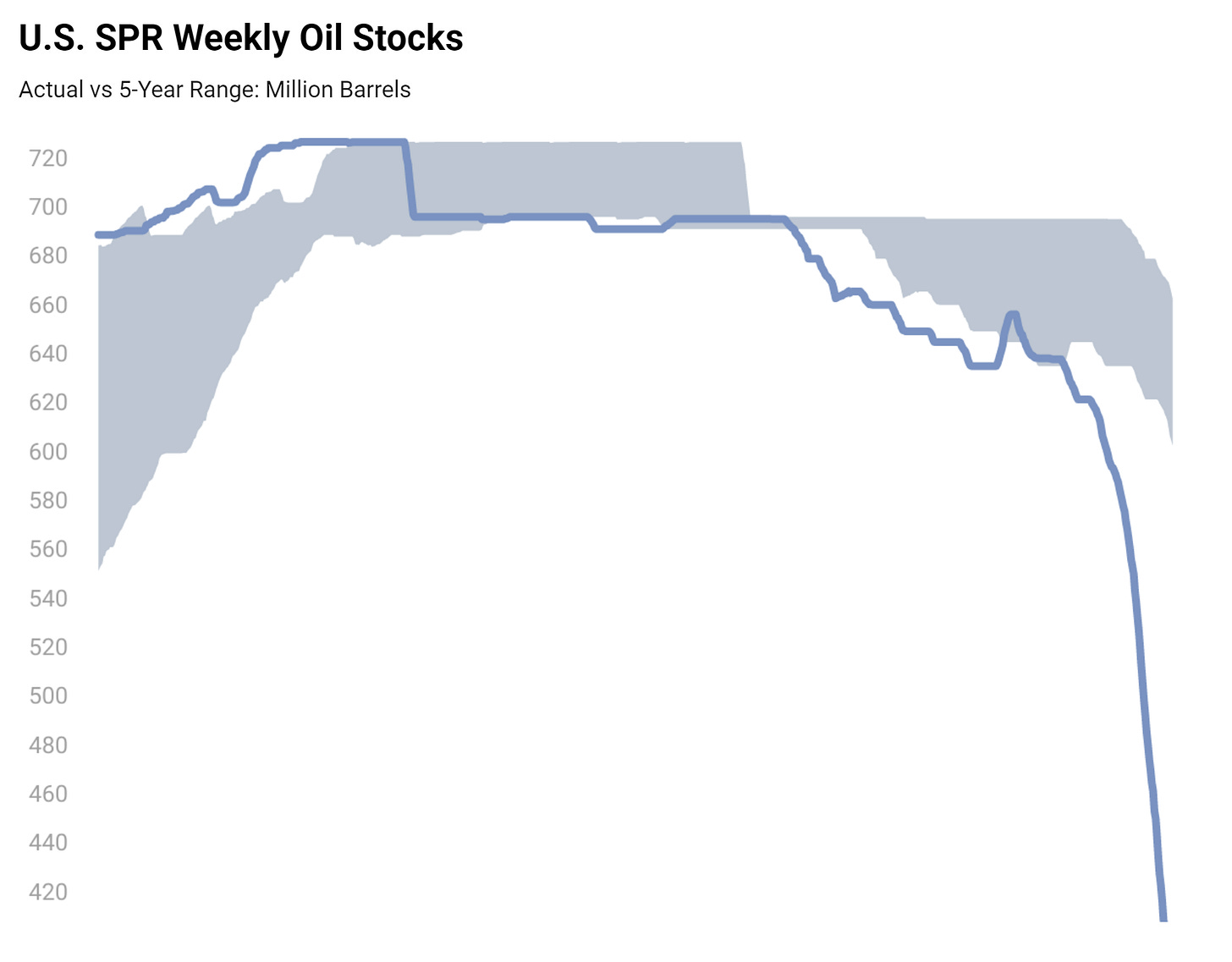

Figure 2. United States Strategic Petroleum Reserve (SPR) Weekly Oil Stocks.

The Organization of the Petroleum Exporting Countries Plus (OPEC+) will likely reduce output in order to reduce market volatility, while the United States uses the Strategic Petroleum Reserve to enhance volatility, i.e., reduce energy prices in the short term through the use of the Strategic Petroleum Reserve releases and refillings.

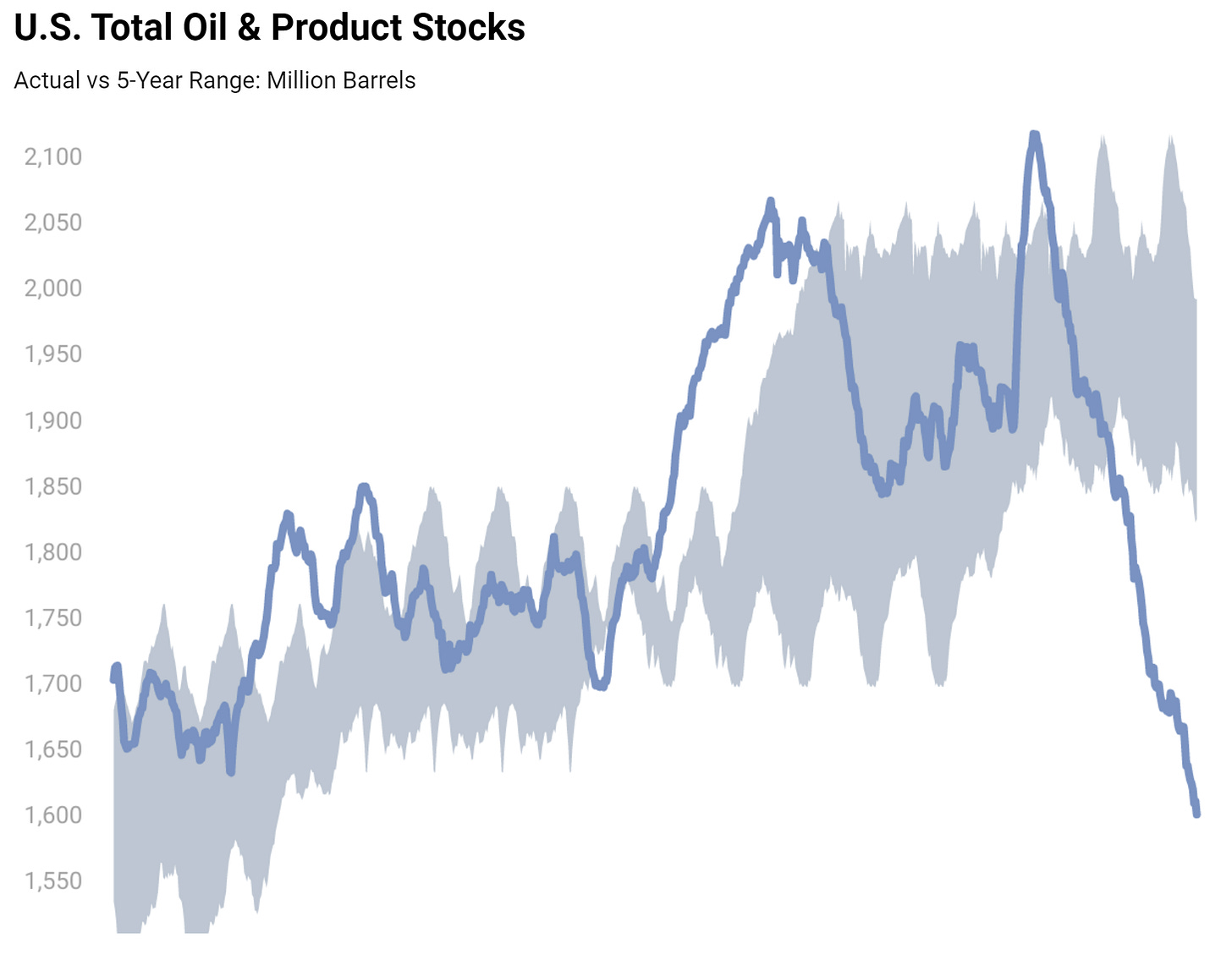

Figure 3. United States Total Oil and Products Stocks.

The fact that energy is an essential base consumption for both consumers and producers of goods, drives up the prices as demand doesn't decrease even with rate hike increases.

Many of the reasons behind the Biden Administration's measures over the Strategic Petroleum Reserve and fuel production decreases through legislative actions are made with a good heart but aren’t realistic. The Biden Administration should temporarily increase domestic production of liquid fuels in demand by the consumer instead of using the Strategic Petroleum Reserve, until oil and gas consumption by the consumer is replaced with sustainable sources of energy.

The current disinflation environment is similar to that of the 1980s; however, monetary policy can't help to lower forward supply-side inflationary pressures, as monetary policy can only help to lower demand-side inflationary pressures through interest rate increases until supply and demand equilibrate.

In sum, all of this will cause a supply and demand disequilibrium that will cause reflation in energy prices in the long run until or unless domestic production of those goods increases. Which is the main reason why the supply-side inflation risks are to the upside in the United States. Overall, the United States economy remains above Americans’ expectations, and the job market data remains strong, as reflected in the statistics, despite mass layoffs not only in the tech sector.

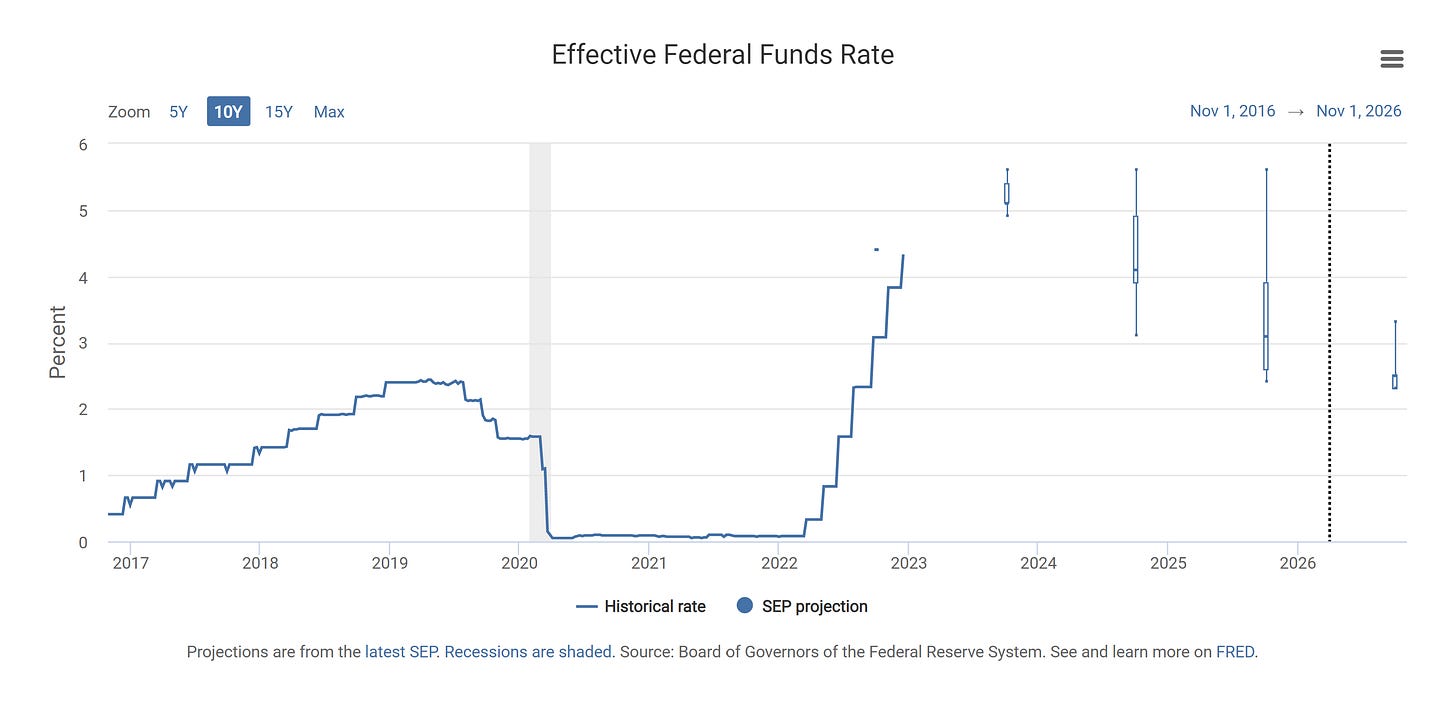

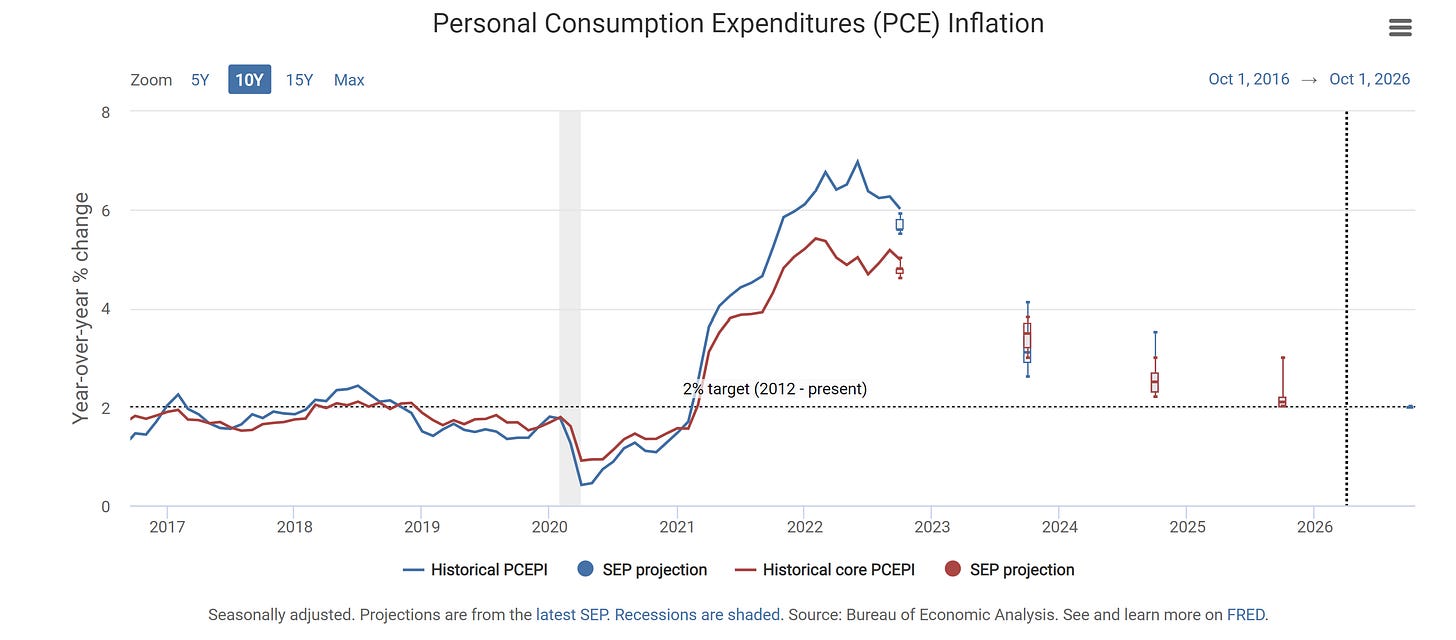

The Federal Reserve’s interest rate decision towards an increase of 50 basis points was expected, given previously shown data showed a decline in Personal Consumption Expenditures (PCE) import and export prices and a strong job market that allows a hawkish but nimble stance, as expected. Jerome Powell's remarks were coherent and in line with already-given data in other FOMC officials' speeches that signaled that 75 basis point hikes were off the table and that the terminal rate is above market expectations.

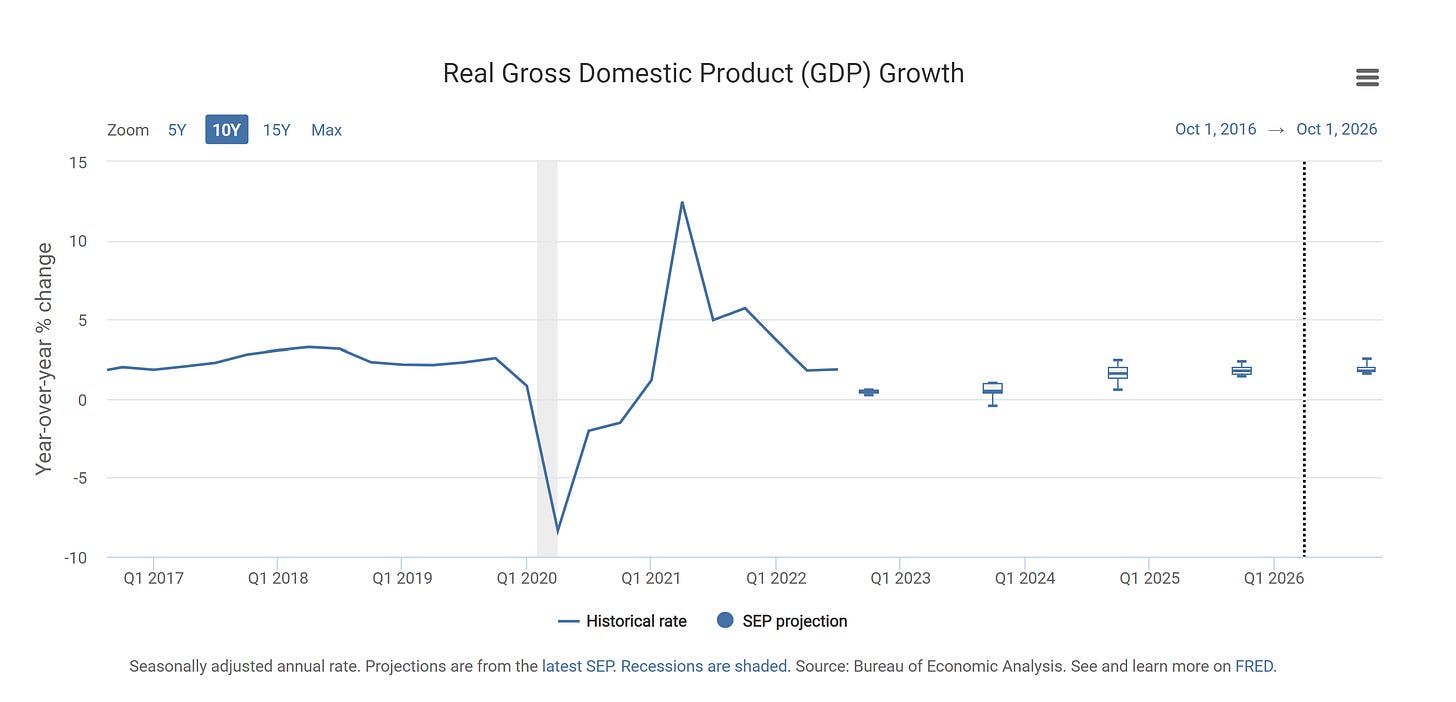

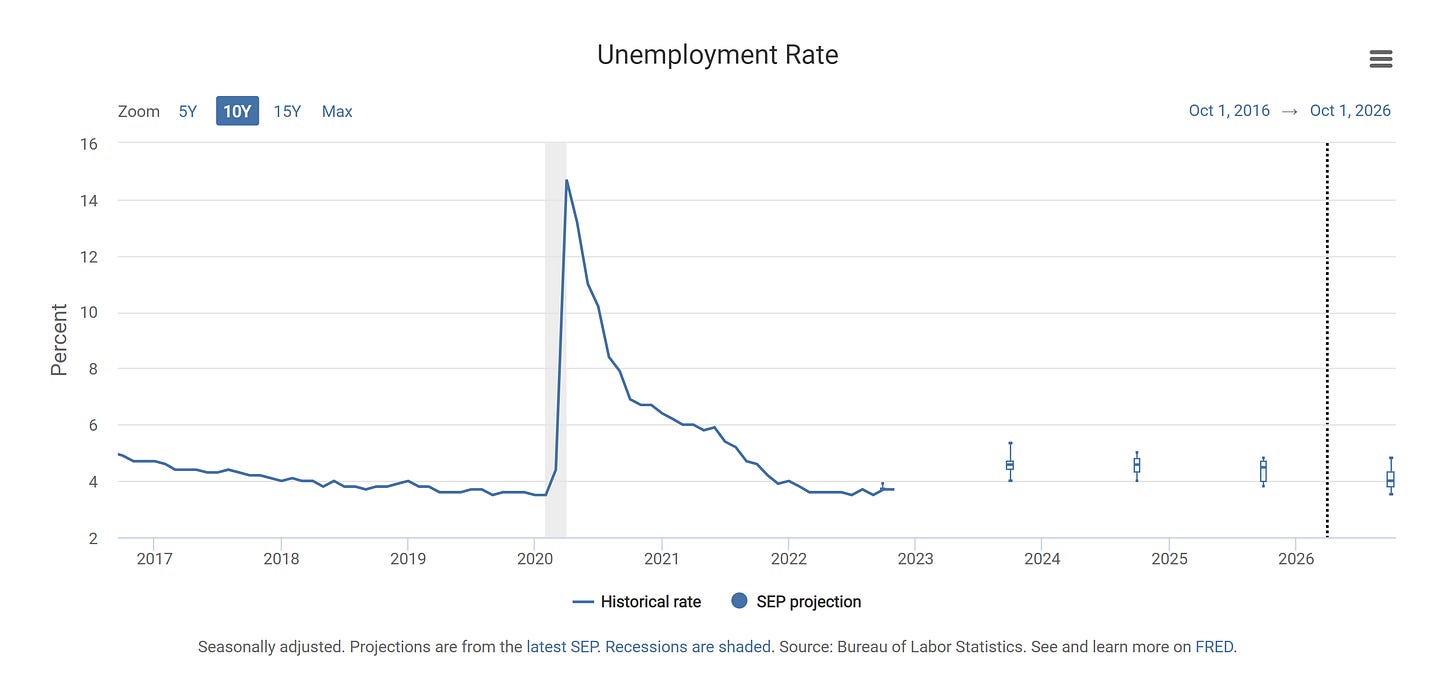

FOMC macroeconomic projections are logical and coherent, in the range of market expectations when it comes to Gross Domestic Product (GDP) growth and unemployment rate projections, the market is underpricing the forward interest rate hikes. No rate cuts are expected until 2024; instead, higher rates for a longer period of time than market expectations.

Figure 4. Effective Federal Funds Rate Projections by the FOMC

Figure 5. Personal Consumption Expenditures (PCE) Inflation Projections by the FOMC

Figure 6. Real Gross Domestic Product (GDP) Growth Projections by the FOMC

Figure 7. Unemployment Rate Projections by the FOMC

The logical view of the current scenario remains nearly unchanged. What has changed from the previous logical view is the supply-side inflation forecast, as there are more legislative measures that generate more supply-side inflationary pressures, there are more supply-side inflation expectations. When it comes to reducing supply-side inflationary pressures, the only factors that have helped reduce price pressures are a strong dollar which has enhanced competitiveness in global trade lowering imports and export prices and an improving supply-chain status which has enhanced supply of goods.

Europe:

The European inflation has been reduced as a result of the ECB's actions to reduce persistent demand-side inflationary pressures through increases in the interest rates, as data shows in the European inflation statistics.

It’s welcome that the ECB has signaled the start of the Quantitative Tightening, this enhances the long term value of European Government Granted Bonds. Inflation risks in Europe are far more widespread than in the United States, as many European countries rely more than 50% on Russian natural gas to have energy. As explained before in this post, energy is the main source/vector of inflation risks to the upside, the same way that it is in the United States.

Overall, the unemployment rate in Europe is at 6.5%, which is a new historic low since the series began in 1998 and is consistent with rising nominal wages. Which inflation is still a barrier for consumers and producers as it is reflected in the consumer and producer price indexes, and thus higher interest rates are expected in order to reduce demand-side inflationary pressures.

The ECB's interest rate decision to raise interest rates by 50 basis points was expected, and further rate hikes are required to reduce demand-side inflationary pressures as long as demand-side inflationary pressures persist and until inflation gets back to the 2% target. What is expected is a 5% peak rate, what the ECB has signaled is a 3.2% peak rate, 2.9% peak rate is the market is betting.

United Kingdom:

The United Kingdom economy is behaving in the range of expectations, as inflation lowers given PM Rishi Sunak legislative and fiscal policy measures that are lowering supply and demand side inflationary pressures, allowing the Bank of England to have a more clear path towards reducing demand-side inflationary pressures through monetary policy, which is reflected in the United Kingdom Gross Domestic Product (GDP) data and the fiscal and legislative prudence and Bank of England’s monetary policy guidance has enhanced the United Kingdom Government Granted Bonds.

The Bank of England Monetary Policy Committee’s macroeconomic projections from November were coherent, as mentioned before and the December changes in the projections in the Monetary Policy Committee (MPC) Minutes proved to show that the Bank of England Monetary Policy Committee (MPC) is aware of the changes in the macroeconomic data.

The outlook over the UK economy remains the same. Further rate hikes are expected, peak rate of 5%, Market Participants Survey (MaPS) median peak rate expectations is at 4¼% (Source of the Market Participants Survey (MaPS) peak rate expectations Page 8).

Asia:

China:

China’s economy is behaving in the range of expectations, the reopening of the Chinese economy through changes in the coronavirus measures has increased the forward Gross Domestic Product (GDP) forecast and has also enhanced the value of China’s Government Granted Bonds. The People's Bank of China (PBoC) monetary policy stance keeps being the same as inflation is below the People's Bank of China (PBoC) 3% inflation target. The Chinese government measures towards enhancing infrastructure has increased the attention of the world, as China is reopening the economy.

Japan:

Japan’s inflation is overheated, the Japanese Yen devaluation is the main source of price increases, which are given by the Bank of Japan's Modern Monetary Theory and Quantitative Easing. Japan’s government $200bn spending package to fight inflation will generate more inflation and because Japan produces few goods, there are supply-side inflationary pressures as a result, as well as demand-side inflationary pressures as a result of the Bank of Japan's Modern Monetary Theory and Quantitative Easing.

The outlook and forecast remain the same. As mentioned before, the Bank of Japan has two paths, either hyperinflation or deflation, and Japan has chosen hyperinflation, given the measures taken by both the government and the Bank of Japan. Prudent fiscal and legislative policies have to be implemented in order to enhance the value of the Japanese currency and the Japanese Government Granted Bonds, until then inflation risks are to the upside.

Explanation of how to hedge the current scenario:

The current Geo-Political Risks (GPRs) such as World War with high probability of starting in the first quarter of 2023, have increased from the previous data, the only way to hedge this is by protecting from risks that are adhered to it, such as supply shocks that cause volatile spikes in prices. I.e., a defensive hedge.

Given the government's legislative actions in the United States and Europe, the inflation risks are to the upside on non-core inflation prices in the long term, while forecasts and expectations in the short term of non-core inflation are to the downside as energy price disinflation is in place given the United States Department of Energy strategic measures on and over the open market through and by the use of the Strategic Petroleum Reserve and given the G7 oil and gas price cap.

Overall import and export prices and Personal Consumption Expenditures data reflect that the monetary policy tightening path is working and that global trade competitiveness between countries has risen as a result of some currencies' strength variations, as explained before, which is also reflected on the consumer and producer price indexes. This is what has enhanced the value of Government Granted Bonds, inflation is far from over as it remains above the 2% inflation target; expectations over the rate hikes remain the same; all of this data points to the achievement of a soft landing.

Governments' fiscal policies in the United Kingdom and some European countries have been guided in the correct manner, which has enhanced United Kingdom’s Government Granted Bonds and some European countries' Government Granted Bonds value. This proves that fiscal prudence is in place in some European countries and proves that some politicians listen to monetary policymakers, given the fact that the ECB's Christine Lagarde called on governments not to adopt measures that will fuel inflation on the 16th of September 2022.

The United States' fiscal policy expansion has compelled the Senate to pass a stopgap funding bill, which has put downward pressure on the United States Government Granted Bonds as speculation over the continuance of the United States government's fiscal policy expansion increased and so inflation expectations rose.

The recommended papers for quants for market hedging remain almost the same, as volatility driven by news remains the same.

To optimize the trading frequency:

Author(s): SONGZI DU, HAOXIANG ZHU (2017) "What is the Optimal Trading Frequency in Financial Markets?"Oxford University Press for The Review of Economic Studies Ltd, Volume 84, Issue 4, Pages 1606–1651

To reduce the impact of the macroeconomic and news data releases:

Author(s): XIN HUANG (2018) "Macroeconomic News Announcements, Systemic Risk, Financial Market Volatility and Jumps" Robert I. Webb Journal of Futures Markets. Volume 38, Issue 5, Pages 513-534

Author(s): KAM F. CHAN, PHILIP GRAY (2018) "Volatility jumps and macroeconomic news announcements" Robert I. Webb Journal of Futures Markets. Volume 38, Issue 8, Pages 881-897

Author(s): JESÚS FERNÁNDEZ-VILLAVERDE & JUAN RUBIO-RAMÍREZ (2010) "Macroeconomics and Volatility: Data, Models, and Estimation" National Bureau of Economic Research, NBER Working Paper Number 16618

Author(s): ROBERT F. ENGLE, ERIC GHYSELS, BUMJEAN SOHN (2013) "Stock Market Volatility and Macroeconomic Fundamentals" The Review of Economics and Statistics MIT, Volume 95, Issue 3, Pages 776–797

Options Strategies:

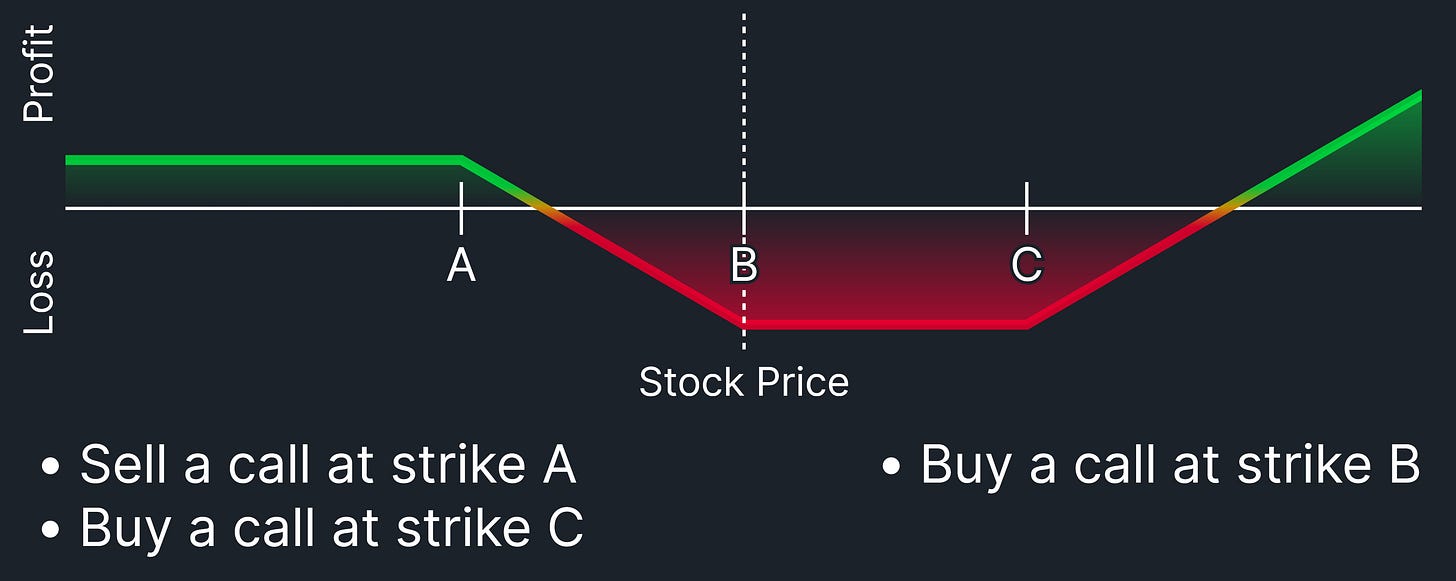

(Bullish directional options strategy algorithm)

Author(s): OMER FARAJ S. AMAITIEK, TOMÁS BÁLINT, M. REŠOVSKÝ (2011) "Call Ladder strategy and its application in trading and hedging" Technical University of Kosice, Acta Montanistica Slovaca Volume 15, Issue. 3, Pages 171 – 182

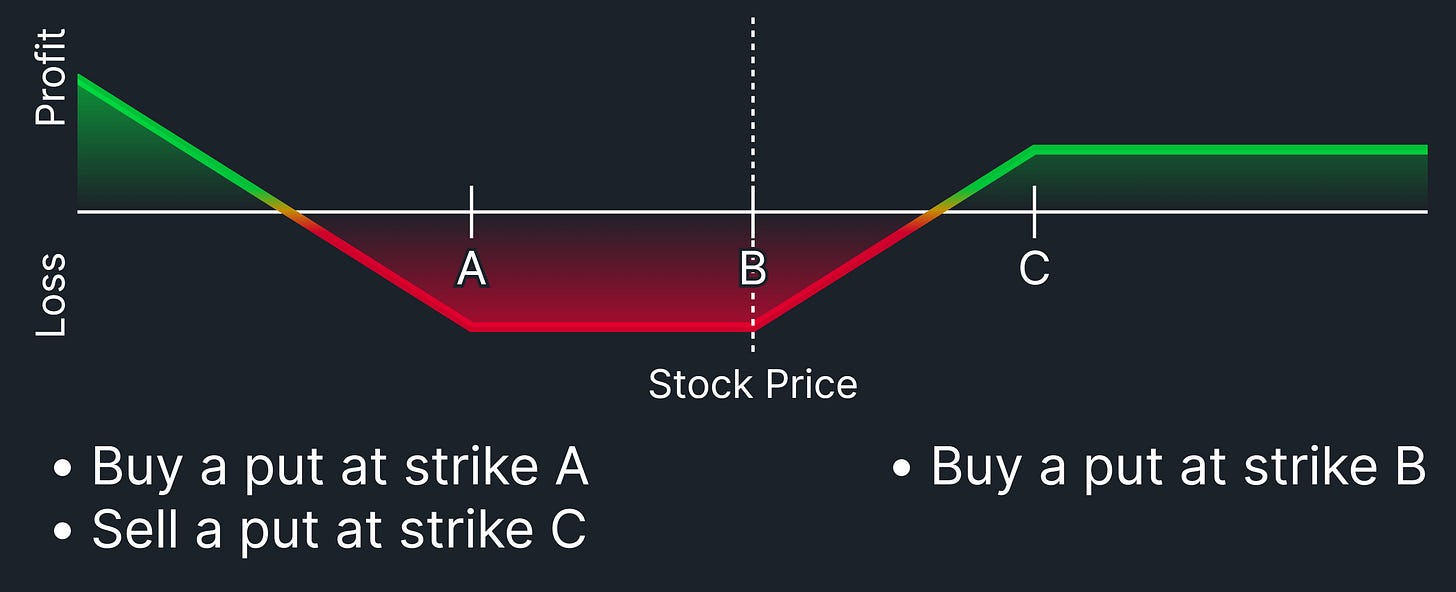

(Bearish directional options strategy algorithm)

Author(s): OMER FARAJ S AMAITIEK; SOLTÉS, VINCENT (2010) "The Short Put Ladder Strategy and its Application in Trading and Hedging" Theory, Methodology, Practice; Club of Economics University of Miskolc, Volume 6, Issue 2, Pages 77-85.

All of those papers are recommended to read and implement in your models if you want to hedge the market based on the variance of macroeconomic data, thus changing the bullish/bearish exposure to the market. With all of that in place, there is no upside or downside risk that affects you, because you are prepared for news and data releases, and you are prepared for either outcome by having a directional exposure on the market and thus profiting from market upside and downside moves.

Do feel free to share, leave a comment and subscribe to Quantuan Research Substack if you want, by using the next buttons.